Yearn Finance crashes 40% in five hours, as altcoins lose footing

- Yearn Finance price faces an immense sell-off, knocking the YFI token down by 40%.

- Profit-taking in altcoins is likely going to trigger double-digit losses for many altcoins.

- Bitcoin price continues to move sideways around the $36,000 region with no directional bias.

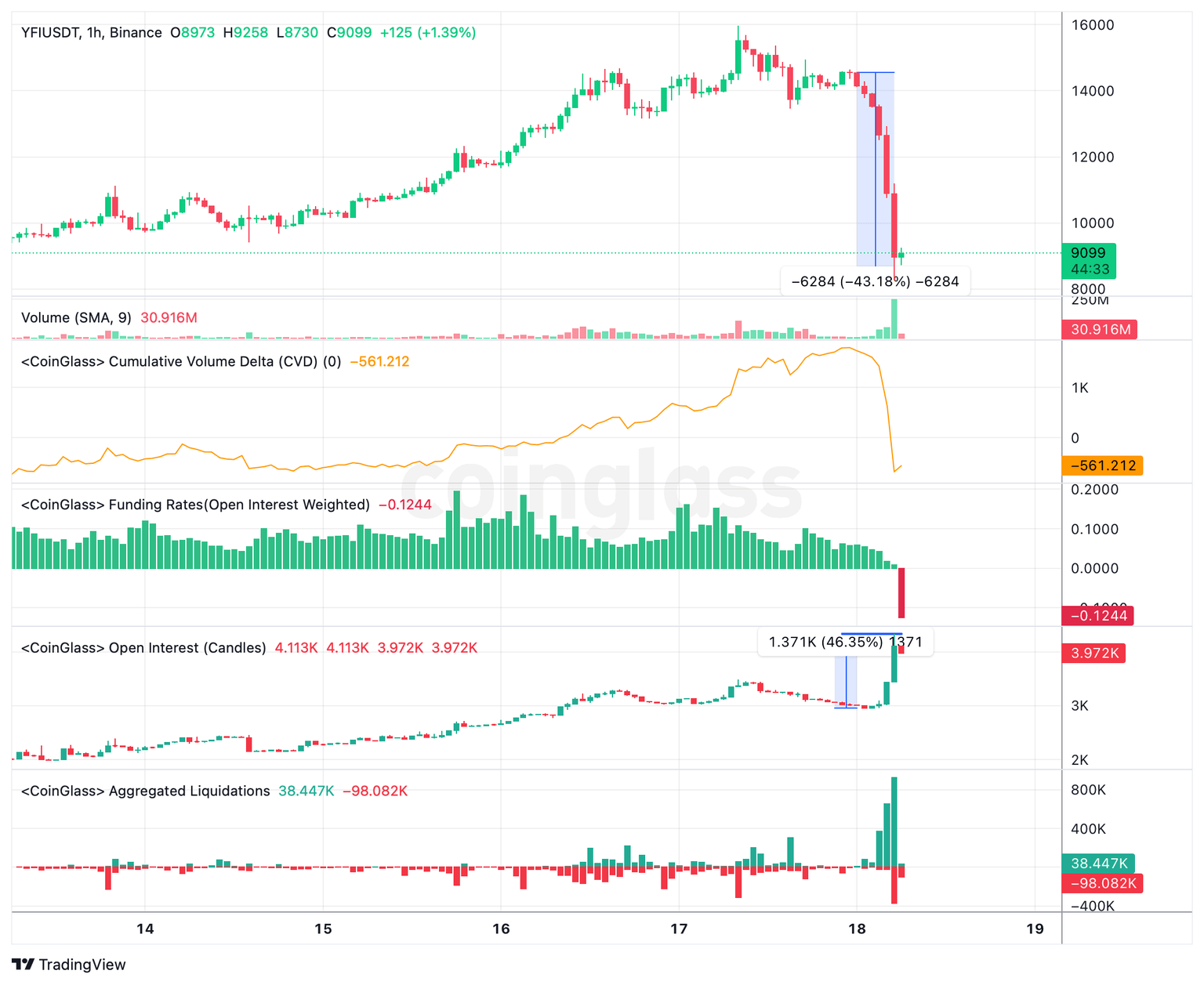

Yearn Finance (YFI) price has suffered a massive selling spree that has resulted in a 43% cras, undoing five-day gains in the last five hours. This move comes as Bitcoin price moves sideways and shows no directional bias whatsoever, but altcoins are susceptible and likely to suffer a similar fate as the trading volumes are generally low during weekends.

Yearn Finance’s historic rise and dramatic crash

Yearh Finance’s YFI token rallied a whopping 167% in just nine days between November 8 and 17. This impressive rally set a local top at $15,955 on November 17 and triggered its dramatic crash that undid nearly five days of gains in just five hours.

Here are the takeaways of this 43% crash.

- The five-hour selling spree caused YFI longs worth $2.1 million to face liquidations, according to data from CoinGlass.

- A closer look at the futures data shows a 40% increase in open interest, suggesting that this move could have been triggered due to the opening of short positions.

- Interestingly, $372,143 worth of shorts were also liquidated and could be considered FOMO bears that piled on at the last minute and at the end of the 43% crash.

YFI/USDT 1-hour chart

Altcoins likely to face YFI’s fate in the upcoming week

The run-up in crypto prices over the last few weeks was mainly due to the ETF approval. To be specific, the ETF approval window, extending from November 13 to 17, was why most altcoins squeezed higher in the last week. But since the SEC has clearly delayed this decision, the approval is likely to come in January 2024. Hence, investors are likely to book-profits, which could trigger a market-wide correction.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.