Yearn.Finance price on the verge of a massive correction as indicator flashes sell signal

- Yearn.Finance price is up by 54% in the past 24 hours and has hit a high of $37,185.

- The digital asset retraced significantly from this high down to $29,555.

It seems that after a massive breakout, YFI is pulling back significantly and might continue doing so. The digital asset is currently trading at $32,554 after a massive rejection from the high of $37,185 earlier today.

Yearn.Finance price might drop lower as indicator shows sell signals

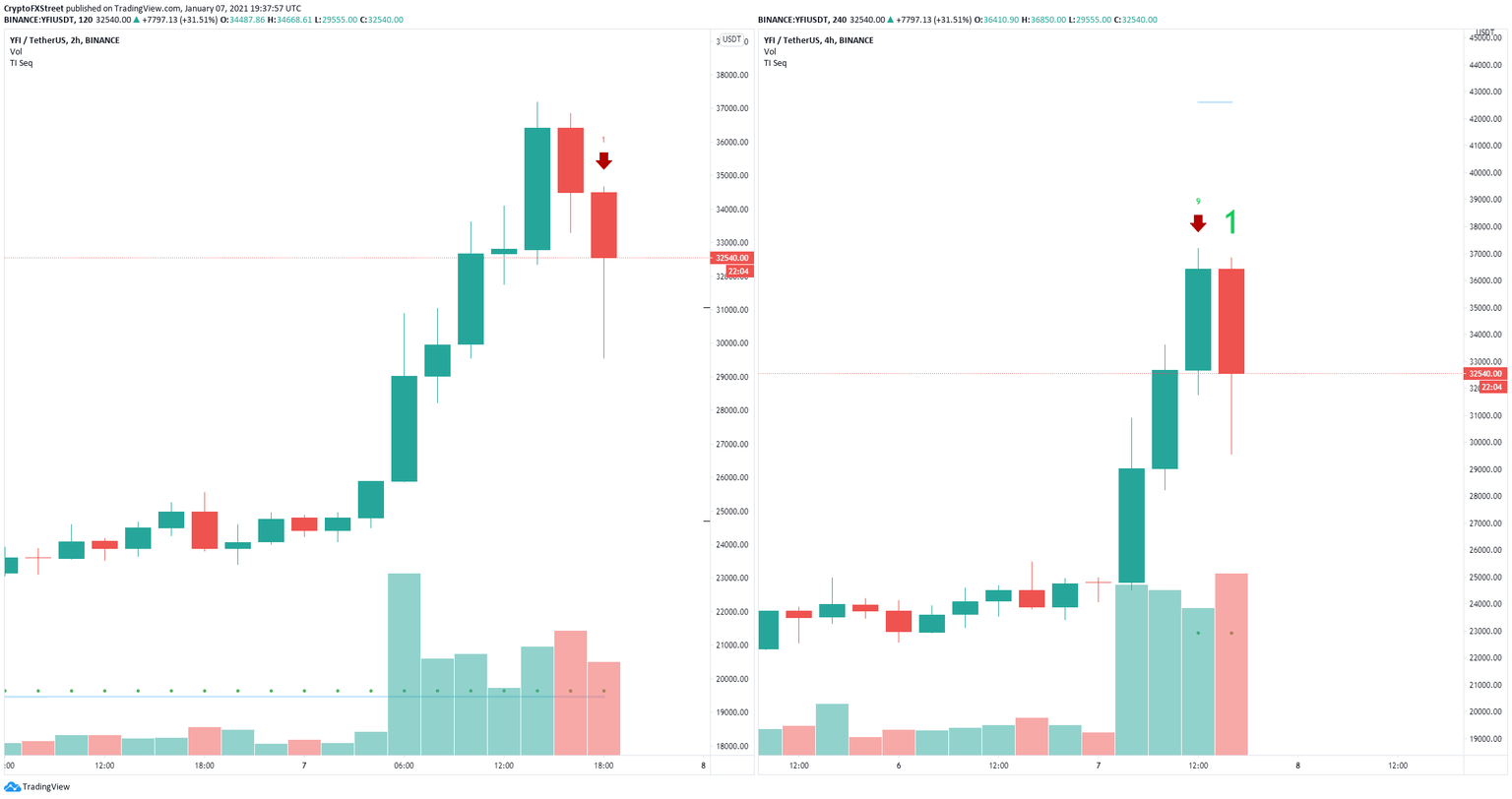

On the 2-hour chart and the 4-hour chart, the TD Sequential indicator has just presented two sell signals which seem to be getting a lot of follow-through action. YFI has very little support to the downside due to the speed of the move up.

YFI sell signals chart

The In/Out of the Money Around Price (IOMAP) chart shows very low support below $33,126 until an important area between $29,169 and $28,148 which indicates Yearn.Finance price could drop towards that point. A breakdown below that could send the digital asset down to $25,000.

YFI IOMAP chart

On the other hand, the IOMAP chart also indicates that the only significant resistance area is located between $33,169 and $34,147. A breakout above this range can quickly drive Yearn.Finance price towards $38,147.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.