- XRP/USD is one of the worst-performing cryptocurrencies out of the top-10 in 2019.

- XRP needs to stay above $0.1900 in the short run to avoid sharp sell-off.

Ripple's XRP has settled above $0.1900. The third-largest digital asset is range-bound on Tuesday amid decreasing trading activity. XRP has had a hard year. The coin is down 45% since January 2019 despite the recovery of the cryptocurrency market.

The US-based fintech startup entered new partnership deals and expanded the network of banks and financial institutions that use its technology for cross-border payments. However, the project's fast development was not supportive of the cryptocurrency as most of the partners do not use XRP itself and reply only to technological solutions.

Apart from that, the team has been criticized for being too centralized and manipulating the market.

XRP/USD: technical picture

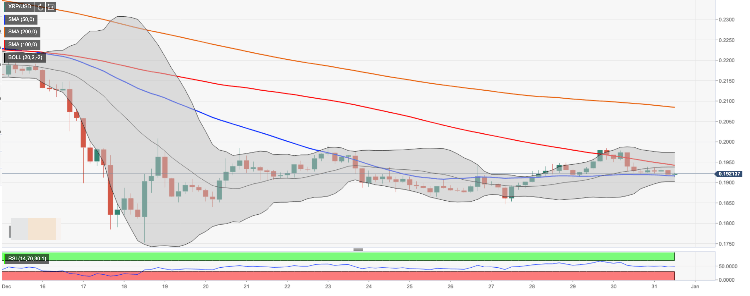

XRP/USD recovery has been limited by the middle line of the daily Bollinger Band at $0/1980. This resistance area is closely followed by a psychological $0.2000. We will need to see a sustainable move above this handle for the upside to gain traction with the next focus on $0.2200 reinforced by a confluence of SMA50 (Simple Moving Average) and the upper line of the Bollinger Band on a daily chart.

On the downside, the local support is created by psychological $0.1900 with the lower line of 4-hour Bollinger Band located right above this area. If the price moves below this support, the sell-off may be extended towards the next barrier at $0.1800 and December 18 low of $0.1752.

XRP/USD 4-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.