Yearn.finance Price Forecast: YFI/USD DeFi charming giant rockets to $13,000, what next?

- The decentralized finance token, YFI continues to break barriers and hit new all-time highs.

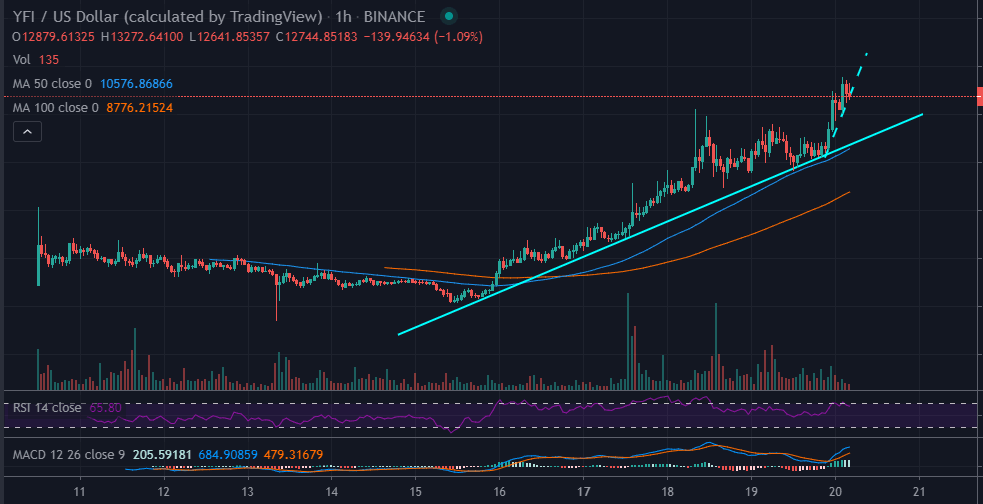

- YFI/USD hits an new all-time high at $13,552 plunges below $13,000 immediately; support at $12,500 eyed.

Yearn.finance has quickly become a hot topic in the decentralized fiancé ‘streets.’ The project continues to ooze power, hitting new high after new high. Indeed it has been a ride of their lifetimes for those who entered the project at a lower price of let's say $4,000 because, at the time of writing, YFI is trading at $12,719 (on Binance).

The current price level comes after a majestic rally to highs above $13,000. In fact, a new all-time was traded at $13,552 on Thursday. A retreat seems to be underway with the buyers trying to seek support, preferably above $12,500. If the reversal is to continue, tentative support lies at $12,000 while extended declines will target the support at $11,000 and $10,000 respectively.

From a technical perspective, the consistent rocketing of the price has hit overbought levels. The RSI is moving down from the levels at 70, a situation that is encouraging sellers to increase their positions.

On the other hand, the MACD clearly shows that the price has stalled and the trend is quickly turning bearish. At the same time, the position of the MACD in the positive region suggests that buyers still have a say and could hold the price at a higher support level ($12,500); as confirmed by the visible bullish divergence.

YFI/USD 1-hour chart

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren