XRP tests $0.52 resistance while XRP Ledger developers propose lending protocol on the blockchain

- Ripple sees XRP Ledger developers propose direct lending on the blockchain, no smart contracts involved.

- XRP attempts to break past and close above $0.52 resistance for the sixth consecutive day.

- XRP holders keep eyes peeled for SEC reply brief, deadline is May 6.

Ripple (XRP) has failed to close above $0.52 for five consecutive days, struggling with the sticky resistance. XRP holders digested the news of US Securities and Exchange Commission’s (SEC) response to Ripple in its filing that addressed the issue of “expert testimony.” Traders now have their eyes peeled for the court’s decision on the next major concern, the $2 billion fine proposed by the SEC and Ripple’s counter of $10 million.

XRP Ledger developers have proposed the introduction of direct lending on the blockchain, without the involvement of smart contracts. The proposal has garnered interest in the XRP holder community.

Daily Digest Market Movers: Ripple holders await May 6 deadline while XRP Ledger proposes new development

- Ripple uses the decentralized public blockchain, the XRP Ledger for its cross-border payment settlement.

- XRP Ledger’s developers have proposed the introduction of direct lending to users using the Ledger, without developing a smart contract application. Developers propose the introduction of a mechanism for fixed-term, interest-accruing loans pooled from collective funds without requiring on-chain collateral.

- The proposed approach relies on off-chain underwriting and risk management and what developers refer to as a “First-Loss Capital protection scheme” to secure the protocol.

XLS-66d lays the foundation for a robust, decentralized lending protocol native to the #XRPLedger.

— RippleX (@RippleXDev) May 1, 2024

Highlights include:

✅ Simplicity & direct lending

✅ Protocol-native approach

✅ Modular & flexible design

Learn more: https://t.co/UKkcX23Usu

- The proposal has garnered interest from traders and is still in its initial stage, as XRP holders and the developer community share inputs on the idea.

- The SEC vs. Ripple lawsuit has been a major catalyst for XRP since 2020. XRP holders have digested the news of SEC’s response to Ripple, where the regulator addressed the concern surrounding “expert testimony.”

- The major issue in the lawsuit is the $2 billion fine proposed by the SEC and Ripple’s counter of $10 million.

- The SEC must file its reply brief by the May 6 deadline and this is likely to be the last court submission before Judge Analisa Torres decides upon the penalty to be imposed on the payment remittance firm, for unregistered securities sale.

Technical analysis: Ripple tackles resistance at $0.52

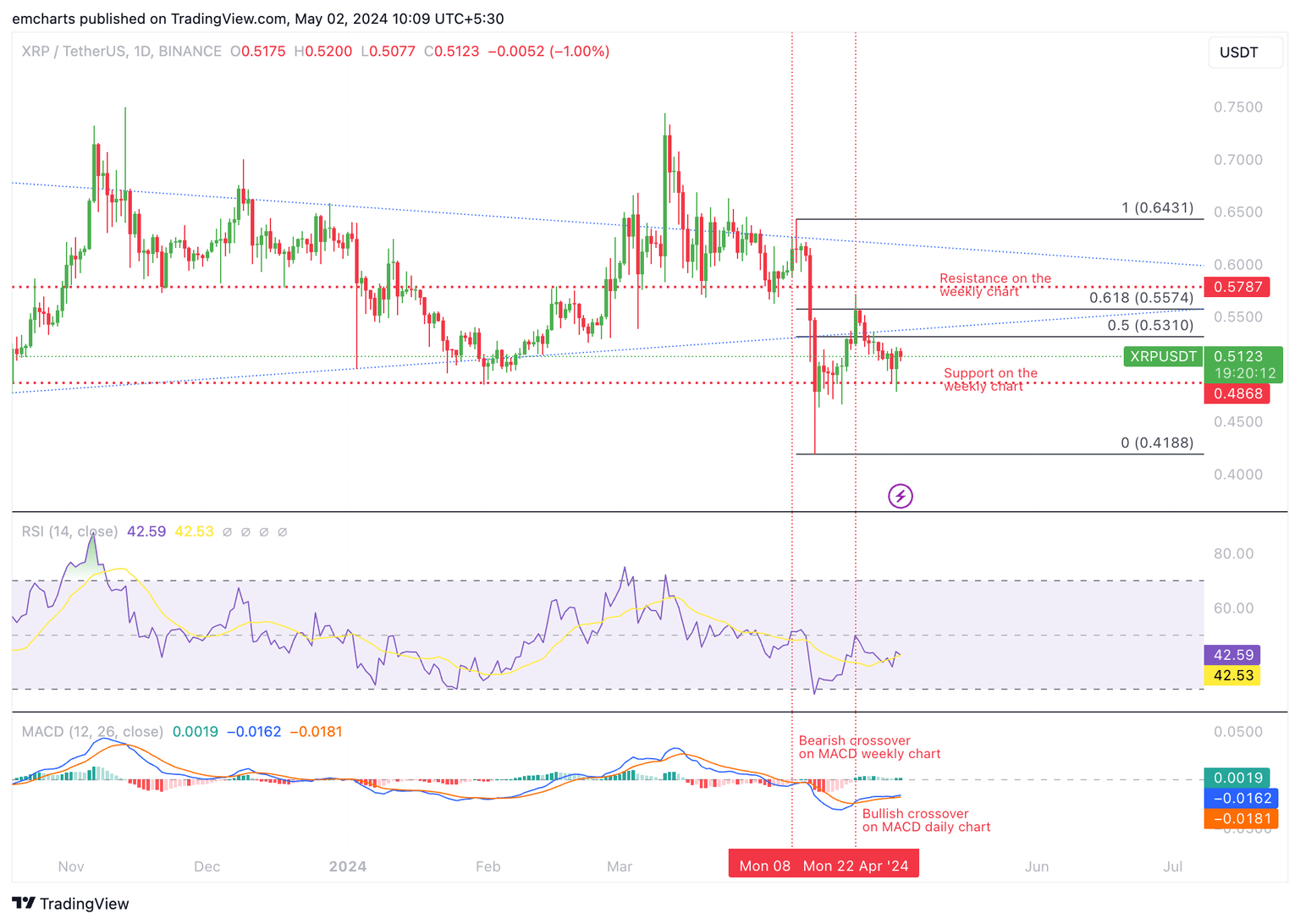

Ripple is faced with sticky resistance at $0.52. The altcoin has attempted to close past this level for five consecutive days with no success. In the weekly time frame, XRP price could decline further. There is a bearish crossover, where the signal line crosses over the Moving Average Convergence Divergence indicator, on the weekly chart, on April 8.

On the daily timeframe however, on April 22, the MACD line crossed over the signal line, supporting a recovery in XRP.

The $0.4868 level emerges as key support for XRP, on the weekly time frame.

This level has been respected as support since mid April, making it key to XRP recovery. A daily candlestick close below this level could invalidate the thesis of recovery.

XRP faces resistance at $0.5310, and $0.5574, the 50% and 61.8% Fibonacci retracement levels of the decline between April 9 and 13. $0.5787 is a key resistance level on the weekly chart.

XRP/USDT 1-day chart

XRP could find support at $0.4868 (weekly support) and April 19 low of $0.4665 in the event of further correction in Ripple.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.