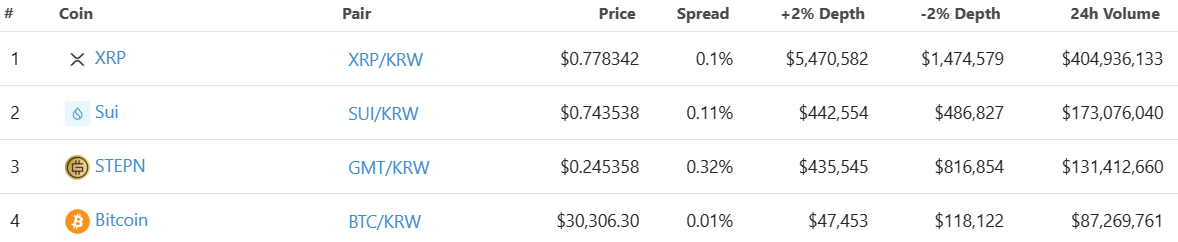

- XRP, SUI and GMT emerged as the top three cryptocurrencies in the last 24 hours on South Korea's largest exchange, Upbit.

- Bitcoin stood below at the fourth position recording only $80 million worth of transactions.

- XRP price is still maintaining its bullish streak despite correcting by 12% a few days ago, thanks to the surge in new addresses.

With XRP price soaring for the last few days, Ripple investors are having a field day as the altcoin has become a must-have for crypto investors. Consequently, the cryptocurrency has not only taken on, but also eclipsed top crypto assets to emerge as the most in-demand in some regions.

XRP price continues to milk partial SEC lawsuit win

XRP price has maintained an uptrend with the help of Ripple enthusiasts and Securities and Exchange Commission (SEC) haters. The Securities and Exchange Commission partially won and partially lost the lawsuit it filed against XRP's parent company Ripple in December 2020. Since the ruling, the altcoin has found rising interest resulting in a different win today.

Over the past 24 hours, XRP has outperformed Bitcoin, Ethereum and many other top cryptocurrencies, emerging as the most traded asset on South Korea's biggest crypto exchange, Upbit.

At the time of writing, XRP notes over $400 million worth of trading in the last 24 hours, followed by SUI recording $173 million worth of trades. GMT came in as the third most traded asset at $131 million, while Bitcoin stood fourth, bringing in $87 million in trades.

Upbit 24-hour trading volume

To put into perspective the impact of Ripple taking home the win of not being a security unless it's used for institutional sales, XRP noted almost 4.5 times higher volume on Upbit than the biggest cryptocurrency in the world.

Furthermore, this bullishness is also the result of rising interest in the cryptocurrency, which has led to a sudden increase in the number of investors as well. The XRP network growth has been decently inclining, which suggests that the rate at which new addresses have been created in the last five days is 164% faster than the average.

XRP network growth

This is reflected in the price action as well since XRP price is still up by nearly 3% in the last 24 hours, even when Bitcoin price slipped below $30,000. Despite correcting by nearly 12% right after the 73% rally, the altcoin is still noting an uptrend, which is bound to slow down soon.

XRP/USD 1-day chart

However, if investors continue to act as bullish as they are at present, a severe drawdown could be deflected, keeping the XRP price above the $0.70 support area.

SEC vs Ripple lawsuit FAQs

Is XRP a security?

It depends on the transaction, according to a court ruling released on July 14:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

How does the ruling affect Ripple in its legal battle against the SEC?

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

What are the implications of the ruling for the overall crypto industry?

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

Is the SEC stance toward crypto assets likely to change after the ruling?

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Can the court ruling be overturned?

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[19.24.11,%2018%20Jul,%202023]-638252906555119532.png)