XRP/USD Technical Analysis: XRP recovers from Monday's drop but there is a resistance in sight

- All of the major crypto's fell on Monday and XRP is trading 3.87% lower.

- The XRP/USD price hit a low of 0.2408 but has recovered some of its losses.

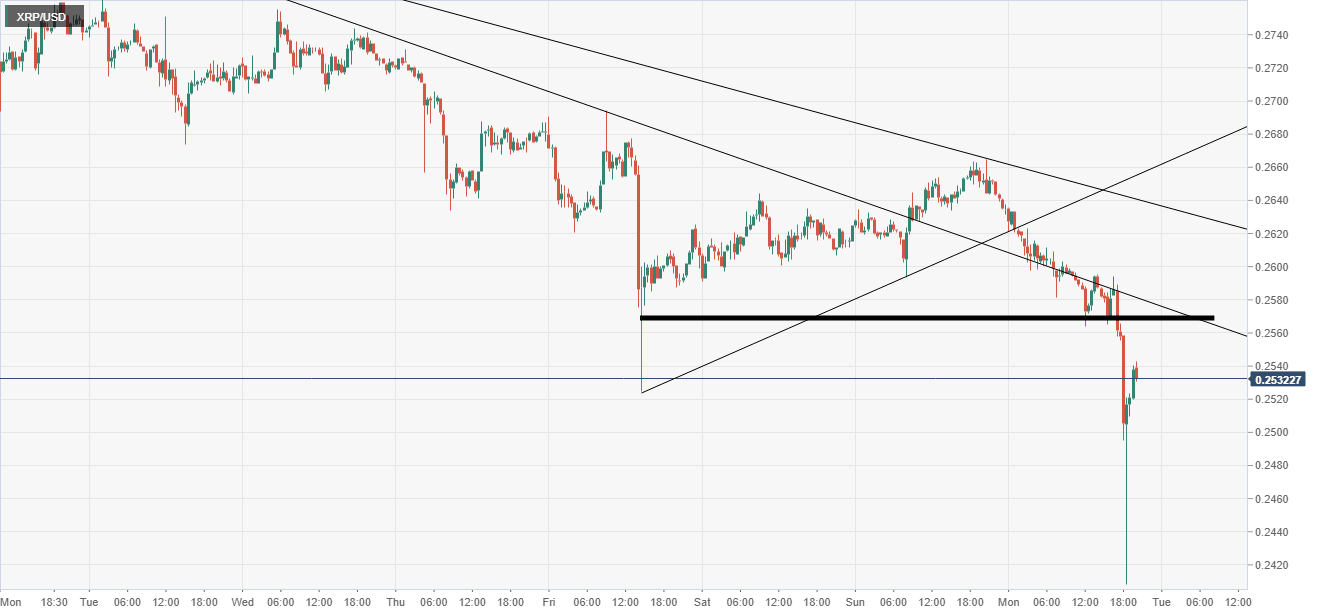

XRP/USD 30-Minute Chart

The 30-minute chart below shows the extent of the fall in cryptocurrencies on Monday afternoon.

XRP/USD at one stage traded 9.27% lower but now has recovered to trade only 3.87% lower at the time of writing.

There was no real catalyst for the move but some analysts have attributed the sell-off to the US Federal Reserve looking into a digital dollar.

On the chart, there is a clear resistance at 0.2567 that would need to be taken out to support a move higher.

The daily chart is still showing a clear downtrend since 0.5000 was hit on June 21st 2019.

Additional Levels

Author

Rajan Dhall, MSTA

FX Daily

Rajan Dhall is an experienced market analyst, who has been trading professionally since 2007 managing various funds producing exceptional returns.