XRP spikes 12% as whales continue 'enormous accumulation' – Santiment

XRP’s price surged 12% in a day with data showing whales have been accumulating the asset in significant volumes, speculation around an ETF listing in the US and optimism toward President-elect Donald Trump’s looming inauguration.

“XRP investors are pleased to see the #3 market cap asset reach $2.69 today for the first time since Dec. 17, 2024,” crypto analysis firm Santiment said in a Jan. 14 X post.

At the time of publication, XRP had surged further, trading at $2.83, a price not seen since early 2018, according to CoinMarketCap data.

XRP whale accumulation is gaining momentum

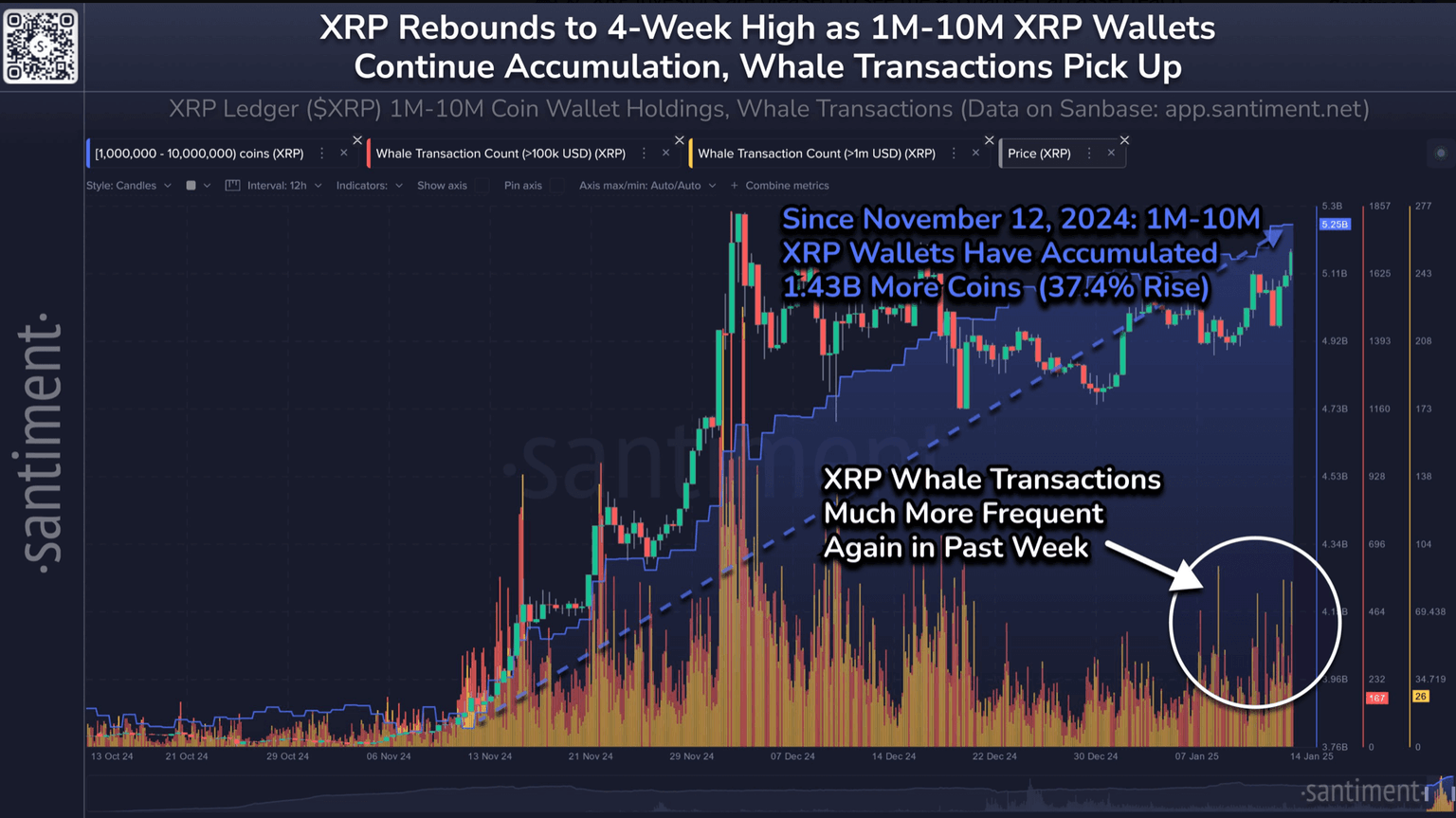

Santiment said that XRP’s (XRP $2.85) price increase could be attributed to the “continued enormous accumulation” from wallets holding between 1 million and 10 million XRP tokens.

The analysis firm said that since Nov. 12, the cohort had accumulated 1.43 billion XRP tokens, marking an increase of about 37.4%.

XRP whales have been accumulating aggressively since November 2024. Source: Santiment

Onchain protocol Derive’s head of research, Sean Dawson, told Cointelegraph that XRP’s strong momentum is “most likely due to a possible XRP ETF listing sometime this year.”

Dawson said that as Bitcoin (BTC $97,155) “gets bought up,” investors may be inclined to rotate capital into altcoins like XRP, further “fuelling bullish sentiment.”

Blockchain-focused media company Gokhshtein Media founder David Gokhshtein said in a Jan. 15 X post, “XRP holders deserve this.”

XRP’s price saw tight consolidation throughout 2024, with the price difference between Jan. 17 and Oct. 17 being just 3.8%.

SEC deadline to file an appeal cited as “another factor”

“XRP’s legal battles with the SEC could also come to a head this year in the former’s favor,” Dawson added.

Dawson said while he expects the SEC to appeal the case, it will be against a backdrop of “pro-crypto sentiment” in the White House and “will likely trickle down to SEC appointees and their subsequent enforcement.”

Meanwhile, banking giant JPMorgan projected that Solana SOL $189.90 and XRP ETPs may eclipse the performance of spot Ether ETH $3,234.20 ETFs in their first six months of trading.

“When applying these so-called “adoption rates” to SOL and XRP, we see SOL attracting roughly $3 billion-$6 billion of net assets and XRP gathering $4 billion-$8 billion in net new assets,” JPMorgan said in a Jan. 13 report.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.