XRP yet to see gains despite Ripple's partnership with Chipper Cash

- Ripple announced that it has partnered with payment services provider Chipper Cash.

- The partnership will explore cross-border payment expansion in Africa using Ripple Payments.

- XRP is down 2% after seeing a rejection at the 50-day Simple Moving Average.

XRP failed to recover on Thursday, noting a 2% decline despite Ripple's latest partnership with mobile payment services provider Chipper Cash. The collaboration aims to support cross-border payments for Chipper Cash using Ripple Payments.

Ripple partners with Chipper Cash for faster payment services

Digital asset infrastructure provider Ripple announced in a press release that it has partnered with payment services platform Chipper Cash. The company stated that it would support cross-border payments into Africa using Ripple Payments.

Ripple claims the move will make international money transfers into the continent faster, cheaper and available 24/7. Ripple Payments offers a digital asset-based payment solution designed to reduce transaction costs and processing times using the XRP cryptocurrency.

"By integrating our technology into Chipper Cash's platform, we're enabling faster, more affordable cross-border payments while driving economic growth and innovation across the markets they serve," said Reece Merrick, Ripple's Managing Director, Middle East and Africa, in the press release.

Chipper Cash claims that the partnership will help users begin to send and receive payments faster and at lower costs.

The announcement follows Ripple's agreement to drop its cross-appeal against the United States Securities and Exchange Commission (SEC) after the agency dropped its appeal against the company.

With the SEC's regulatory headwinds now behind the company, Ripple is seeking expansion into more international markets. Earlier in the month, the company announced it secured a regulatory license from the Dubai Financial Services Authority (DFSA) that will enable it to offer crypto payment services to businesses in Dubai.

XRP sees rejection near 50-day SMA, risks decline to $1.96

XRP saw $10.39 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $9.09 million and $1.30 million, respectively.

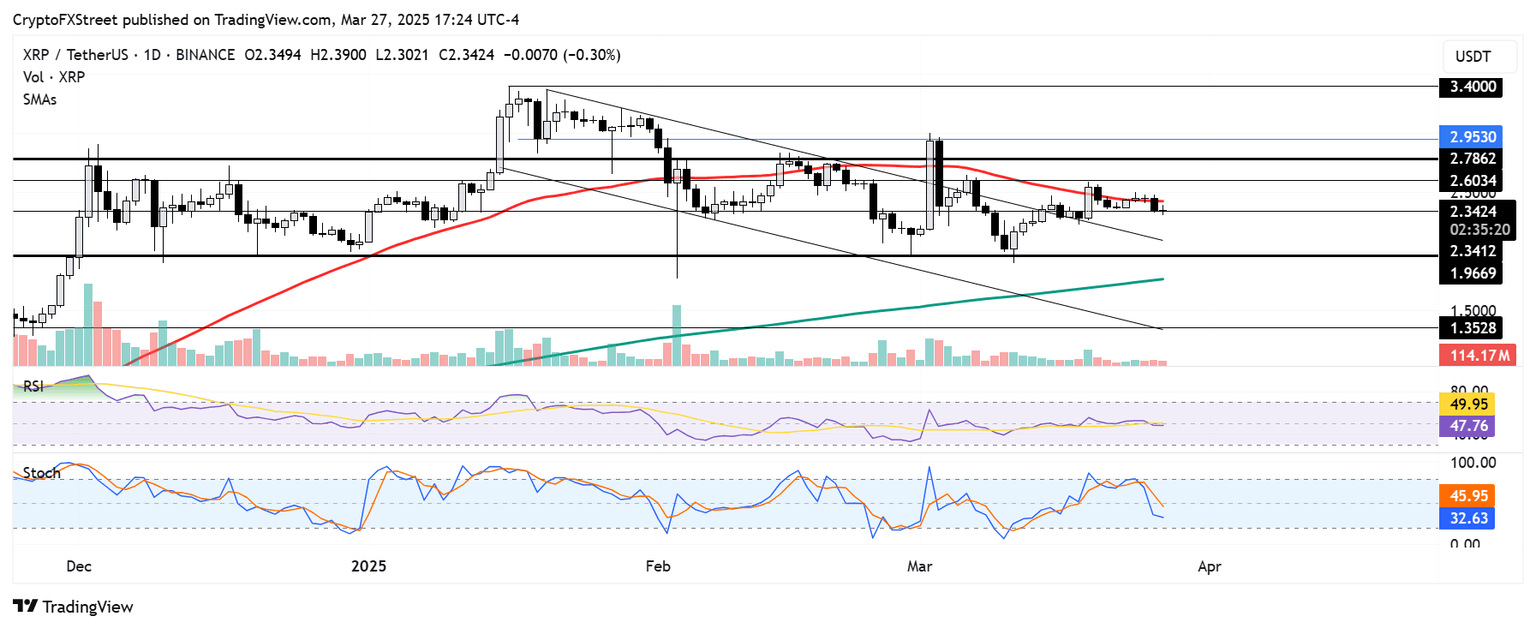

XRP is testing the support at $2.34 after seeing a rejection near the 50-day Simple Moving Average (SMA) and declining 2%. A decline below this support level could send the remittance-based token toward $1.96 if it fails to bounce off the upper boundary of a descending channel. However, if bulls defend $2.34, XRP could retest the $2.60 resistance.

XRP/USDT daily chart

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in a downtrend below their neutral levels, indicating dominant bearish momentum.

A daily candlestick close below $1.96 will invalidate the thesis and could send XRP to the support level at $1.35.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi