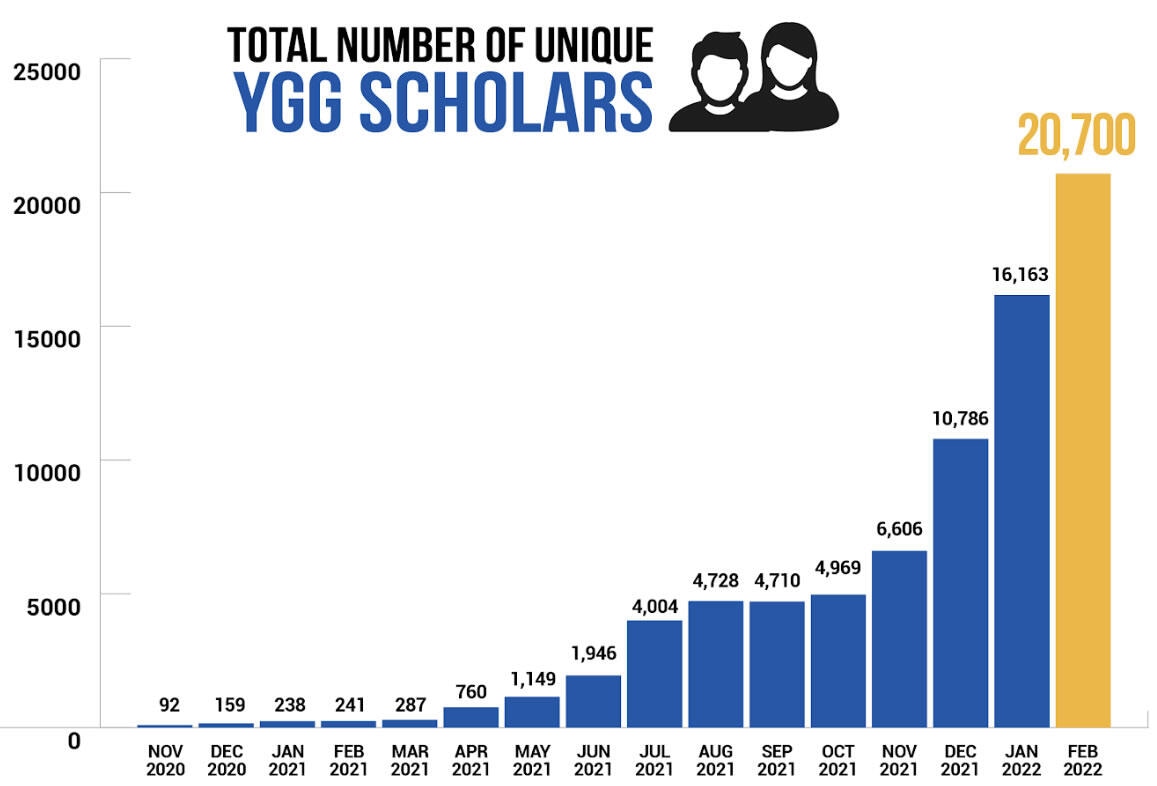

Yield Guild games hits 20K Axie Infinity P2E scholarship milestone

There are now more than 20,000 new scholars in the guild, which is still seeing sustained demand for play-to-earn gaming.

The popular gaming guild YGG has reached a milestone in terms of new scholars for the Axie Infinity platform and various other play-to-earn games.

Yield Guild Games reported 20,700 unique Axie Infinity scholars in February, an increase of 8,500% since the same month last year when there were just 241. The milestone marks a “new record in the play-to-earn space” said YGG in an announcement shared with Cointelegraph.

The play-to-earn scholarships allow new players to borrow a team of Axie NFTs from the Guild. Their in-game earnings are then split between the player, the community manager, and the YGG DAO.

YGG reported that in February, scholars farmed more than 26.4 million SLP, the native token for Axie Infinity. This figure represents a 57% increase from January’s farming figures.

It added that more than 18.4 million SLP (worth around $360,000 as of the end of February) or 70% of the total, was received by scholars, 20% went to the scholarship manager, and 10% to the Guild.

Despite the slide in SLP (Smooth Love Potion) prices, there has been sustained demand for scholarships with YGG. SLP is currently trading at around $0.018, down more than 95% from its July 2021 all-time high of $0.40 according to CoinGecko.

YGG is a decentralized community of play-to-earn gamers based in Southeast Asia and Latin America. It operates across several games investing in yield-generating in-game nonfungible tokens (NFTs) that are lent out to the players. It secured a $4 million funding round to invest in NFTs in June 2021.

In addition to Axie scholarships, YGG has launched similar incentives for the soccer-themed cyberpunk play-to-earn game CyBall. The 1,000 scholarships were snapped up quickly and the program is now full but YGG said that more will be offered soon through its Discord channel.

In February, Cointelegraph reported that the YGG had launched a new gaming-focused proof-of-stake blockchain called Oasys.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.