Zilliqa Price Forecast: ZIL future is unclear but favors a potential 25% upswing

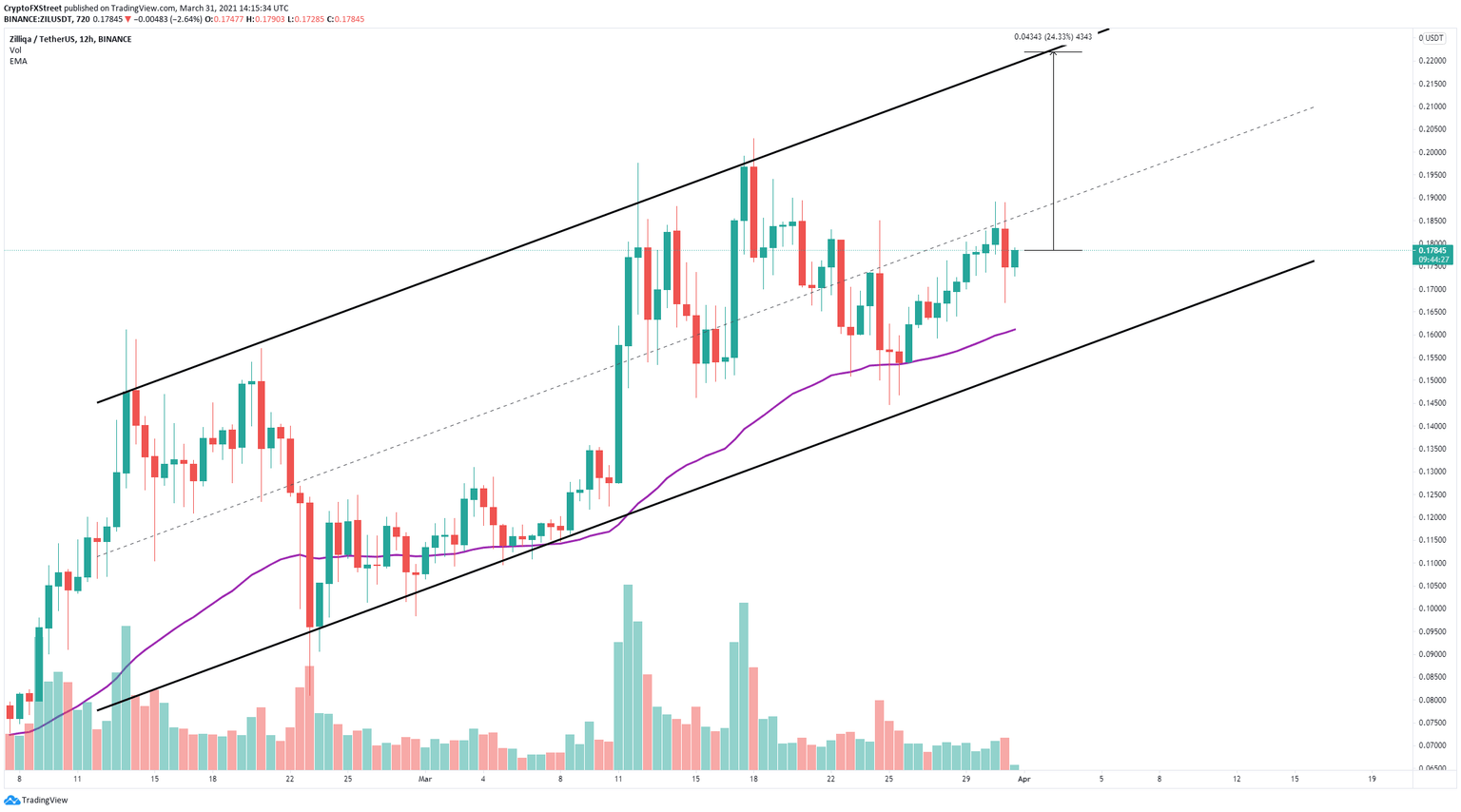

- Zilliqa price is contained inside an ascending parallel channel formed on the 12-hour chart.

- The digital asset is trading in the middle of the pattern above several key levels.

- Good chance for ZIL to see a 25% upswing towards $0.22.

Zilliqa price has been trading inside a massive ascending parallel channel for almost two months now. There is a lot of uncertainty with the asset's short-term price action, even though bulls seem to be the favorite at the time of writing.

Zilliqa price aims for a 25% upswing but needs more

On the 12-hour chart, Zilliqa is trading around the middle of the ascending parallel channel. The digital asset defended the 50-EMA support level with a target aimed at a significant 25% upswing toward the top trendline of the pattern at $0.22.

ZIL/USD 12-hour chart

However, the middle trendline at $0.188 will act as a strong resistance level for Zilliqa. Rejection from this point will quickly push ZIL toward the 50-SMA and 50-EMA, both coinciding at $0.163.

Rejection from this point will quickly push ZIL toward the 50-EMA at $0.163.

ZIL/USD 12-hour chart

The most significant support trendline is $0.155, which is the lower boundary of the ascending parallel channel. A breakdown below this point has the potential to drive Zilliqa price down by 45% towards $0.085.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.