Yearn.Finance whales are back into accumulation suggesting YFI price is poised to rebound

- YFI price aims for a rebound towards $31,000 in the short-term.

- Yearn.Finance whales have started accumulating again, hinting at a potential reversal.

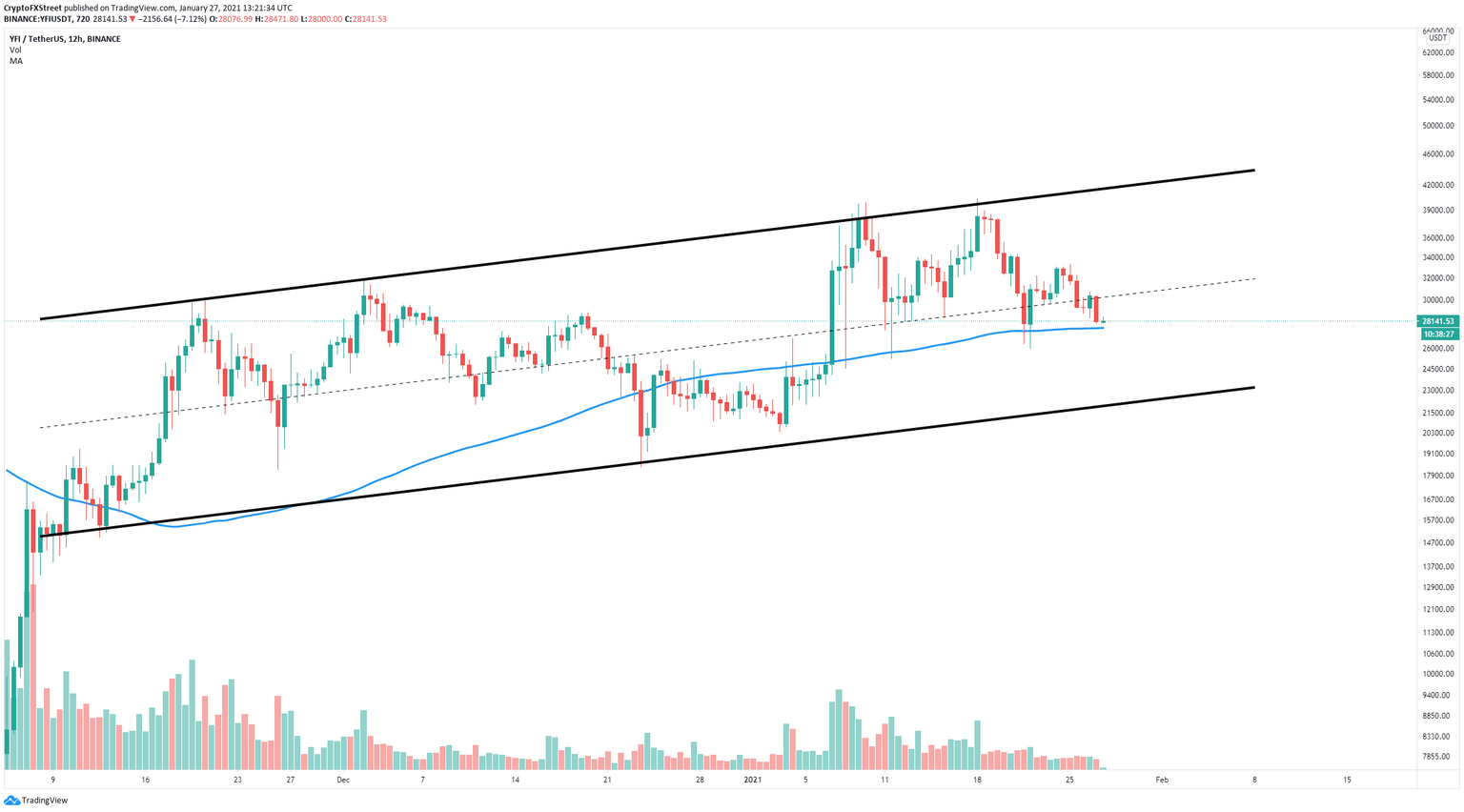

- The digital asset is trading inside a parallel channel on the 12-hour chart.

