ZK-rollups become the latest trending solution for scalability on the Ethereum network as developers strive to increase throughput capabilities while decreases transaction costs.

Scalability on the Ethereum (ETH) network has been a point of contention within the cryptocurrency ecosystem for years, primarily due to high fees and network congestion during periods of peak demand.

The latest solution to emerge as the final fix to Ethereum’s scalability woes are Zero-knowledge rollups (ZK rollups), a form of scaling that runs computations off-chain and submits them on-chain via a validity proof.

Zk rollup season

— cryptowarlord.eth ( ͡° ͜ʖ ͡°) (@CryptoWarlordd) December 7, 2021

Earlier in the year, protocols that opted to use optimistic rollups such as Optimism and Arbitrum dominated the headlines and were touted as the best solution to scaling on Ethereum, but aside from Arbitrum, the hype for those protocols has quieted down and traders have pointed out that even optimistic rollups have higher than desirable fees when the network is under peak demand.

Early successes in 2021

At the same time that optimistic rollup solutions were in the spotlight, protocols that adopted the ZK rollups model quietly demonstrated their capabilities.

dYdX, a decentralized perpetual and futures exchange, was one of the earliest adopters of ZK-rollup technology through its partnership with StarkWare, whose StarkNet network is a permissionless decentralized ZK-Rollup.

To date, the platform has seen a decent amount of success and at times managed to process a higher 24-hour trading volume than Coinbase.

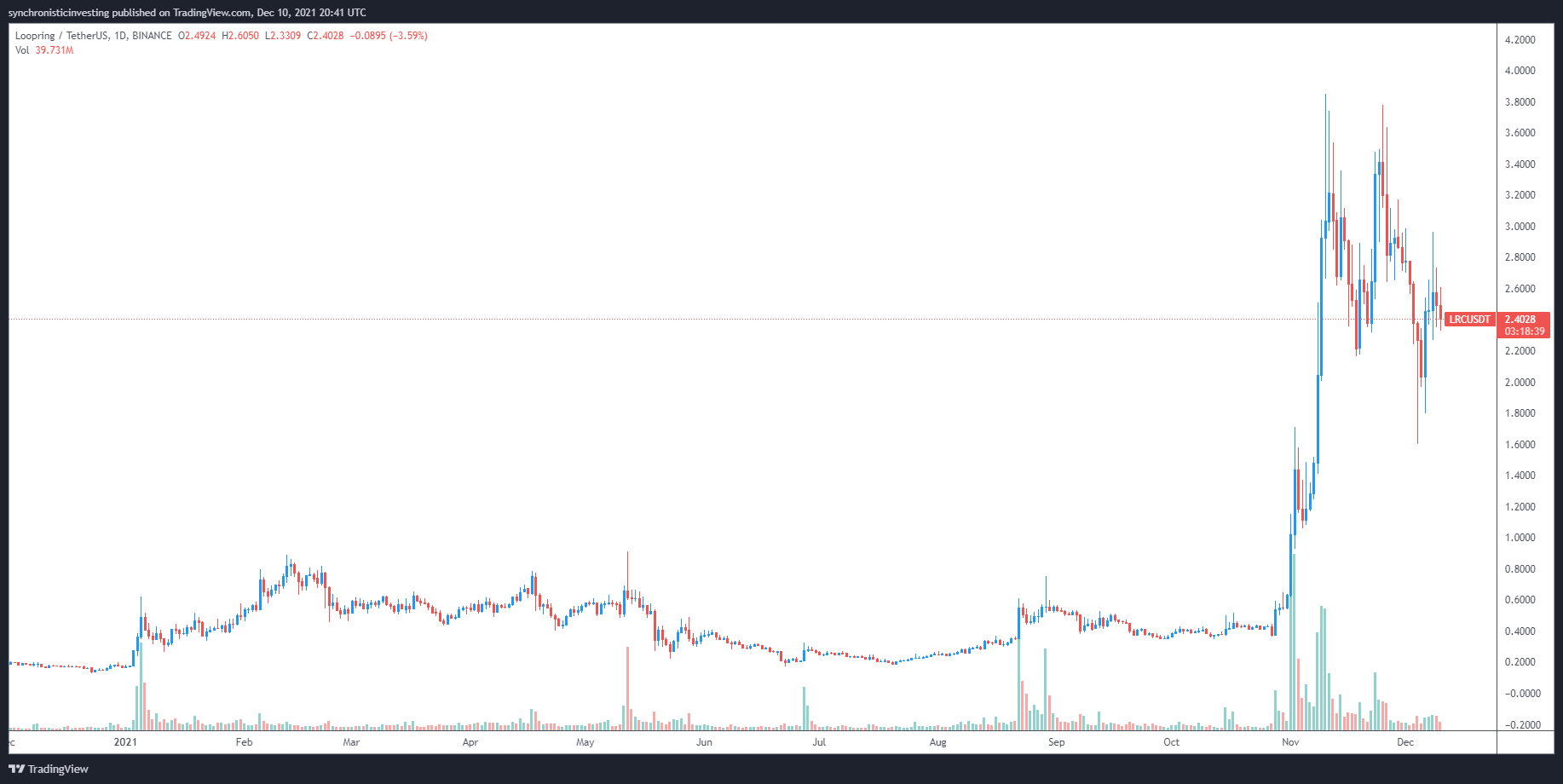

Loopring (LRC) is another protocol that has utilized ZK-rollups to decrease transaction costs and speed up its throughput capabilities, which has helped drive the price of LRC to a new all-time high of $3.83 in early November.

LRC/USDT 1-day chart. Source: TradingView

ZK-rollups could be the next "rotation" for traders

Following last week's sharp market-wide sell-off, ZK-rollups have reemerged as a buzzword in crypto sector.

Polygon, a layer-two platform for the Ethereum network, made headlines with the announced acquisition of Mir, a project developing two subcategories of zero-knowledge proofs known as PLONK and Halo.

The 250 million MATIC token investment by Polygon, which already offers some of the lowest fees of any protocol on the Ethereum network, was done in an effort “to explore and encourage all meaningful scaling approaches and technologies at this stage,” according to Polygon co-founder Sandeep Nailwal.

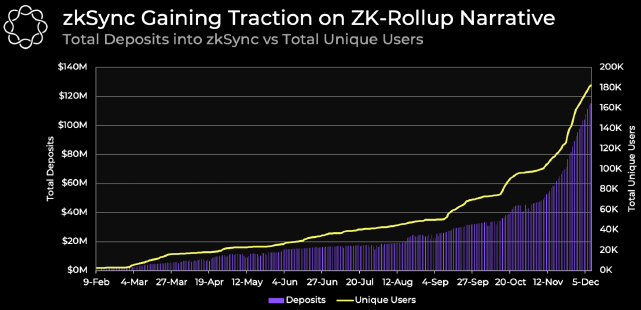

Another much-anticipated protocol that has been gaining traction recently is zkSync, a scaling solution created by Matter Labs that secured $50 million in a Series B round led by Andreessen Horowitz in early November.

zkSync total deposits vs. total unique users

According to Digital Delphi, the two main projects that are live on zkSync is ZigZag, a decentralized exchange, and a funding platform called Gitcoin.

Analysts at Delphi Digital said,

According to L2 fees, token swaps through ZigZag on zkSync have the lowest fees.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.