This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

Bitcoin (BTC) and Ethereum (ETH) have started the week on a bearish note, declining amidst the broader risk-off sentiment in the crypto market.

Major altcoins have also struggled for momentum on Monday morning following a poor start to 2024.

However, while blue-chip cryptos continue to disappoint, exciting new altcoin projects like Bitcoin Minetrix (BTCMTX) are gaining traction – with its presale nearing the $10 million funding milestone.

Bitcoin & Ethereum Struggle to Sustain Upside Momentum Despite Solid Trading Volumes

Bitcoin is trading around $42,300, a slight decrease from its price 24 hours ago.

Technical indicators remain bearish for BTC in the short term, with yesterday’s daily candle closing with a long wick to the upside.

This suggests that sellers have gained some control in the market, and further downside could be imminent.

However, Bitcoin remains up 9% from last week’s low, with trading volumes around $14.8 billion daily.

Ethereum is faring slightly better than Bitcoin, currently hovering around the $2,270 level.

The second-largest crypto by market cap is down a marginal 0.43% since yesterday and is facing strong resistance from its 50-day exponential moving average (EMA) around $2,300.

Unless ETH can reclaim and close decisively above this level, there could be further price declines on the cards.

The good news for ETH holders is that spot trading volumes actually increased by 12% in the past 24 hours.

So, although the token’s price may be stagnating, this uptick in trading volume could be a sign of underlying bullish sentiment.

Macro Uncertainty Keeps BTC & ETH Rangebound Ahead of Pivotal Fed Decision

As Bitcoin and Ethereum struggle to find a definitive direction, this week could prove key thanks to some critical macroeconomic events on the calendar.

All eyes are on the US Federal Reserve’s policy meeting on Wednesday, where the central bank is expected to keep rates the same in their battle against stubbornly high inflation.

However, any surprises could spark significant volatility across risk assets like cryptocurrency.

Meanwhile, developments around troubled Chinese property developer Evergrande are also being closely watched.

Fears of contagion from a potential collapse contributed to last year’s crypto bear market – so further negative news could dampen sentiment.

Crypto sentiment is already near 3-month lows, according to the Crypto Fear & Greed Index, suggesting investors and traders remain cautious.

As such, leading cryptos like BTC and ETH could remain rangebound until the macro picture becomes clearer.

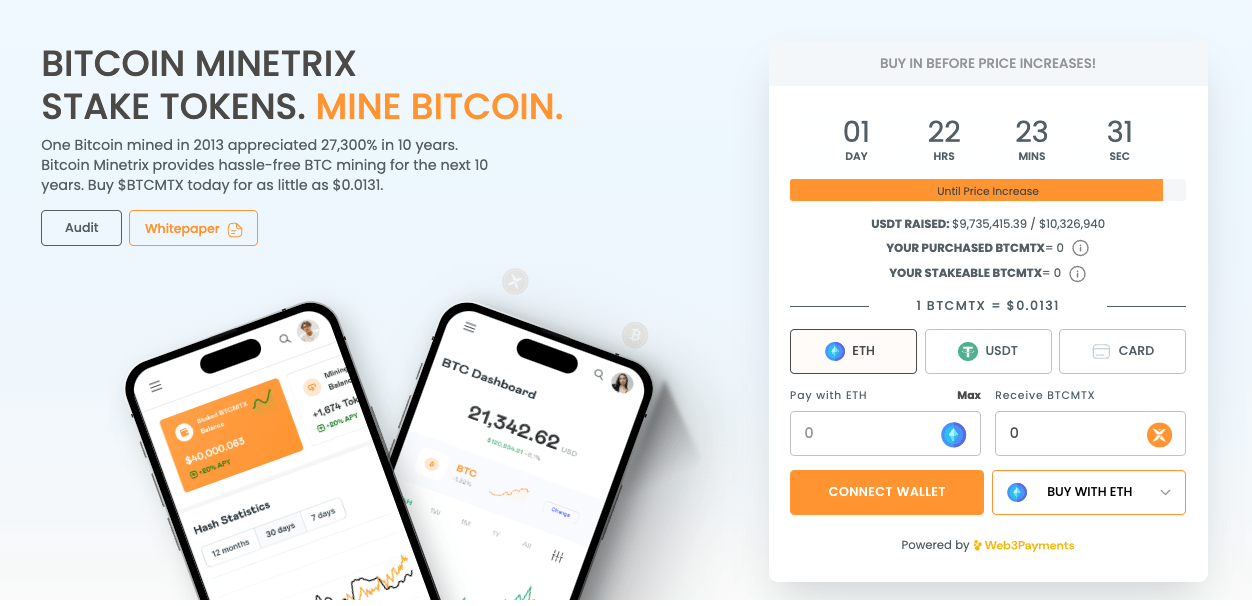

Trending Bitcoin Minetrix Approaches $10m as Innovative Crypto Mining Approach Draws Attention

While flagship cryptocurrencies struggle due to market uncertainty, the standout performer right now is the exciting new altcoin project, Bitcoin Minetrix (BTCMTX).

This innovative protocol is gaining significant attention for its presale fundraising success, having already raised over $9.7 million and marching rapidly towards the $10 million milestone.

What sets Bitcoin Minetrix apart from its peers is its unique value proposition and real-world utility.

The project aims to increase access and lower barriers to entry into Bitcoin mining by enabling users to stake and earn BTC payouts.

Its dual-earning model creates a circular ecosystem that incentivizes long-term holding – miners earn BTC, which can be used to acquire more BTCMTX tokens that can be staked for compounded returns.

Currently, Bitcoin Minetrix offers staking APYs of 68%, with over 610 million tokens pledged already.

Bitcoin Minetrix’s team is even developing a user-friendly mobile app and forging partnerships with leading cloud mining platforms to expand capacity further.

As interest in crypto mining surges ahead of the next Bitcoin halving event, Bitcoin Minetrix looks perfectly positioned to capitalize on growing demand.

This potential has led to bullish predictions from YouTubers like Jacob Bury, who stated that it could be the “best crypto to buy now.”

While short-term technicals and macro uncertainty hamper Bitcoin and Ethereum, Bitcoin Minetrix continues to win over investors seeking crypto investments with clearer prospects.

As such, the project could be poised for substantial growth once it rolls out its mining-focused services later this year.

Visit Bitcoin Minetrix Presale

This is a sponsored post. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by the external author of the post. You should be aware of all the risks associated with trading. Cryptocurrency presales can be very risky investments as the assets have yet to be proven in the market. Some or all the tokens mentioned in the articles may be devalued or subject to scams, and investors may lose all capital as most of these assets lack proper due diligence. FXStreet is not responsible for any losses incurred from investments in crypto presales.

ETF News provides quality insights in the form of financial guides and video tutorials on buying and investing in stocks. We compare the top providers and provide detailed insight into their product offerings. We do not advise or recommend any provider but want to enable our readers to make informed decisions and trade on their own responsibility. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss for your capital. Up to 67 % of retail investor accounts lose money trading with the brokers compared on this website. Please make sure you fully understand the risks and seek independent advice. By continuing to use this website, you agree to our Privacy Policy.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.