XRP traders cheer as Ripple secures on-demand liquidity implementation in $1.8 billion Filipino remittance corridor

- Ripple taps into the $1.8 billion a year remittance market between Japan and the Philippines through its on-demand liquidity service.

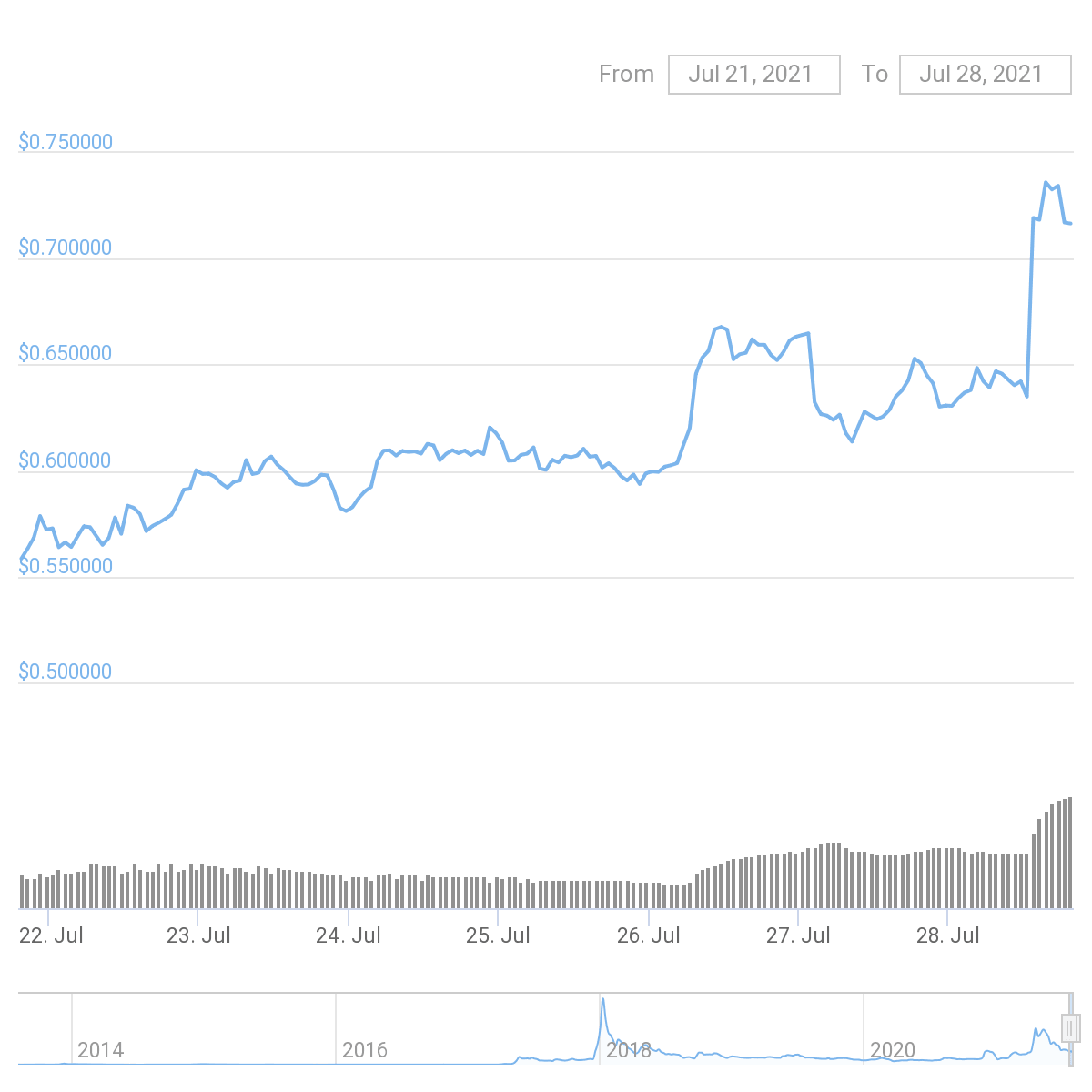

- XRP traders responded to the news with enthusiasm, with the altcoin rallying to a five-week high.

- Ripple's expansion in Asia started with the acquisition of a 40% stake in cross-border payments specialist Tranglo.

XRP buyers stepped in soon after Ripple's execution of its first on-demand liquidity service in Japan.

Ripple's latest implementation in Japan drives XRP price higher

In 2020, Ripple offered its on-demand liquidity (ODL) to small and medium enterprises (SMEs) in its beta phase. The ODL service leverages XRP as a bridge between two fiat currencies, allowing institutions to eliminate pre-funding of destination accounts. It is now being rolled out to clients as part of Ripple's Asia expansion plans.

Using Ripple's ODL reduced operational costs and unlocked capital for the business, making it lucrative for SMEs. The implementation in Japan has allowed Ripple to tap into a $1.8 billion-a-year remittance market to the Philippines.

The real-time payment settlement network targeted Japan since it has one of the highest remittance costs in the world, nearly 10.5%. SBI Remit Co. ltd, the largest money transfer provider in Japan, joined mobile payments leader Coins.ph and crypto exchange SBI VC Trade in offering customers an affordable remittance option through Ripple's ODL.

Nobuo Ando, Representative Director of SBI Remit, said,

The launch of ODL in Japan is just the start, and we look forward to continuing to push into the next frontier of financial innovation, beyond real-time payments in just the Philippines, but to other parts of the region as well.

Ripple's service has enabled SBI Remit Co, Coins.ph, and SBI VC Trade to free up their capital, choose pre-funding services offered by ODL and accelerate their expansion. Ripple has demonstrated potential in the altcoin and attracted interest from buyers.

The crypto has rallied to a five-week high and is currently trading at the $0.71 level based on CoinGecko data. XRP posted a daily gain of 10.2%, and the announcement drove more buyers to the asset.

XRP Price Chart

Ripple's plans to expand into Asia started with the acquisition of payments provider Tranglo and were solidified with the Filipino remittance corridor deal. Further expansion is likely to attract more interest from crypto traders across spot exchanges.

Raoul Pal, founder, and CEO of Realvision.com tweeted about XRP earlier today, stating that he is long on the altcoin.

Im personally long XRP but I don't mind allowing others to have their views expressed too.

— Raoul Pal (@RaoulGMI) July 27, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.