Zcash is set to undergo its first halving; here’s what to expect

- Zcash community gets ready for the first halving and a major network update.

- The event may have positive long-term price implications.

Zcash is the 34th largest digital asset. It came to life on October 28, 2016, as a decentralized cryptocurrency focused on privacy and anonymity based on zk-SNARK zero-knowledge proof technology. The project has already undergone several protocol updates; however, now it will have its first halving, meaning that ZEC miners' remuneration will be slashed from 6.25 ZEC to 3.125 ZEC per block.

Halvings are a part of the economic model of numerous cryptocurrencies. They help control the network inflation and ensure that coins are issued at a steady pace with a predictable decaying rate.

The process is usually automatic and does not require additional preparatory steps from the token holders. However, Zcash halving will be accompanied by the fifth large system update known as Canopy, including five significant ZCash blockchain improvements.

Here's what ZEC holders need to know before the event

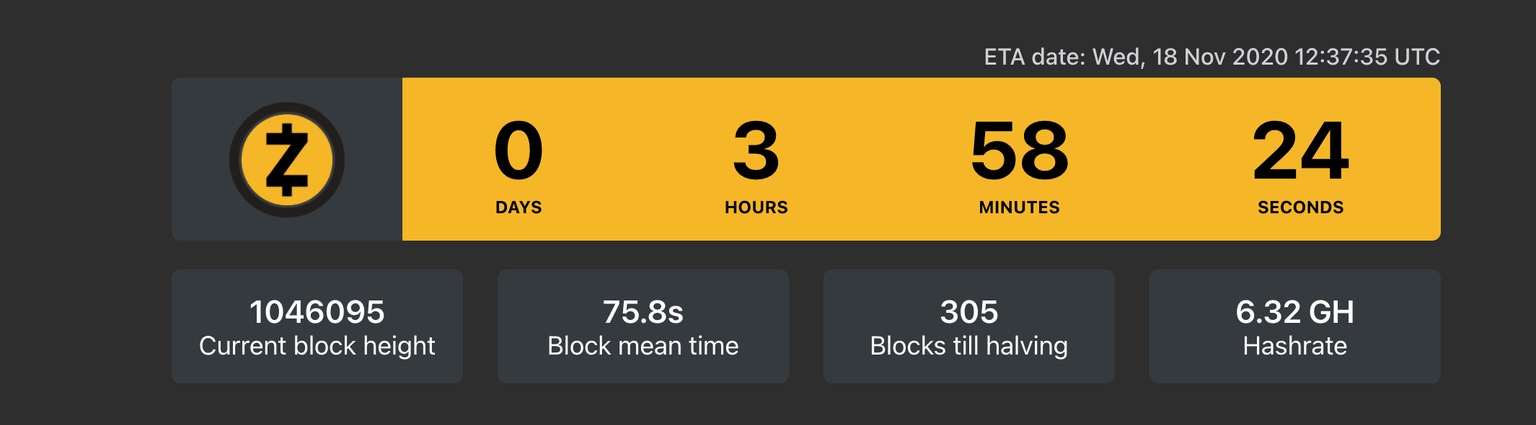

Zcash halving will happen at block 1,046,400. Based on the current estimates, it will occur on Wednesday, November 18, at 12:37 UTC; however, the actual time may differ as it depends on the block discovery rate.

Zcash halving countdown

Usually, the reduced coin supply leads to a price increase. However, according to Ryan Watkins, a crypto analyst at Messari, this time, the bulls' hopes may not be satisfied. The expert notes that Zcash miners are responsible only for 5% of Zcash's daily trading volumes, meaning that they have a low influence on the coin's market price.

Assuming miners sell all their ZEC as they mine it, they still have only historically made up less than 5% of ZEC daily trading volumes over the past year.

— Ryan Watkins (@RyanWatkins_) November 9, 2020

The measure isn't perfect, but its a good enough proxy to show that miners may not be what's holding ZEC back. pic.twitter.com/rjewwJdQUI

However, Zcash halving may have long-term price implications for the coin and create short-term volatility spikes as the stakeholders, including miners, try to adjust to the new network conditions.

The Founder's Reward is set to expire

Zcash miners are not the only ones who have their remuneration slashed in November. As the team plans to roll out the Canopy update, Founder's Reward will expire, and a new development fund will be introduced. As FXStreet previously reported, miners will receive only 80% of the block reward, while 20% will be distributed between developers, investors and founders. The scheme will be effective for four years.

At the current ZEC exchange rate, the new development fund will raise about $70 million, while $28 million will go to the third parties outside Electric Coin, the team behind Zcash core development.

$28M will go to third parties outside of the @ElectricCoinCo and @ZcashFoundation pic.twitter.com/bPC8PiRXXY

— Messari (@MessariCrypto) November 17, 2020

Zcash price implications

At the time of writing, ZEC/USD is changing hands at $63. The coin has lost over 4% since this time on Tuesday, though it is still around 6% higher on a week-to-week basis. While halving events tend to be bullish for the digital asset's price, the positive effect may take time to manifest itself.

For example, BTC price barely moved after its third halving in May 2020. Also, if history is any guide, Zcash price may surge ahead of the event due to increased attention from the community and retreat slightly for another bullish wave. In the financial world, this phenomenon is known as "buy the rumor, sell the fact".

As it stands, Zcash traders should not expect any miracles and get ready for potentially sharp short-term price movements.

ZEC/USD daily chart

From the technical point of view, ZEC/USD is supported by the daily EMA200 located on the approach to $60. This support separates the coin from a sharp sell-off towards $50, the level that served as a backstop for ZEC in June and July and was verified as strong support on several occasions in September and November.

On the upside, a sustainable move above $67 is needed for the recovery to gain traction, with the next focus on $74. This area stopped the bullish momentum in October and also served as channel support during the consolidation period in August. A sustainable move above this area will set the stage for a move towards $85.

Author

Tanya Abrosimova

Independent Analyst