This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

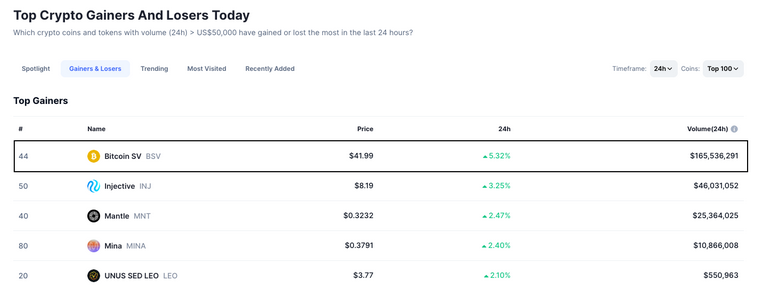

Bitcoin SV (BSV) has recently been one of the standout performers in the crypto market, surging over 10% in the past 24 hours.

BSV's price is now trading above the $41.00 level – the highest since early July.

With traders anticipating further upside for BSV, one emerging crypto also attracting attention is Bitcoin Minetrix (BTCMTX), which offers a novel way to capitalize on BTC mining yields.

Bitcoin SV breaks out as bulls target $50 next

Bitcoin SV emerged as a hard fork of Bitcoin Cash in 2018, featuring larger block sizes to enable greater scalability.

After a prolonged period of lackluster price action, BSV has seen a resurgence in recent weeks, rising by 57% from August’s low.

This price pump allowed BSV to break above the critical $40.00 resistance level that had capped the coin since July.

Additionally, BSV hit a 100-day high of around $43.33 yesterday before the price pulled back slightly.

The breakout was driven by bullish sentiment from the broader crypto market, which has remained since the false rumors that BlackRock’s spot BTC ETF application had been approved.

Although these rumors weren’t directly related to BSV, the general uptick in market sentiment likely contributed to its recent gains.

Currently, Bitcoin SV is ranked first on CoinMarketCap’s list of the top crypto gainers, ahead of fellow trending tokens Injective (INJ) and Mantle (MNT).

Can BSV continue pumping until the end of 2023?

Looking ahead to the remainder of 2023, Bitcoin SV has the potential for upside if bullish momentum persists.

However, BSV may encounter resistance around the $50.00 level, which has proved to be a strong psychological barrier in the past.

This is a logical target for bulls in the near term and would represent a further 20% push from today’s price.

For sustained growth beyond that, BSV would need to see increased adoption and real-world usage beyond what it currently offers.

Its scalability advantages could become more sought after if crypto bull market conditions arise – yet competition from other blockchains may challenge its market position.

Given its current network activity and role in the crypto ecosystem, a reasonable price target for BSV by year's end is $50 to $56, aligning with the resistance level and wick seen on July 1.

With CoinGecko sentiment analysis revealing that more than 75% of users are "feeling good" about Bitcoin SV's prospects, the backing supports further price gains in the weeks ahead.

Bitcoin Minetrix poised for exponential growth as the next big crypto mining disruptor

As traders look ahead following Bitcoin SV’s breakout, the big question is which altcoin could be poised for a similar price pump next.

One contender gaining traction is Bitcoin Minetrix (BTCMTX), an innovative new crypto project focused on making BTC mining accessible through its staking model.

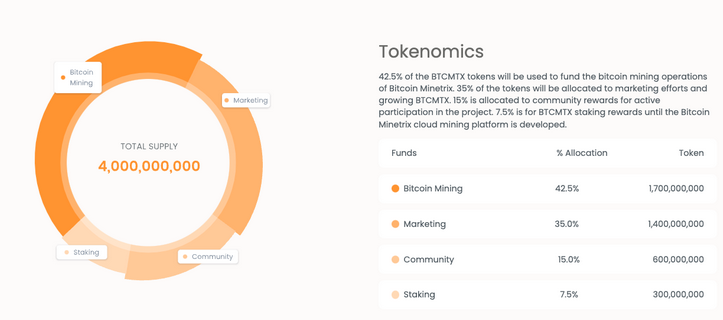

BTCMTX operates using a “Stake-to-Mine” concept where users can stake their tokens to earn mining credits.

These credits are then destroyed to gain cloud mining power for Bitcoin – opening up BTC mining to everyday crypto enthusiasts.

BTCMTX also offers staking rewards of up to 331% per year for token holders, providing another source of recurring income.

With mining power becoming increasingly difficult for individuals to obtain, BTCMTX’s model looks well-positioned to tap into growing market demand.

Currently in its presale phase, Bitcoin Minetrix has already raised an impressive $1.7 million in just one month, with BTCMTX tokens on offer for $0.0111 each.

Investors worldwide have been clamoring to get involved in the presale, given that BTCMTX is poised to be launched on major exchanges once it concludes.

Adding to its momentum, BTCMTX is currently ranked first on CoinSniper, signaling strong interest from the crypto community.

Moreover, the project’s Telegram channel has grown substantially, indicating the potential for a successful open market launch.

With an ambitious vision and exciting use cases, BTCMTX could follow BSV in delivering significant upside for bullish investors before the end of 2023.

Visit Bitcoin Minetrix Presale

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Crypto Today: Bitcoin, Ethereum, XRP slide further as risk-off sentiment deepens

Bitcoin faces extended pressure as institutional investors reduce their risk exposure. Ethereum’s upside capped at $3,000, weighed down by ETF outflows and bearish signals. XRP slides toward November’s support at $1.82 despite mild ETF inflows.

Ripple eyes record high breakout in 2026 as Ripple scales infrastructure

XRP has traded under pressure, but short-term support keeps hopes of a sustainable recovery in 2026 alive. The launch of XRP ETFs and regulatory clarity in the US pave the way for institutional adoption.

Bitcoin risks deeper correction as ETF outflows mount, derivative traders stay on the sidelines

Bitcoin (BTC) remains under pressure, trading below $87,000 on Wednesday, nearing a key support level. A decisive daily close below this zone could open the door to a deeper correction.

Monero builds momentum amid bullish bets and looming resistance

Monero (XMR) trades close to $430 at press time on Wednesday, after a 5% jump on the previous day. The privacy coin regains retail interest, evidenced by heightened Open Interest and long positions.

Crypto Today: Bitcoin, Ethereum, XRP tilt toward breakout on risk-on sentiment

Bitcoin (BTC) kicked off October on a strong note, with the price breaking above $116,000 on Wednesday. Despite a market-wide expectation that September is usually a bearish month for cryptocurrencies, BTC posted gains of 5.31%.

Bitcoin: Fed delivers, yet fails to impress BTC traders

Bitcoin (BTC) continues de trade within the recent consolidation phase, hovering around $92,000 at the time of writing on Friday, as investors digest the Federal Reserve’s (Fed) cautious December rate cut and its implications for risk assets.