- Asset management firm Zeus Capital LLP has accused Chainlink of artificially pumping the coin’s price.

- The firm has claimed that it has all evidence related to the alleged price manipulation.

- Zeus Capital Limited, an investment bank, has clarified that it has no affiliation with Zeus Capital LLP.

Zeus Capital LLP, an asset management company, has publicly accused Chainlink of artificially pumping the price of its coin. The firm has also published a report that says that Chainlink has been making fake partnerships and using them as a marketing scheme. The asset management firm stated that Chainlink is created to enrich the founders.

Zeus Capital LLP took to Twitter to say that they have "unlimited resources to go after LINK" and documented everything related to the alleged price manipulation.

We’ve unlimited resources to go after $LINK.

— Zeus Capital (@ZeusCapitalLLP) August 2, 2020

You can’t short squeeze us.

The attempt to manipulate the market and save LINK from today’s flash crash is being documented and added to the lawsuits.

Everyone involved will face the consequences.$LINK will drop to $0.0001 as in March pic.twitter.com/OHQe7Kz63H

The screenshots included in the tweet claim that “LINK marines" pumped the coin to liquidate Zeus Capital's short position.

A few days back, Zeus Capital Limited, a popular investment bank, published a post in which it clarified that it has nothing to do with the Zeus Capital LLP that is accusing and threatening Chainlink of bad acting. An excerpt from the post reads:

For the avoidance of doubt we would like to state that Zeus Capital Limited has not produced or published research on this subject and has no relationship or affiliation with Zeus Capital LLP whatsoever.

Zeus Capital LLP also published an interview with an anonymous “industry professional who held a senior position at Callisto Network.” This person said that after Callisto offered to enter a partnership with Chainlink, the latter immediately agreed and published a press release to that effect. However, the person has claimed that no actual collaboration took place and Callisto did not integrate Chainlink oracles, according to a CryptoComes report.

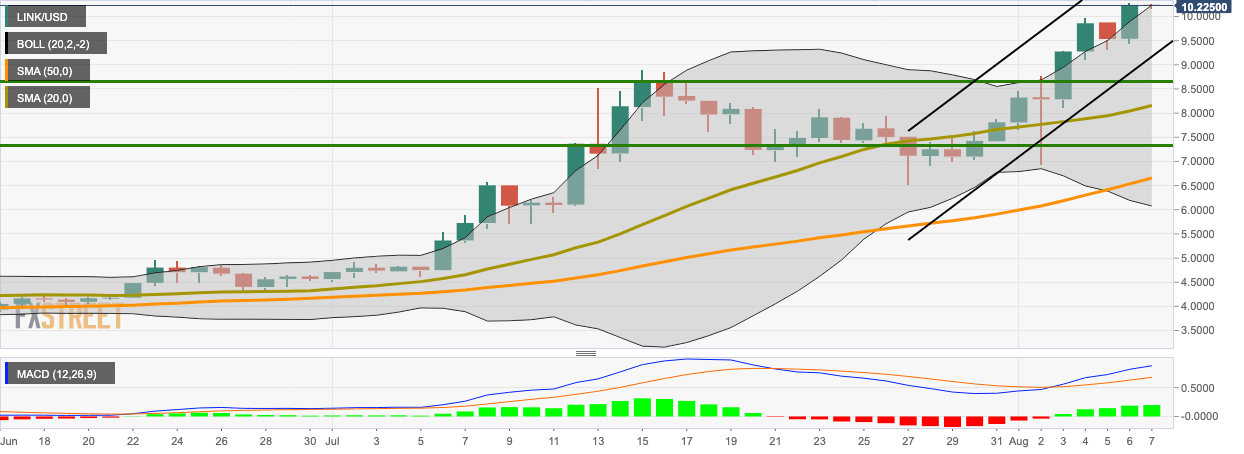

LINK/USD daily chart

LINK/USD had a heavily bullish Thursday, wherein it jumped from $9.492 to $10.25. Currently, the bears have taken the price down a bit to $10.21 in the early hours of Friday. The price is trending above the 20-day Bollinger Band, showing that it is currently overvalued. The MACD shows increasing bullish momentum. We have healthy support levels at $9.492, $8.66 and $8.17 (SMA 20).

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.