zkSync Era lending protocol EraLend exploited for $3.4 million in USDC

- zkSync Era protocol EraLend was exploited, and the hacker reportedly made multiple transactions in USDC.

- The lending protocol has since suspended all borrowing operations and is also advising users against depositing USDC.

- zkSync Era, which launched this March, peaked in terms of performance earlier this month but has lost more than $300 million in total value locked in the last 20 days.

Crypto crimes came down significantly over the past six months but did not come to a stop, and the latest victim is Eralend’s zkSync Era. Lending protocol EraLend, based on the Ethereum layer-2, was exploited on Tuesday, leading to losses worth millions of Dollars.

Read more - ISIS-affiliated groups raise $2 million in Tron-based USDT: TRM Labs report

zkSync Era protocol exploited

zkSync Era-based lending protocol EraLend fell victim to an exploit on July 25 after hackers managed to steal over $3.4 million in USDC (USD Coin). While the root cause of the exploit is yet to be identified, the development team of the protocol confirmed the hack stating,

"We've experienced a security incident on our platform today. The threat has been contained. We've suspended all borrowing operations for now and advise against depositing USDC. We're working with partners and cybersecurity firms to address this.

Since the details regarding the exploit are yet to be revealed, the exact method of the hack remains unknown. However, according to Twitter user Spreek, multiple transactions took place in which the USDC was moved to the exploiter's address.

a second hack tx that i missed for another 1m usdc. again dunno if that's all the loss. pic.twitter.com/AyPaLWwSvt

— Spreek (@spreekaway) July 25, 2023

Upon confirming the hack, the lending protocol team reassured users that the only token to be affected was the stablecoin USDC and that ETH (Ethereum) and LP tokens were completely safe. EraLend did not immediately respond to FXStreet's request for comment.

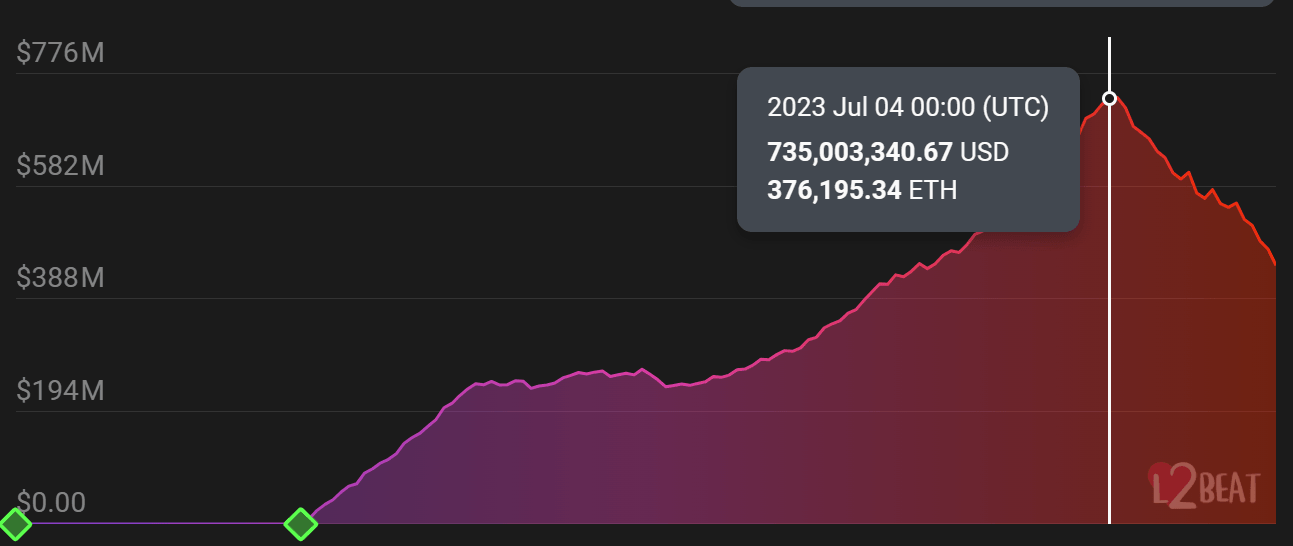

This exploit marked the first major hack experienced by the Ethereum layer-2 solution since its launch in March. zkSync Era noted sudden bullishness towards the end of June and peaked in terms of the performance of protocols at the beginning of this month. The total value locked (TVL) on the chain exceeded $735 million.

zkSync Era TVL

This was short-lived, however, as soon after the protocol began losing investors' funds, and in the last 20 days, the L2 lost over 40% of its TVL, amounting to almost $300 million. At the time of writing, the Ethereum layer-2 chain has about $446 million locked on it.

On the contrary, performance does not seem to have been impacted and has noted improvements even, with the activity rising over the past month. The layer-2 has been conducting just as many transactions per second (TPS) as the Ethereum mainnet averaging 11-12 TPS.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.