Yield exploration: Can IPOs provide consistently higher returns than retail stocks?

Despite challenging conditions brought on by the COVID-19 pandemic, companies raised more money through stock market listings in 2020 than in any other year besides 2007. With an IPO boom underway, could this provide investors with a fresh approach to making money? Or are initial public offerings not worthy of the fuss that they’re causing?

Businesses raised nearly $300 billion through listings worldwide throughout 2020, including a record-breaking $159 billion in the US alone. IPO fever included public debuts of large tech businesses like DoorDash and Airbnb, alongside the rise of SPACs companies that sought to buy other businesses to fast-track them into going public.

(Image: PwC)

So far, the IPO boom has only continued to gather momentum at an alarming rate. In the US, SPAC initial public offerings have already surpassed their 2020 total, while the number of companies going public is also continuing to rise.

But what does this mean for investors? Could IPO fever lead to larger yields than through traditional retail investing? Let’s take a deeper look into the lure of the IPO:

The Appeal of Early Investment

Companies decide to make an initial public offering mainly to generate funds for future growth, but sometimes it can also be to boost the awareness or stature of the company. This generally occurs at a scale of £100s in order to establish a clear, long-term plan that satisfies the requirements of the exchange they’re aiming to list on. The company will also aim to convince prospective investors that they are a viable investment opportunity to consider buying into.

IPOs enable a company’s shares to be bought and sold by members of the public via an established trading exchange like the New York or London Stock Exchange. As an initial buyer of a newly listed company’s stock, you’ll be among the first people to have the chance to invest in that company. IPOs carry significant appeal for investors because the initial share price can often be interpreted as good value before floatation begins.

In the wake of the COVID-19 pandemic, many tech-oriented companies have been enjoying profitable years due to the increased consumer demand for technology and remote services. This has led to a rise in tech IPOs and high performing tech stocks.

One example of a successful tech initial public offering can be found in that of Snowflake, a data warehousing company that was initially expected to price shares at between $75 and $85 dollars before going public at $120. On its first day of trading, Snowflake stocks rose significantly to $300 - resulting in a market cap of almost $75 billion.

Be Wary of Shorter IPO Shelf-Life

So, can IPOs deliver higher returns than traditional stock market investing? The answer varies depending on many factors. However, trends seem to suggest that initial public offerings appear to be a great option for investors who are looking to make short term gains as opposed to those who buy into a company’s long-term potential.

That said, retail investors should carry out extensive research before jumping head-first. Maxim Manturov, Head of Investment Research at Freedom Finance Europe, says: “Research is always a top priority. First things first, one should pay attention to how the company's earnings rise and its potential TAM. It is also advisable to explore the company's products and what needs they cover, the company's financial condition, and liquidity. A healthy debt-to-assets ratio, renowned IPO underwriters, and suggested ways to use the raised funds are also worth paying attention to. The more information one can get, the deeper understanding one will have.”

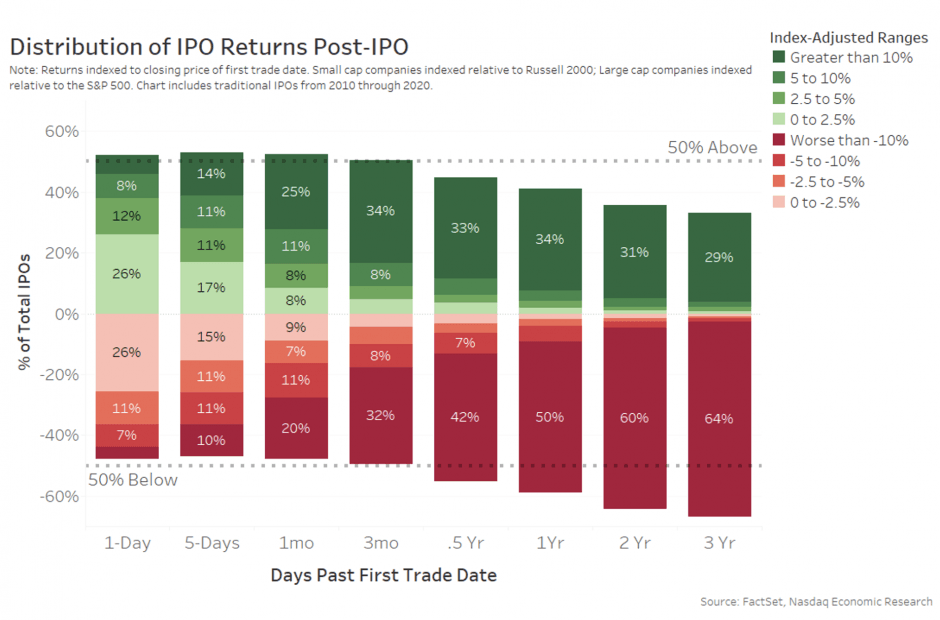

Nasdaq reviewed the performance of companies that came to market between 2010 and 2020. The findings showed that long-run performance varies to a significant degree on longer timeframes.

(Image: Nasdaq)

Here, we can see that IPO prices shift significantly over time. While within the first day, first five days, and the first month of trading IPOs typically appreciate in value, this trend appears to reverse after three months before tumbling dramatically. After three years, 64% of initial public offerings generally fall by more than 10%, while 29% will have climbed by over 10% of its original price.

This means that statistically, IPOs are at their most profitable within the days and few months following their respective listings. Of course, it’s worth noting that experienced traders may be more skilled at identifying the 29% of stocks that move significantly up following listings, but it remains clear that the world of initial public offerings is generally at its most profitable over the short term.

There could be many reasons for this trend taking place. In some cases, initial IPO enthusiasm wanes, or expected earnings aren’t reached. Meanwhile, some investors reprice the IPO to reflect the slower growth rate of the company in question.

Muscling in on The IPO Buying Spree

The ‘I’ in IPO refers to the stock’s initial offering price, but that price tends to only apply to the kind of investors who can get in on the deal early. Sadly, unless someone is a key client at a brokerage firm, average retail investors can struggle to buy shares at their IPO price.

Speaking on the subject, David Schneider, certified financial planner at Schneider Wealth Strategies said that “allocations of hot IPOs are not in the cards for mere mortals,” referencing how notoriously difficult it can be to get in on initial public offerings for individual investors.

The key issue here is that many companies set to go public will want to sell their shares to institutional investors that will be much more capable of purchasing a huge volume of stocks in one single transaction - a feat that most other investors couldn’t achieve.

Statistically speaking, IPOs can offer investors consistently higher returns than traditional stock investing when it comes to shorter holding periods. Naturally, the act of investing should still require plenty of research into prospective companies and opportunities before participating.

With an IPO boom in full swing, we’re seeing more initial public offerings arriving than ever before. In this new digital gold rush, for investors who have done their homework, there may be plenty of opportunity for profits ahead.

Author

Dmytro Spilka

Solvid

Dmytro is a tech, blockchain and crypto writer based in London. Founder and CEO at Solvid. Founder of Pridicto, an AI-powered web analytics SaaS.