Yearn.Finance price faces steep resistance ahead, but on-chain metrics suggest it could hit $25,000

- Yearn.Finance price is having a tough time deciding which direction to take.

- Several on-chain metrics seem to be extremely positive for YFI in the long-term.

YFI is currently trading at $21,900 but without a clear short-term direction. The digital asset seems to have a great long-term perspective according to various on-chain metrics.

Yearn.Finance price could be poised for a breakout soon

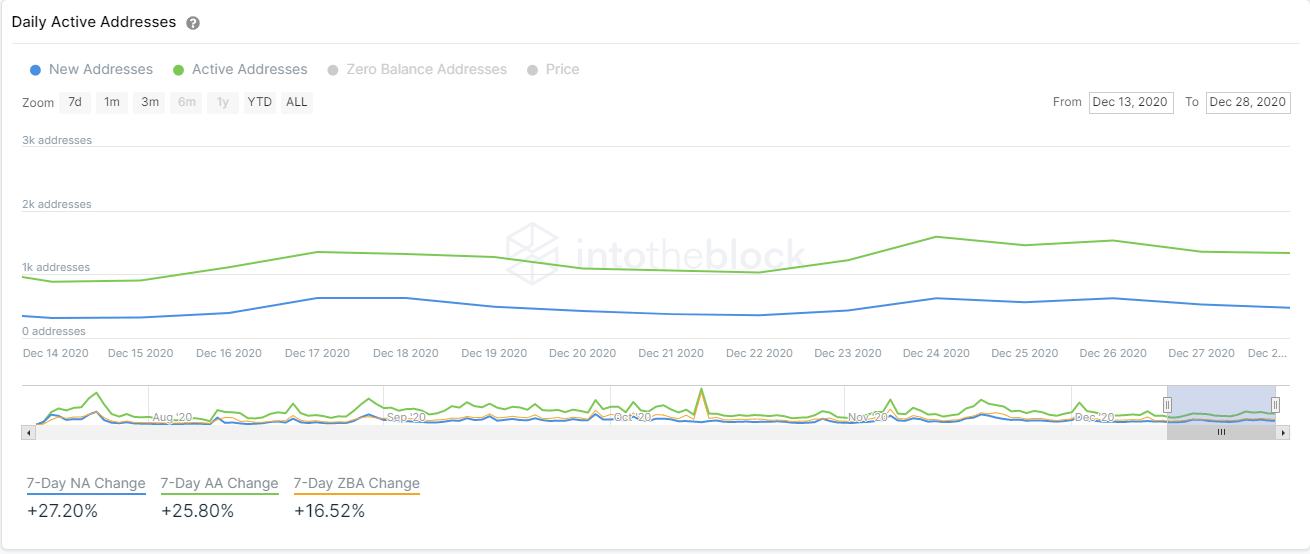

There seems to be a lot of interest in YFI in the past month. The number of new addresses joining the network has increased by 27% in the past week. Similarly, active addresses also had a major spike since December 14.

YFI New and Active Addresses chart

More importantly, the number of whales holding between 100 and 1,000 coins ($2,190,000 and $21,900,000) has increased tremendously over the past two months from 16 on October 18 to a current high of 39. In the past week alone, this number increased by five.

