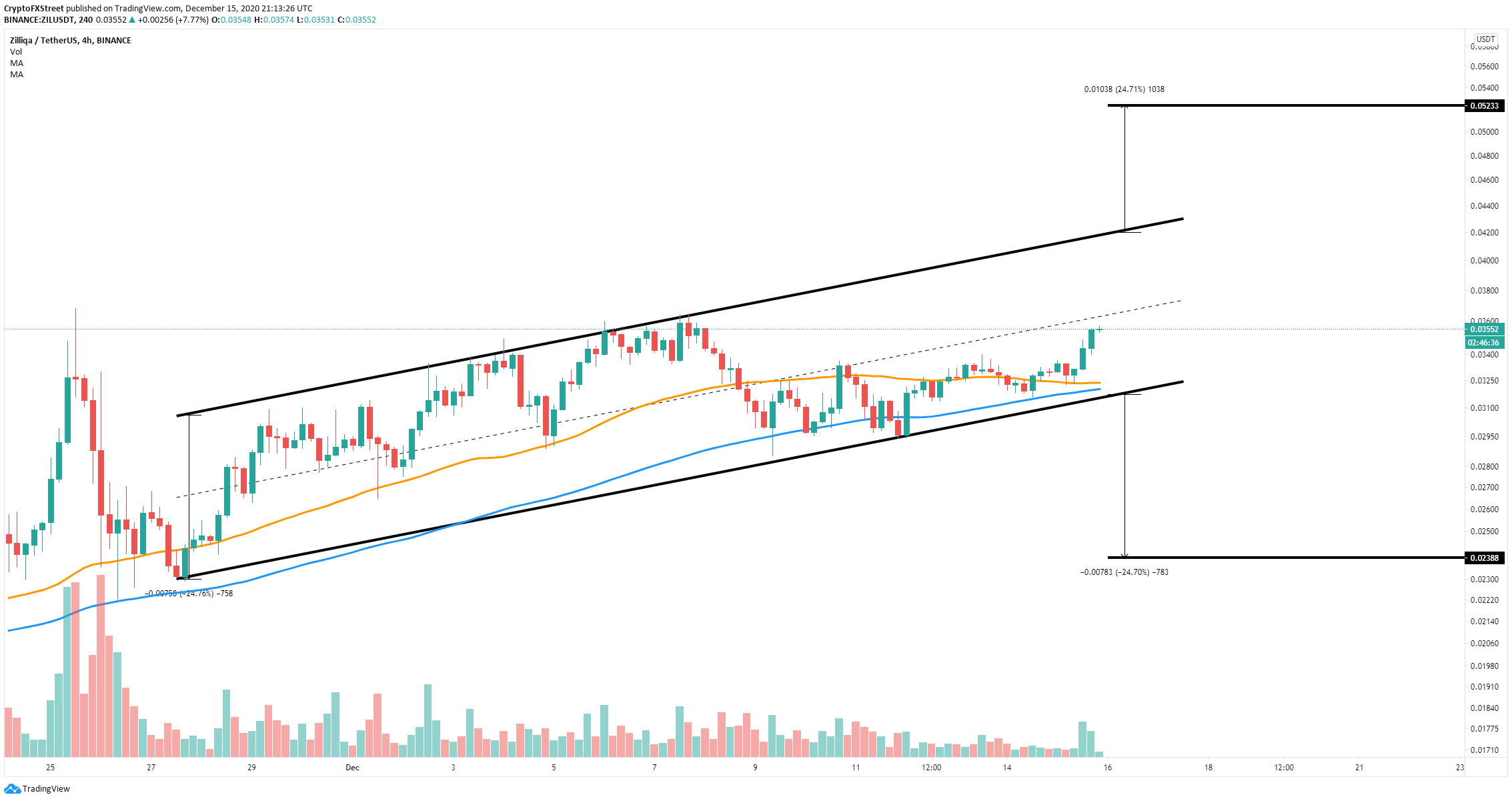

- Zilliqa price is trading inside an ascending parallel channel on the 4-hour chart.

- The digital asset is right in the middle of the pattern and awaits a clear breakout or breakdown.

Zilliqa price has been trading in a short-term uptrend since the beginning of November and it’s close to the 2020-high of $0.036 again. The digital asset needs to see a clear breakout to hit a new high by the end of 2021.

Zilliqa price keeps the bullish momentum

After defending the lower trendline of the ascending parallel channel on the 4-hour chart, the bulls managed to push Zilliqa price above the 50-SMA and the 100-SMA, turning both into support levels and keeping control of the trend.

