XRP update: Ripple USD, CLO comments on likelihood of SEC appeal, partnership with SBI Digital Asset Holdings

- Ripple CLO Stuart Alderoty believes the SEC is less likely to appeal the final ruling in the lawsuit.

- Ripple’s SVP of stablecoins recently spoke on the definition of the asset as the firm continues to test RippleUSD in private beta.

- The payment remittance firm recently partnered with the crypto arm of SBI holdings to boost the utility of the XRP Ledger.

- XRP climbed above $0.56 on Saturday, likely to sweep liquidity at $0.52 prior to recovery in the altcoin.

Ripple (XRP) surged above $0.56 on Saturday, amidst positive developments in the ecosystem. Ripple’s executive commented on the definition of a stablecoin, as the firm tests Ripple USD, their stablecoin, in private beta.

The token is seeking regulatory approval and is not available for purchase or trade, per Ripple’s official announcement.

XRP traders are digesting the final ruling in the Securities & Exchange Commission’s (SEC) lawsuit against Ripple. The firm’s Chief Legal Officer, Stuart Alderoty assuaged the concerns surrounding SEC’s likely appeal in the lawsuit.

Ripple ecosystem notes positive developments

Ripple has three key market movers: SEC vs. Ripple lawsuit outcome and likely appeal, Ripple USD stablecoin and the recent partnership with SBI Holding’s crypto arm. Post the partnership announcement with SBI Digital Asset Holdings, XRP price failed to rally. The development is expected to boost the utility of the XRP Ledger.

Ripple started testing its stablecoin in private beta, even as the asset awaits regulatory approval. The firm’s SVP spoke on stablecoins and the asset’s definition, in an official update by Ripple.

We’re back for another episode of #CryptoInOneMinute with Ripple SVP, Stablecoins @_JackMcDonald_ discussing “What makes a stablecoin, stable?” Short answer – it’s all about the assets backing the stablecoin. Learn more: https://t.co/uMcoqVx86k pic.twitter.com/kOQuEwesOZ

— Ripple (@Ripple) August 16, 2024

Stuart Alderoty says less than 10% of appeals result in reversal of rulings, trying to assuage the concerns of XRP traders speculating the regulator’s next move.

XRP risks decline to $0.52

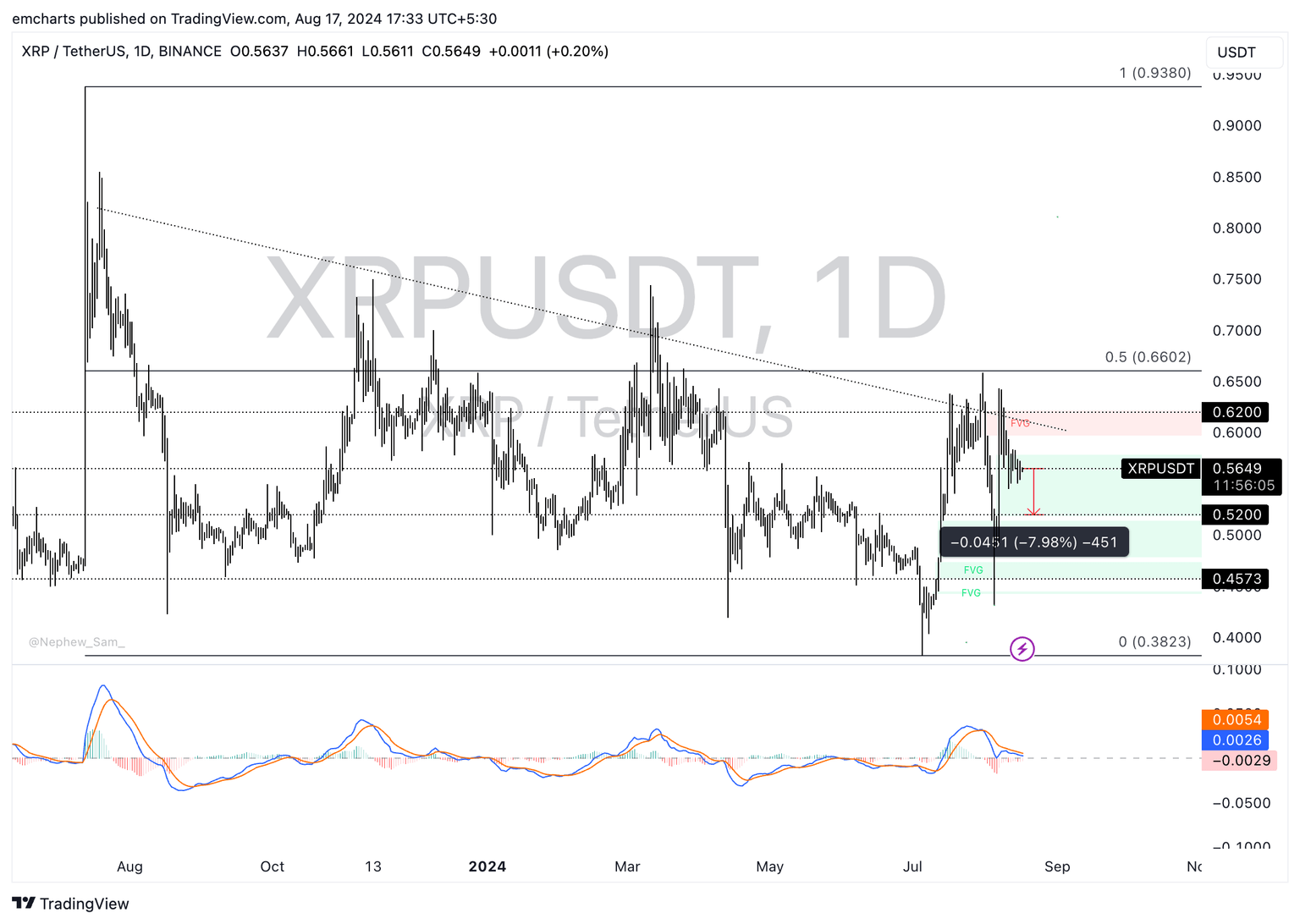

Ripple has attempted to break out of its multi-month downward trend on three occasions and failed to do so. XRP trades at $0.5649 at the time of writing, on Saturday. The Moving Average Convergence Divergence (MACD) indicator shows there is underlying negative momentum in Ripple price.

XRP could sweep liquidity at support at $0.52 before attempting a recovery. This marks nearly 8% decline from the current price level.

XRP/USDT daily chart

A daily candlestick close above $0.57 would invalidate the bearish thesis and XRP could rally towards its psychologically important $0.60 target.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.