- Zilliqa price attempts to form support after a major pullback from a prior rally.

- The weekly chart warns of further downside pressure if bulls fail capitalize on last week’s close.

- Upside potential is likely limited to the $0.12 value area.

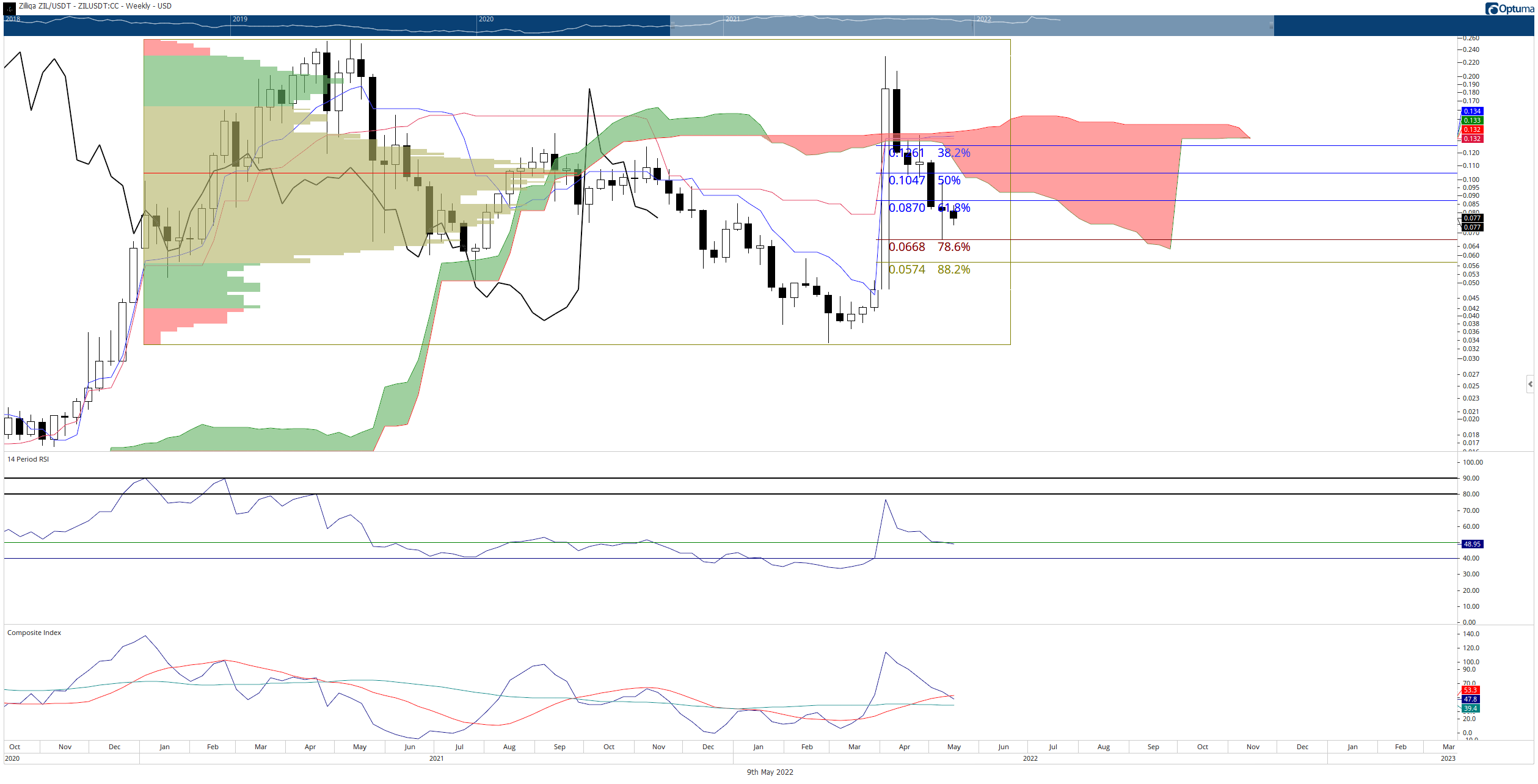

Zilliqa price is coming off a deep pullback from the massive 500% rally in March. Last week’s weekly candlestick showed a historically bullish reversal pattern, but follow-through is necessary to confirm that pattern.

Zilliqa price struggles to hold $0.07

Zilliqa price, like the rest of the cryptocurrency market, is facing a continued sell-off. Despite last Monday’s (May 2, 2022) nearly 38% price spike, buyers have been unable or unwilling to capitalize on that move. Bears are very close to eliminating the entirety of that gain.

One piece of positive data for bulls is the candlestick pattern that developed on the weekly chart. The pattern is a Gravestone Doji - an extremely powerful bullish reversal signal when it appears at the bottom of a swing. It also fulfills the criteria for a Spinning Top or Shooting Star. Regardless of the naming, the structure is very bullish when it forms at the bottom of a swing.

However, follow-through is necessary to confirm a bullish reversal. Thus far, Zilliqa price is showing difficulty maintaining a level above last week’s open.

One other piece of technical information that may terminate any further near-term selling pressure is the massive gaps between the bodies of the candlesticks and the Tenkan-Sen. Within the Ichimoku system, the body of the candlesticks and the Tenkan-Sen like to move in tandem. Therefore, a mean reversion is almost a certainty when there is a major gap between the two.

ZIL/USDT Weekly Ichimoku Kinko Hyo Chart

In the event of any relief rally or broader corrective move, Zilliqa price will likely return to the critical $0.12 value area. $0.12 contains the 38.2% Fibonacci retracement, the bottom of the weekly Ichimoku Cloud (Senkou Span A), and the weekly Tenkan-Sen.

If selling Zilliqa price continues to experience broader selling pressure, then a return to the $0.04 value area is the next major level of support.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin lead double-digit gains across meme coins, with Shiba Inu, PEPE and BONK skyrocketing to new monthly highs

Top meme coins Dogecoin (DOGE), Shiba Inu (SHIB), PEPE and BONK lead the meme coin sector with double-digit gains on Wednesday following the crypto market recovery.

Cantor is set to launch a $3 billion venture backed by Softbank and Tether

Brandon Lutnick is spearheading a $3 billion Bitcoin investment through Cantor Fitzgerald, partnering with SoftBank, Tether, and Bitfinex to form 21 Capital. The firm aims to emulate MicroStrategy’s strategy of holding Bitcoin as a treasury asset for long-term appreciation.

Top 3 gainers Fartcoin, Zerebro, DeepBook: Solana and Sui meme coins soar on bold risk-on wave

Meme coins led by Fartcoin, Zerebro and DeepBook (DEEP) are extending gains during the Asian session on Wednesday amid soaring investor risk appetite. Bitcoin (BTC) briefly crossed $93,000 the previous day alongside widespread rallies among altcoins.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $95,000 BTC, $1,900 ETH, and $3 XRP

Bitcoin (BTC) price hovers around $92,800 on Wednesday after rallying 9.75% over the past two days. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and continued their recovery rally. The technical outlook suggests an upward trend, targeting $95,000 BTC, $1,900 ETH, and $3 XRP.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.