ZIL/USD 4-hour chart

The digital asset has bounced notable from the bottom of the pattern and aims for the upper trendline at $0.042. A breakout above this level would quickly push ZIL towards $0.052 in the long-term.

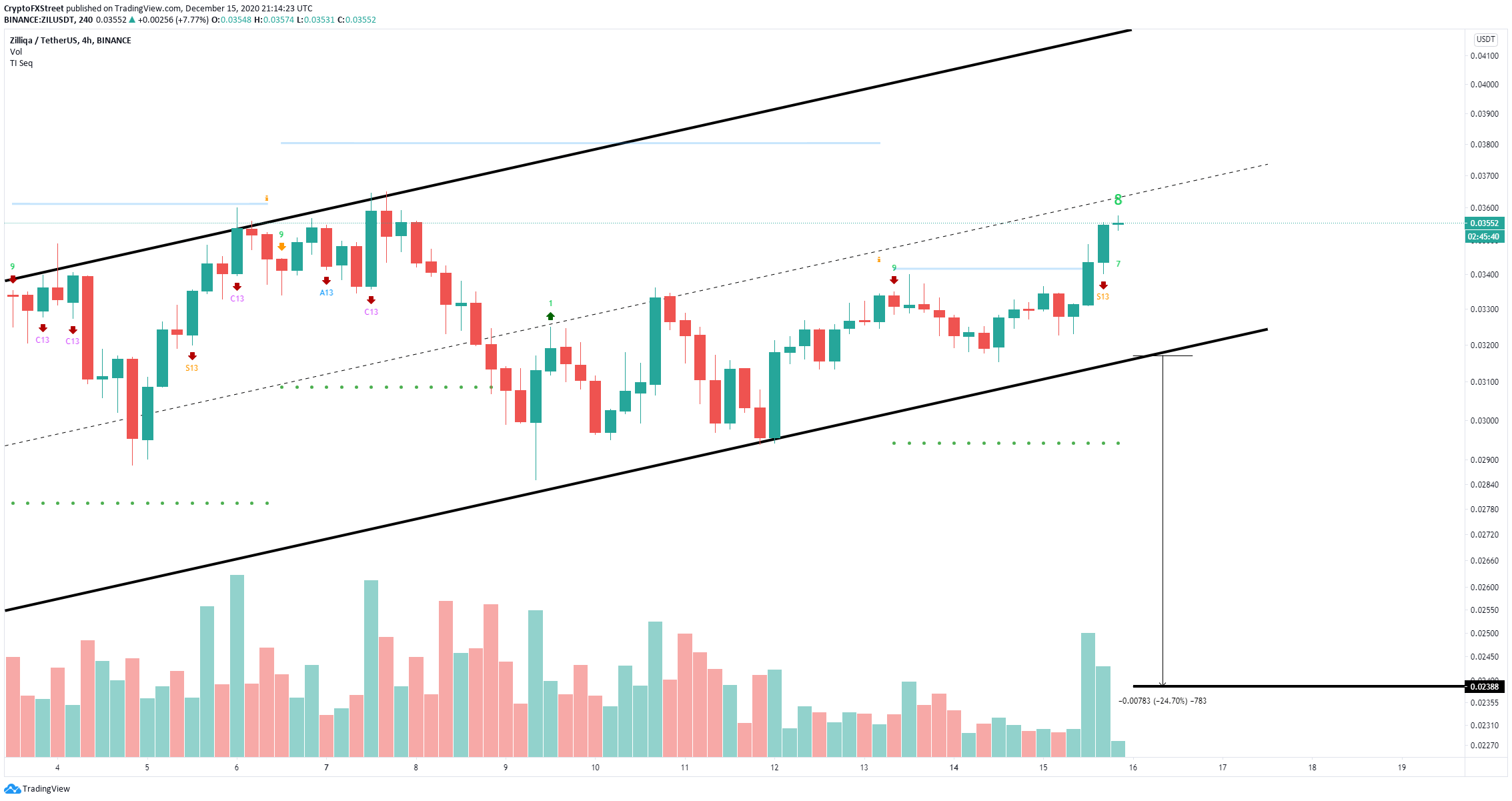

ZIL/USD 4-hour chart

On the other hand, the TD Sequential indicator is on the verge of presenting a sell signal in the form of a green ‘9’ candle on the 4-hour chart. Validation of this call can drive ZIL towards the lower trendline of the pattern. A breakdown below $0.031 can push Zilliqa price to $0.023.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.