Zilliqa Price Prediction: ZIL breaks out of multi-year bullish pattern suggesting a 1,000% upswing

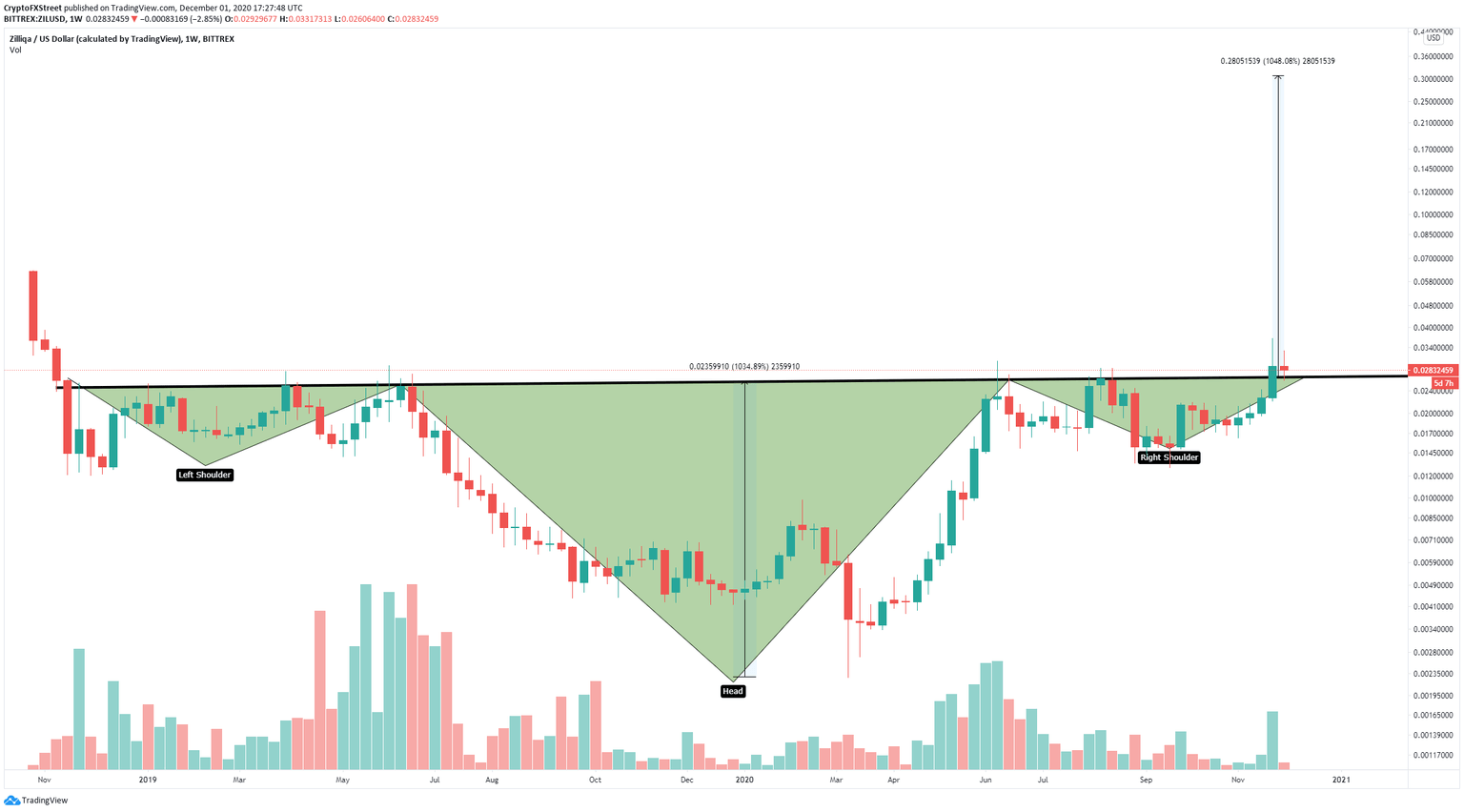

- Zilliqa price seems to be contained inside an inverse head-and-shoulders pattern on the weekly chart.

- ZIL is breaking out and aims for a massive price target at $0.3.

Zilliqa has been trading fairly sideways for the past six months and seems to be finally breaking out of a significantly bullish trading pattern. Several metrics indicate ZIL is on the verge of a massive price move.

