This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

Bitcoin's recent surge to unprecedented highs has caused numerous discussions about its future trajectory.

With the cryptocurrency shattering records and climbing past $90,000, both seasoned investors and newcomers are asking the same question: Could Bitcoin hit the elusive $250,000 mark in the next market rally?

There’s also new projects like PlutoChain ($PLUTO) that could be worth a look!

Let’s unpack this.

Could Bitcoin really reach $250,000?

Bitcoin’s had a phenomenal performance in 2024.

After the U.S. presidential election, where Donald Trump secured a second term, Bitcoin’s price skyrocketed to a record high of $93,445 on November 13. This reflects a staggering 115% increase since January.

Many believe this spike is tied to expectations of a friendlier regulatory environment under the new administration.

But, industry experts are divided on Bitcoin's potential to reach $250,000 in the near future.

Matt Hougan, Chief Investment Officer at Bitwise, projects that Bitcoin could climb to $100,000 by the end of 2024 and $200,000 by the end of 2025. He points to increased institutional adoption and favorable regulation as key drivers.

Similarly, Bernstein analysts see Bitcoin nearing $200,000 by 2025, citing a heightened demand for hard assets like Bitcoin.

However, some experts are more conservative in their forecasts. Changelly predicts an average Bitcoin price of $99,779.47 in 2025, with a maximum of $100,044.82.

Binance's 2025 prediction aligns closely, estimating Bitcoin to trade around $95,943.57.

While these numbers reflect solid growth, they fall far short of the ambitious $250,000 mark.

Several factors could tip the scales. The recent approval of spot Bitcoin ETFs in the U.S. has been a game-changer.

Over $1.6 billion in inflows were reported in just one week, with BlackRock’s iShares Bitcoin Trust dominating.

On top of that, the much-anticipated Bitcoin halving event, slated for April 2024, could significantly limit the supply of new Bitcoin, and potentially push prices higher.

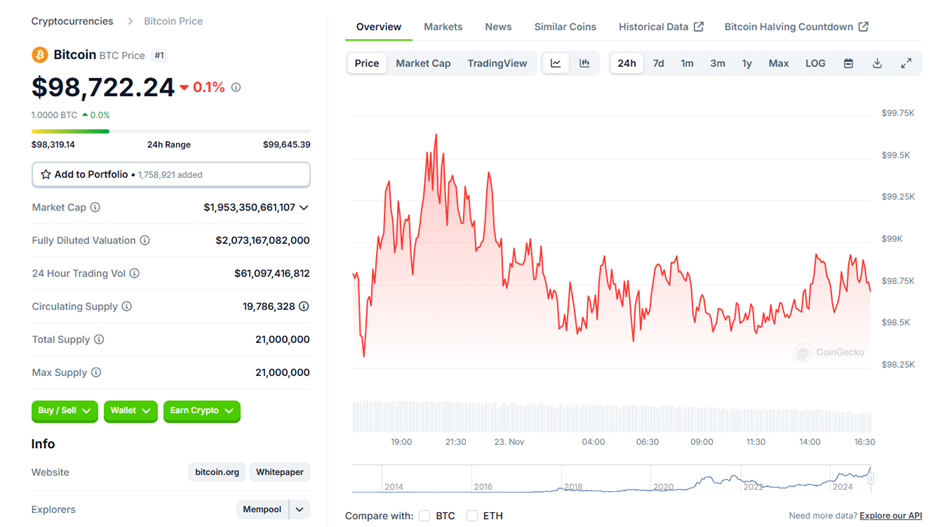

As of November 23, 2024, Bitcoin (BTC) is trading at approximately $98,551.82, reflecting a 4.97% increase over the past 24 hours, according to CoinGecko.

Despite the bullish sentiment, nothing is guaranteed. Bitcoin's inherent volatility means that while significant gains are possible, substantial corrections can occur.

QCP Capital recently flagged a “state of euphoria” in the market, warning that heightened leverage levels could trigger pullbacks.

Moreover, macroeconomic factors, such as Federal Reserve interest rate decisions and global economic conditions, could impact Bitcoin's price trajectory.

PlutoChain ($PLUTO) – World’s first hybrid layer-2 project for Bitcoin

While Bitcoin remains the undisputed leader, its adoption in decentralized finance (DeFi) has lagged behind.

PlutoChain ($PLUTO) is a groundbreaking hybrid Layer-2 solution for Bitcoin that might change that. It could merge Bitcoin’s unparalleled security with the flexibility needed for DeFi, NFTs, AI, and Metaverse applications.

The project has attracted significant attention thanks to ultra-low fees, lightning-fast transaction speeds, and remarkable scalability.

One of PlutoChain’s best innovations is its compatibility with Ethereum’s Virtual Machine (EVM), which could enable Ethereum-based DeFi applications to transition to the Bitcoin network seamlessly.

This eliminates the need for extensive code modifications, offering a user-friendly solution that could bridge Bitcoin’s secure infrastructure with Ethereum’s vibrant ecosystem.

By doing so, PlutoChain could pave the way for Bitcoin to take a larger share of the DeFi market, where Ethereum currently dominates.

Security is another cornerstone of PlutoChain’s design. The project has undergone and passed rigorous audits by SolidProof, which highlights its dedication to safeguarding user assets.

The bottom line

PlutoChain ($PLUTO) should definitely be on everyone’s radar.

The project’s ambitious vision features key milestones such as private and public testnets, bridge integrations, and a mainnet launch.

These developments, paired with an active community on platforms like Twitter, Telegram, and Discord, demonstrate PlutoChain’s commitment to transparency and engagement.

For those interested in learning more, PlutoChain’s whitepaper offers an in-depth look into its vision and cutting-edge technology.

Visit the links below to learn more about PlutoChain and its unique features:

Official Website: https://plutochain.io

X/Twitter Page: https://x.com/plutochain/

Telegram Channel: https://t.me/PlutoChainAnnouncements/

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

This article is not financial advice. Cryptocurrencies are risky and unpredictable; do your research. Forward-looking statements involve risks and may not be updated.

Recommended Content

Editors’ Picks

Ripple's XRP crosses $100 billion market cap following high expectations for its stablecoin and ETF approvals

Ripple's XRP rallied near the $2 mark on Friday after rumors of New York regulators approving the company's RLUSD stablecoin surfaced. The growing demand for an XRP exchange-traded fund could also accelerate its launch in 2025.

Ethereum Price Forecast: ETH eyes yearly high resistance of $4,093 amid heightened interest among US traders

Ethereum is trading near the $3,600 level on Friday and could stage a rally to test its yearly high resistance of $4,093. The rally is fueled by ETH Chicago Mercantile Exchange open interest growth and a rise in USDT supply on the Main chain.

Cardano's ADA, JTO, NEON lead $570 million unlock week ahead of massive $3 billion in further December unlocks

Tokenomist data on Friday revealed that the crypto market will witness another week of heavy cliff unlocks worth over $570 million as part of the larger $3.5 billion December supply injection.

Stellar Price Forecast: Eyes for further gains as bounces off support level and bullish on-chain metrics

Stellar experienced a pullback in the first half of the week but recovered in the second half and is trading around $0.54 on Friday, after rallying more than 170% and reaching levels not seen in over three years in the previous week.

Bitcoin: A healthy correction

Bitcoin (BTC) experienced a 7% correction earlier in the week, dropping to $90,791 on Tuesday before recovering to $97,000 by Friday. On-chain data suggests a modest rebound in institutional demand, with holders buying the dip. A recent report indicates BTC remains undervalued, projecting a potential rally toward $146K.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.