Yam Finance announces migration to V3 in hopes to revive the project

- The liquidity mining protocol Yam Finance announced the updated conditions of V3 migration.

- Yamv2 recovers from lows before the launch, but the fate of Yamv3 looks gloomy.

After a shaky start, the mother and father of all foodie yield farmers get ready to launch the third version of the protocol. This time, the community hopes it will be free of bugs and errors that plagued the first versions of the DeFi project.

In the recent tweet, the Yam Finance team announced that the new protocol's migration would start at 8 PM UTC on Friday, September 18. The exchange will be manual for v2 token holders, who will receive new tokens on a 1 to 1 basis. However, the users do not have to harry as the process has no deadline.

There is no need to migrate immediately upon launch of the migration contract, and incentives will not begin for a further 24 hours. You can monitor gas price via https://t.co/yYUlyO8rxC

— Yam Finance (@YamFinance) September 17, 2020

As the team explained in a blogpost, V3 had successfully passed the audit performed by PeckShield. According to the timeline, YAM/yUSD LP incentives will go live Saturday, September 19, while the first rebase will take place Monday, September 21.

Foodie token with a bitter after-taste

Yam Finance jumped into the DeFi in mid-August and set the stage for a yield farming trend and a food farming craze. The so-called yield farmers staked their tokens on the platform in exchange for the rewards in YAM tokens.

The token's price jumped to nearly $160 when a flaw in a smart contract code was detected, and the price crashed to $0. The team behind the project was forced to relaunch on the Yam v2 posthaste to save the failed crops of the angered community.

YAMv1 chart

Source: CoinGeko

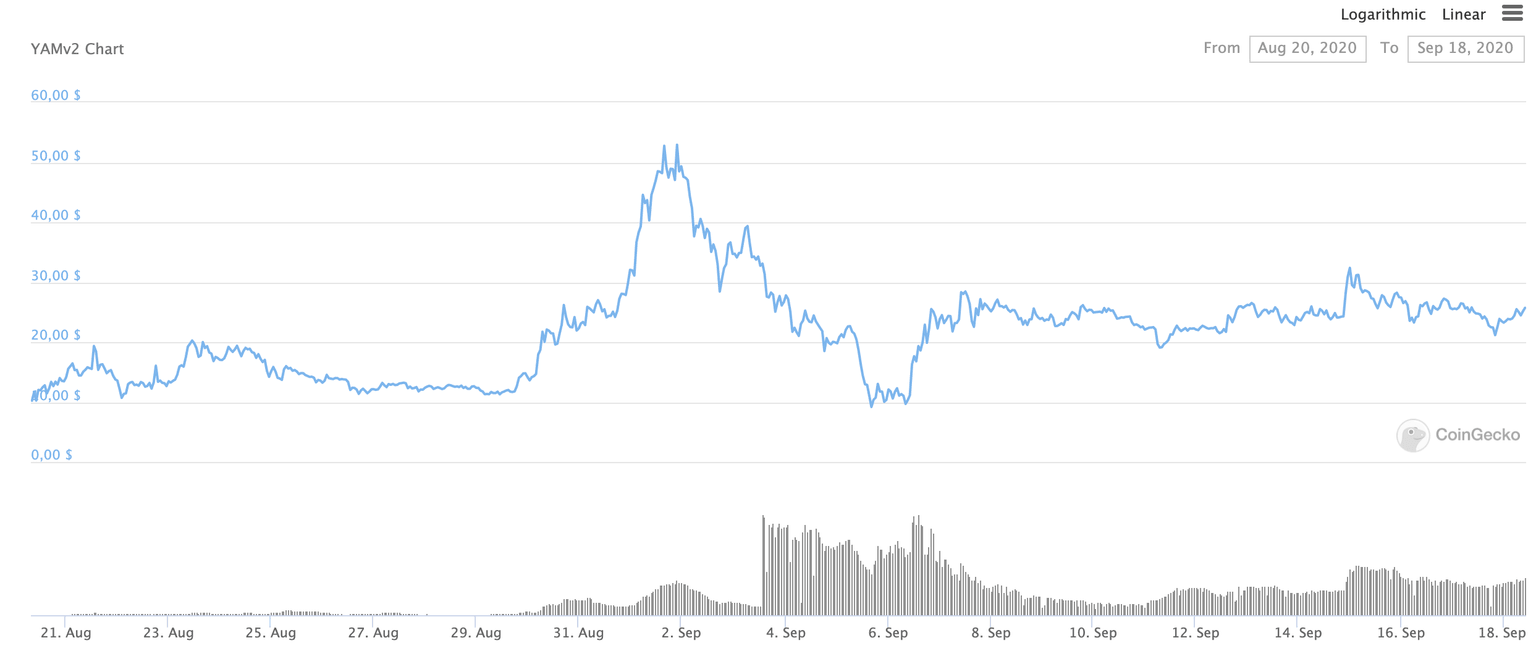

Following the migration, YAMv2 emerged. The token managed to climb $32 but failed to repeat the previous success and returned to $25.7 by the time of writing. YAMv2 token takes 111th place in the global cryptocurrency market rating, with the current market capitalization of $96 million and an average daily trading volume of nearly $60 million. The token is most actively traded on the cryptocurrency exchange BiKi.

YAMv2 may run out of luck

Following the migration news, YAMv2 recovered from the recent low of $21.17. Considering that the previous protocol update helped reanimate the dead token and push the price from nearly $0 to $32, some community members hope to see a similar momentum upon the upgrade to YAMv3.

YAMv2 chart

Source: CoinGeko

However, this time may be different as farmers seem to get tired of migrations, which are neither automatic no suer-friendly. Many people report that they had issues migrating from V1 to V2 and lost money in the process. Some of them are looking at new and promising protocols like UNI.

As the FXstreet previously reported, one of the most popular DeFi protocols, Uniswap, launched native token UNI that will be paid as a reward for all Uniswap's liquidity mining participants program, that will go live on September 18.

Author

Tanya Abrosimova

Independent Analyst