Zilliqa price breaks out of a significant bullish pattern

On the weekly chart, ZIL formed an inverse head-and-shoulders pattern, which is a bullish pattern. The neckline resistance trendline was broken on November 23, and Zilliqa price has already re-tested it in the past week, successfully defending it.

ZIL/USD weekly chart

Using the height of the head to the neckline as a reference, it seems that Zilliqa price is aiming for a massive price target at $0.3, which would mean a 1,000% increase from the breakout at $0.027.

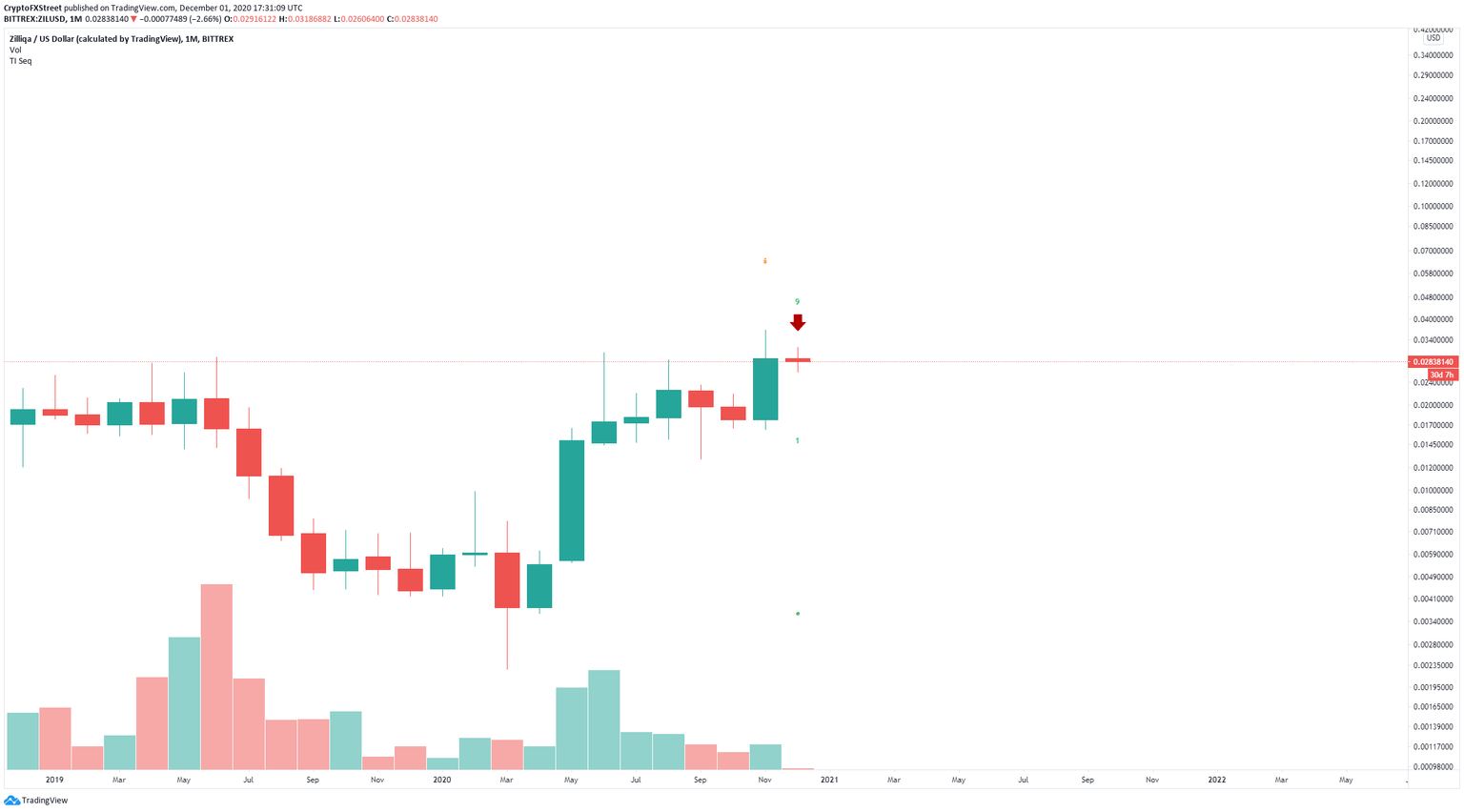

ZIL/USD monthly chart

However, despite the bullish pattern, the TD Sequential indicator has still presented a sell signal on the monthly chart. Validation of the signal could quickly drive Zilliqa price to $0.02 if the neckline support level at $0.027 is broken.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.