Yearn.Finance has been trading inside a defined range from $40,000 down to $28,000 for the past three weeks. The digital asset is potentially on the brink of a rebound as whales have started to accumulate again.

YFI price could quickly jump to $31,000 thanks to large holders

In the past week, the percentage of whales holding between 1,000 and 10,000 coins increased by 10%, which is significant. This indicates that large holders have started to accumulate again, perhaps for staking purposes.

YFI Holders Distribution

Meanwhile, the Market Value to Realized Value (MVRV 90d) metric shows that YFI is currently around the 11% level, which is not a dangerous level. Whenever this measure goes above 80%, the likelihood of a pullback increases greatly, but even 40% seems to be a risky level. However, the current 11% statistic shows that YFI price is at no risk.

YFI MVRV (90d)

Yearn.Finance has established a long-term ascending parallel channel on the 12-hour chart and it’s currently trading right in the middle of it. Defending the crucial 100-SMA support level at $27,500 can easily drive YFI price above $30,000.

YFI/USD 12-hour chart

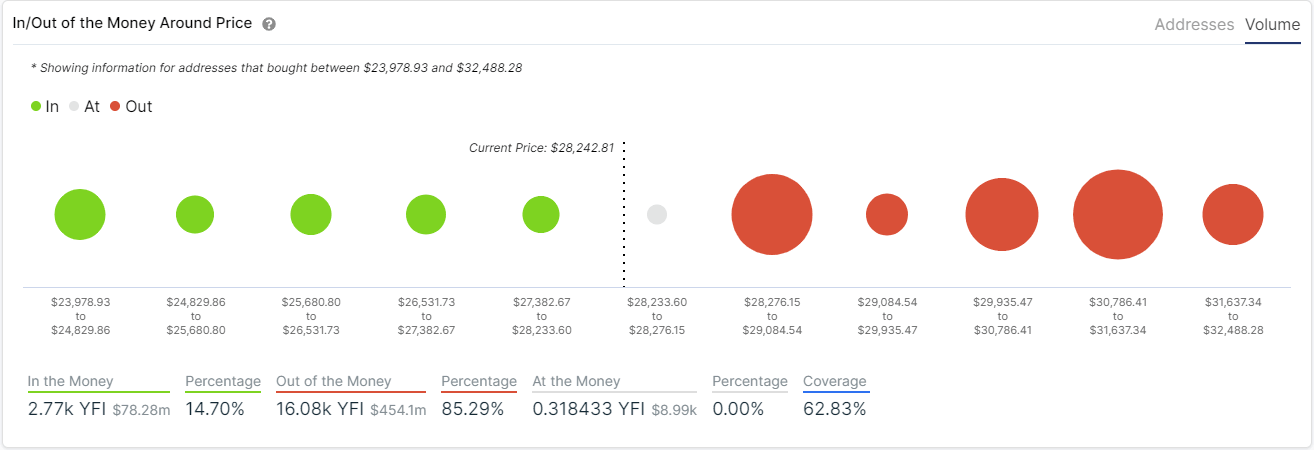

The In/Out of the Money Around Price (IOMAP) model shows a significant barrier between $28,200 and $29,000, where 989 addresses purchased over 4,300 YFI coins. A breakout above this point can push YFI price towards $31,000.

YFI IOMAP chart

However, the IOMAP chart also indicates that support below is extremely weak until $24,000, which closely coincides with the lower trendline of the parallel channel. Losing the 100-SMA support level at $27,500 would drive YFI price down to $24,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.12.08%2C%252027%2520Jan%2C%25202021%5D-637473507058366087.png&w=1536&q=95)

%2520%5B14.18.08%2C%252027%2520Jan%2C%25202021%5D-637473507090398425.png&w=1536&q=95)