Zcash Price Prediction: ZEC targets $75 as first halving approaches

- ZEC price remains in a downtrend despite the recent strength of the market.

- The inflation rate of Zcash will drop from 25% to 12.5% on November 18.

Zcash, one of the main privacy coins in the crypto space, approaches its first mining reward halving event on November 18. One of the biggest criticisms of Zcash has always been its extremely high inflation rate, which can usually reach 25% or more per year. The upcoming halving should reduce this issue by making it harder for miners to find a cost-effective strategy and force them to upgrade their mining hardware. History has shown halvings to be positive in the long-term.

How will Zcash react to its first halving?

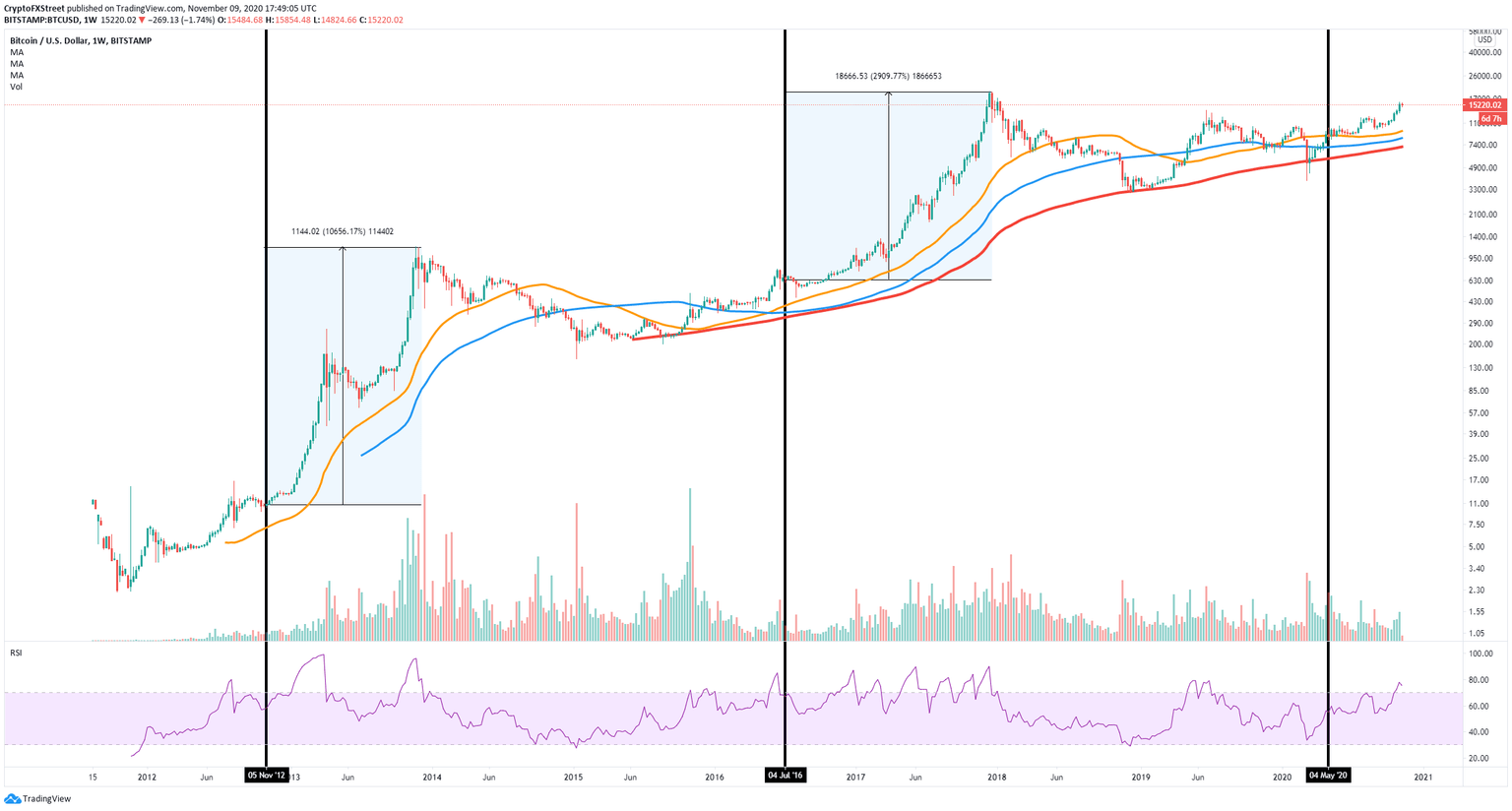

Although this is the first halving for Zcash, we can use Bitcoin to understand the potential implications. The first Bitcoin halving happened in November 2012 and was followed by a 10,600% price surge over the next year.

BTC/USD weekly chart

The second halving wasn’t as successful. In fact, Bitcoin’s price plummeted by 30% within one month but eventually experienced another bull rally, 2,900% this time. Although halvings might not have a positive or significant impact in the short-term, the takeaway is clear. They seem to be the spark of colossal rallies, at least this was the case for the pioneer cryptocurrency.

ZEC price to face critical resistance at $60

ZEC/USD daily chart

On the daily chart, the price of Zcash is trading at $58.44, right below the 200-SMA, and the 50-SMA, which coincide at $60. A breakout above this point can quickly drive the price of ZEC towards the 50-SMA at $68 and as high as $76, the high of October 12. The likelihood of cracking $60 should be higher as the halving event gets closer.

However, a short-term rejection from $60 would be a clear bearish sign and will push Zecash to $51, the low of November 3. This support level is critical; a breakdown from this point can quickly drive ZEC’s price to $44.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.