XTZ Price Prediction: Tezos cooperation with McLaren can only mean one thing

- McLaren will be teamed up with Tezos to create an NFT platform.

- XTZ price rattled by the Fed’s potential rate hikes.

- A nice buy level for Tezos looks nearby.

Tezos is teaming up with McLaren. The Formula 1 team has asked the blockchain currency to build a non-fungible token (NFT) platform. The idea is that the platform will list NFTs from the history of McLaren as the second-oldest running F1 team.

McLaren has elected to team with Tezos for their less energy-intensive model. As a counterpart, Tezos branding will show on the race suits of the F1 team.

XTZ price on-sell the rumor, buy the fact mode

Tezos price went higher on the initial news of this partnership, but it has been treading water since, as risk-off sentiment has taken over the markets after last week’s Fed interest rate decision. Investors got spooked and pulled their money out of the markets. Add to that the fact that China has ordered online paying platform Alipay and domestic banks not to provide services linked to virtual currencies, and you get a quick correction.

Markets are voracious at the pricing in events. Now the two negative elements are in, it is time to look to buy the fact: Tezos has a foot in the door to the billion-dollar franchise F1 is.

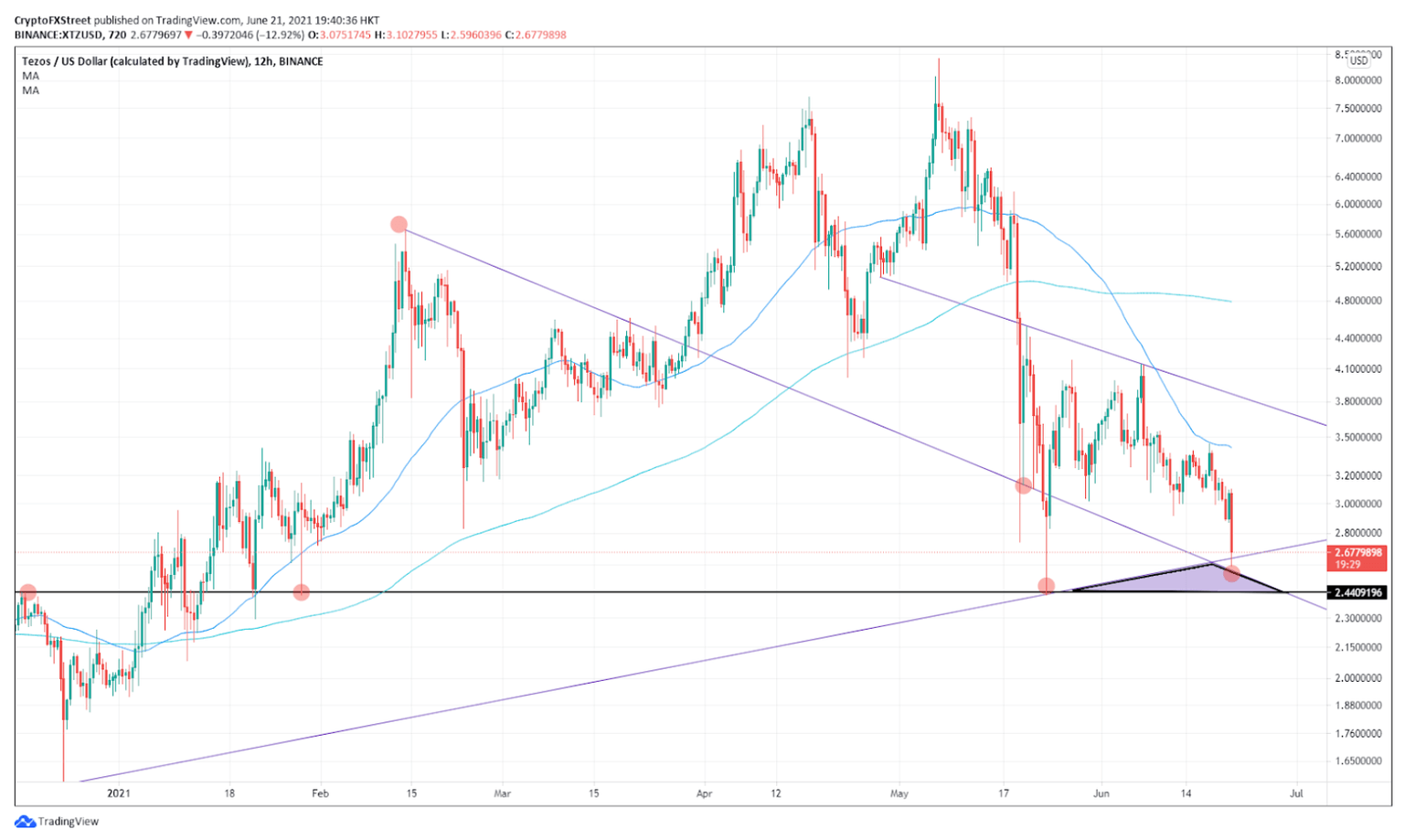

XTZ/USDt 12-hour chart

Monday’s red candlestick is getting in an interesting purple triangle that has proven its base around $2.44, a big support level not seen since February.

This triangle is shaped by two trendlines that are crossing, which might provide Tezos with more support. The death cross triggered by the 55 and 200 DMAs, however, is not very compelling, but once the shock effect of the China news is brushed off, we might see logic returning.

Author

FXStreet Team

FXStreet