- Yearn.finance yVaults will soon support UniSwap (UNI) yield farming.

- YFI/USD renews the uptrend towards $20,000 after bouncing off support at $16,000.

Yearn.finance, received a massive beating last week, losing over 38% of its value. However, the losses were not unique to the decentralized finance (DeFi) token because leading digital assets such as Bitcoin and Ethereum dived to $10,400 and $335, respectively.

Last week, the losses in the market affected most of the cryptocurrencies apart from the top 3 performers, as discussed on Saturday. Meanwhile, YFI is teetering at $19,454 following an extended breakdown from its all-time high of $44,000, traded mid-September. Support at $16,000 is key to the ongoing recovery.

Yearn.finance will soon support UniSwap yield farming

The DeFi remains one of the most diverse and dynamic sectors of the cryptocurrency industry. It has given newly launched tokens like YFI a global presence by allowing them to offer financial solutions to anyone across the world. Yearn.finance users have an opportunity to earn from various DeFi projects through a process called yield farming.

In line with this, Yearn.finance developers have announced the imminent release of version two of yVaults that would farm UniSwap (UNI). UNI is a relatively new token that was launched by the decentralized exchange and liquidity provider, UniSwap. The news has been received well by the community and perhaps it is the force behind the ongoing recovery.

Yearn.finance renews the uptrend as volatility returns

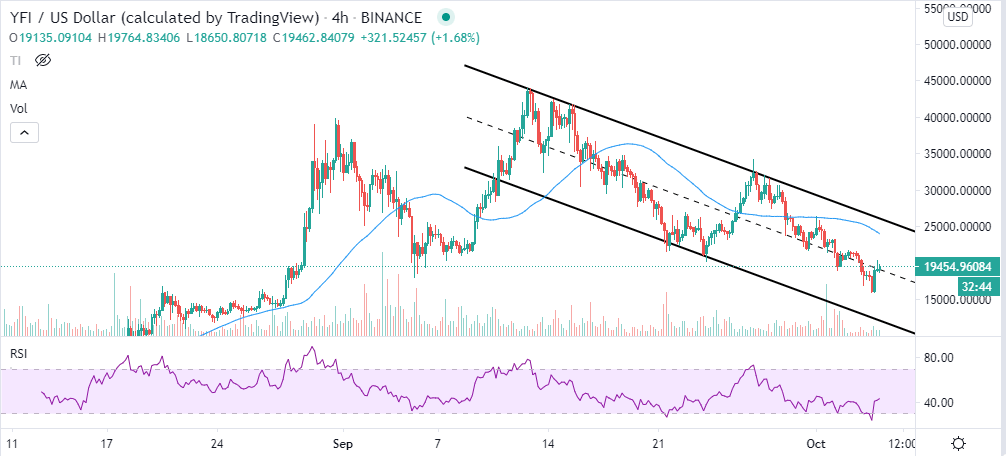

After revisiting support at $16,000, YFI is in the middle of recovery. However, to guarantee sustained gains, the short term resistance at $20,000 must come down. The Relative Strength Index (RSI) clearly shows that the odds favor the bulls. The indicator is almost crossing above the midline. If the uptrend progresses towards the overbought area, the upper leg could extend to $22,000.

The descending parallel channel highlights growing resistance towards $22,000. The channel resistance has not wavered since the all-time high. Therefore, bulls must focus on pulling above the channel to confirm a bull flag pattern.

YFI/USD 4-hour chart

Santiment’s age consumed metric highlights a spike in the movement of tokens as they change addresses. According to Santiment Academy, “age consumed shows the number of tokens changing addresses on a certain date, multiplied by the time since they last moved.” The spike on the chart mainly highlights the movement of a colossal amount of tokens following a long period where they remained idle. Spikes in age consumed tends to signal potential volatility. In this case, 4,800 YFI tokens moved on October 4. The movement happened before the ongoing volatility started.

YFI age consumed chart

IntoTheBlock’s IOMAP highlights a challenging path towards $22,000. The largest resistance runs from $20,600 to $21,200. Here, nearly 560 addresses previously bought 1,600 YFI. While this is the most prominent resistance, other equally strong hurdles could delay breakout to $20,000. On the flip side, the absence of a strong support area spells doom for Yearn.finance in the near term. The most significant support lies between $17,100 and $17,700, a range where nearly 130 addresses bought roughly 54 YFI.

YFI IOMAP chart

Looking at the other side of the picture

Yearn.finance bulls are taking advantage of the volatility to push their agenda for gains above $20,000 and towards $22,000. However, the descending channel’s middle boundary layer support must stay intact for some of these gains to come into the picture. Otherwise, losses could resume, testing the support highlighted by the IOMAP at $17,700 - $17,100. The same metric brings to light the tough resistance heading to $22,000. Therefore, it is doubtful that there will be a quick rally to the near term target.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple's XRP holds symmetrical triangle support as SEC acknowledges Bitwise XRP ETF filings

Ripple's XRP is down 3% on Tuesday despite the Securities and Exchange Commission (SEC) acknowledgment of Bitwise XRP ETF. Unchained Crypto noted that XRP ETF could underperform due to key fundamental issues.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP could decline on FTX repayments pressure

Bitcoin (BTC) price has been consolidating between $94,000 and $100,000 for two weeks. Ethereum (ETH) and Ripple (XRP) faced a pullback earlier this week. BTC, ETH and XRP prices could decline further as FTX repayments could raise selling pressure.

Bitcoin stretches losses as CME premiums dip, Strategy aims to purchase $2 billion worth of BTC

Bitcoin (BTC) continued its downward trend on Tuesday as K33 Research's weekly report indicated growing declines in BTC CME premium and yields. BTC has shown a directionless movement since the presidential election, which suggests waning interest among investors.

How will Dogecoin price react to Elon Musk investigating the US SEC?

Dogecoin price hit $0.25 on Tuesday, plunging 10% in 48 hours as the market reacted to regulatory squabbles between Elon Musk-led D.O.G.E and the US SEC.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best Brokers of the Year

SPONSORED Explore top-quality choices worldwide and locally. Compare key features like spreads, leverage, and platforms. Find the right broker for your needs, whether trading CFDs, Forex pairs like EUR/USD, or commodities like Gold.

Age Consumed chart-637374664640202251.png)

-637374665420006443.png)