Yearn Finance Price Prediction: YFI must hold $13,000 to avoid steep correction

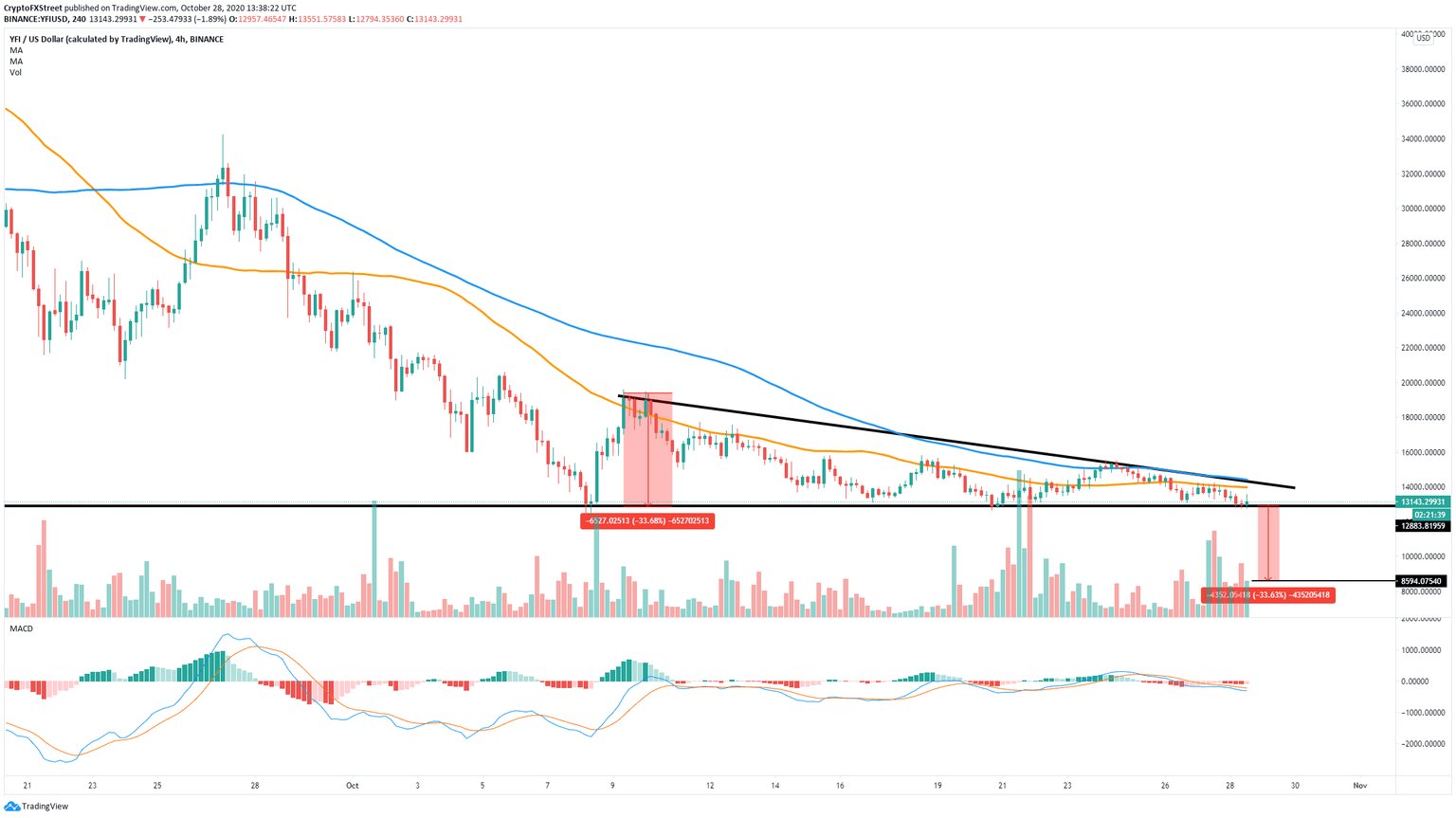

- YFI is bounded inside a descending triangle pattern.

- Bulls need to hold critical support level at $13,000 to avoid a significant pullback.

Despite the bullish momentum of the entire crypto market, it seems that YFI hasn’t benefited from it, being down 16% since October 24. The digital asset is currently trading at $13,153 and shows almost no signs of recovery.

Slipping below $13,000 can drive YFI towards $8,600

The lower trendline at $13,000 of the descending triangle pattern formed on the 4-hour chart has acted as strong support several times in the past since October 8. A break below that level would be significant for the sellers.

YFI/USDT 4-hour chart

The MACD remains bearish and started to gain momentum again. The length from the top of the triangle to the lower trendline can be used as a price target for the bears. In this case, it seems that YFI could drop as far as $8,600.

YFI IOMAP chart

Furthermore, the In/Out of the Money Around Price shows very little support on the way down from $13,129 until $11,172. In comparison, resistance is far more substantial as a higher number of investors bought additional YFI tokens on the way up.

A positive sign for YFI bulls

On the other hand, it seems that the TD Sequential indicator is about to present a strong buy signal on the 12-hour chart. Successfully defending the robust support trendline of the descending triangle pattern could drive the price of YFI towards the upper resistance at $14,100.

YFI/USDT 12-hour chart

A breakout above $14,100 can push the digital asset towards the 50-SMA at $15,222 on the 12-hour chart. A longer-term price target could be almost $19,000, representing a 32% price jump from the triangle pattern.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.