YFI Holders Distribution chart

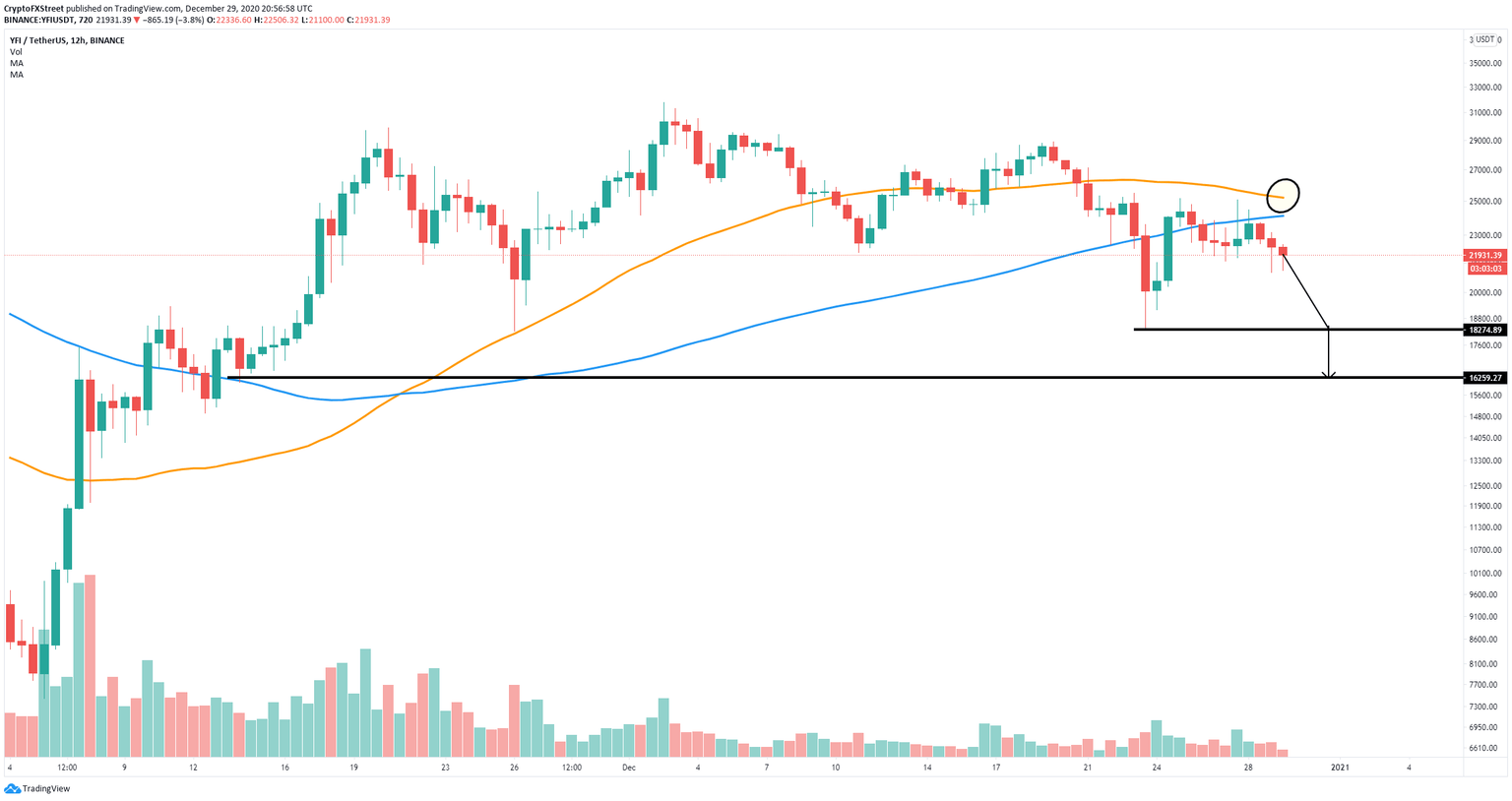

This metric indicates that whales are prepared to hold YFI, increasing its buy pressure. On the 12-hour chart, the digital asset must hold the low of $18,360 and climb above the 100-SMA to potentially touch $25,000, which coincides with the 50-SMA.

YFI/USD 12-hour chart

However, bears have just established a downtrend on the 12-hour chart and aim to crack $18,360 support. A breakdown below this point can quickly drive Yearn.Finance price down to $16,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B21.57.43%2C%252029%2520Dec%2C%25202020%5D-637448722691830509.png&w=1536&q=95)