Zcash to provide holders more privacy features, putting ZEC price in the spotlight for a 25% upswing

- Zcash collaborates with THORChain to offer new privacy features to its users.

- The direct access pools will see users transact with spot Zcash in DeFi.

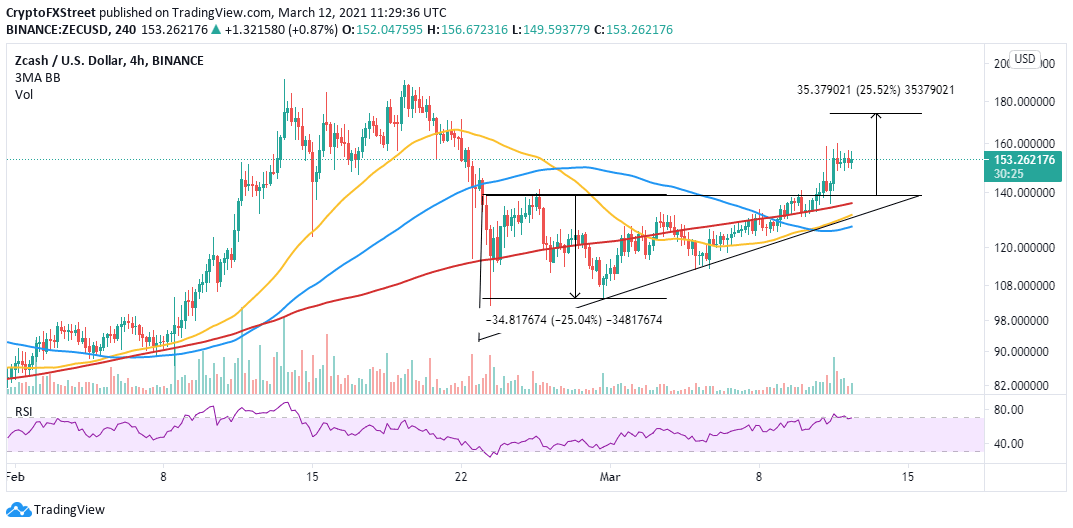

- Zcash is trading above an ascending triangle pattern with a breakout target of $174.

Zcash is looking forward to a revolutionary integration with THORChain to see its users access more privacy features. The network has over the years grown to become one of the go-to cryptocurrency projects when seeking anonymity.

Zcash to offer direct access to shielded pools

Users seeking privacy while carrying out transactions have been looking for ways to store wealth. In other words, the ability to bypass the need for a centralized operator. On the brighter side, the new Zcash update will allow investors access to shielded pools using a gateway into the blockchain ecosystem.

To put this into perspective, Zcash wrote in one of its community forums that integration “would provide the ability to transact with spot Zcash in DeFi, while interacting directly with the shielded pool.”

Zcash is nurturing a 25% upswing

ZEC recently broke out of an ascending triangle pattern, as illustrated on the 1-hour chart. The pattern is bullish and forms after a significant price drop. Period of consolidation is experienced amid low trading volume.

A triangle hypotenuse connects the ascending troughs while the x-axis links a series of relatively equal peals. A breakout is expected after the price crosses above the x-axis. The upswing is usually characterized by increased volume and heads to a precise target, like 25% for ZEC.

ZEC/USD 4-hour chart

It is worth mentioning that the resistance at $160 could still jeopardize the potential spike to $174. Moreover, losses continue under $150, Zcash will be forced to seek refuge at the x-axis. Here, a recovery could ensue, but if overhead pressure mounts, the privacy coin could tumble toward $120.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren