The crypto market appears to have stabilized however traders are proceeding with caution while dealing with altcoins, like XRP, while continuing to rotate money into market leader bitcoin (BTC).

Payments-focused XRP, which Ripple uses to facilitate cross-border payments, has risen over 3% to $2.24 in the past 24 hours primarily on hopes that the legal battle between blockchain company Ripple and the Securities and Exchange Commission (SEC) could conclude soon.

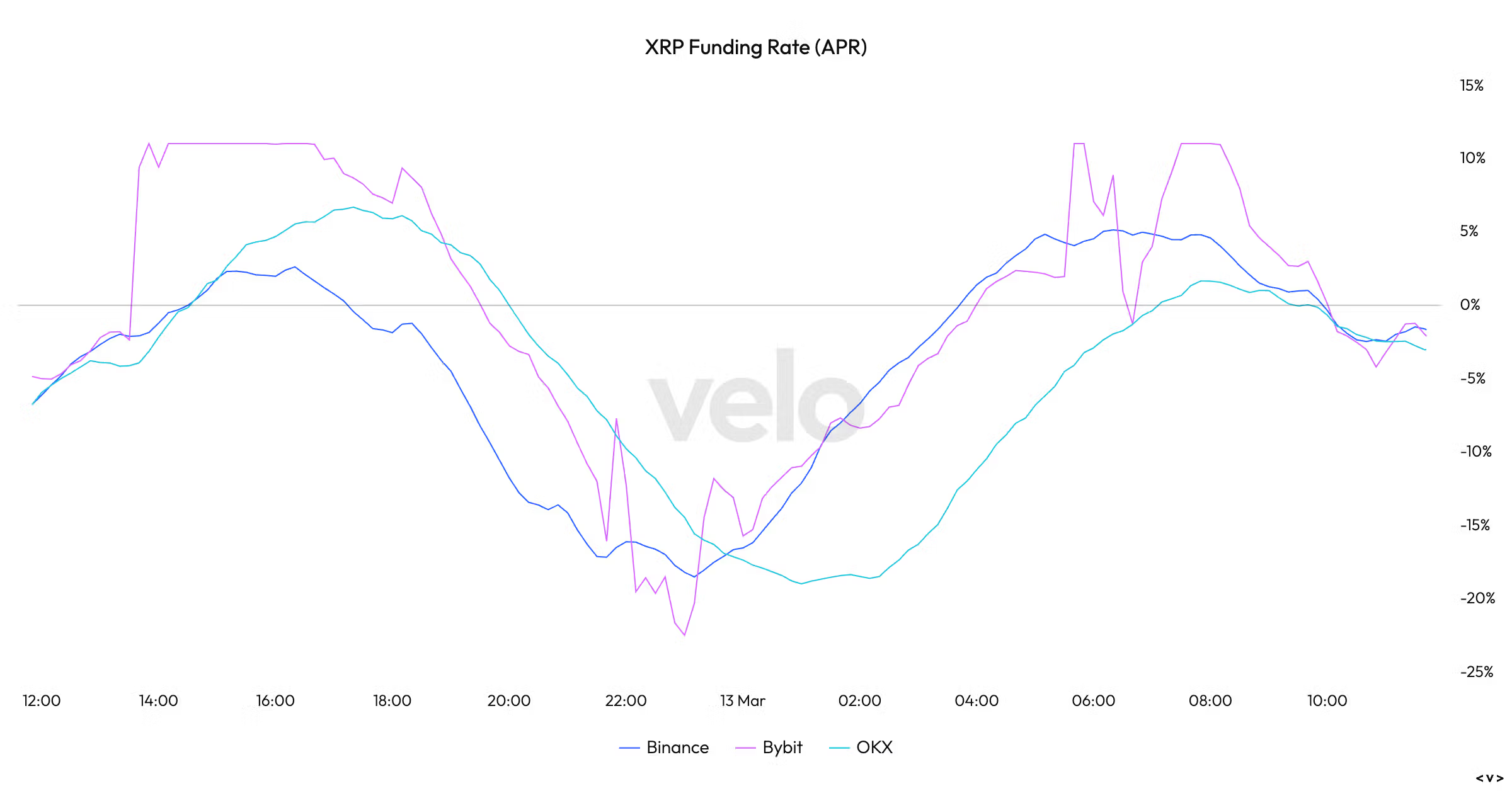

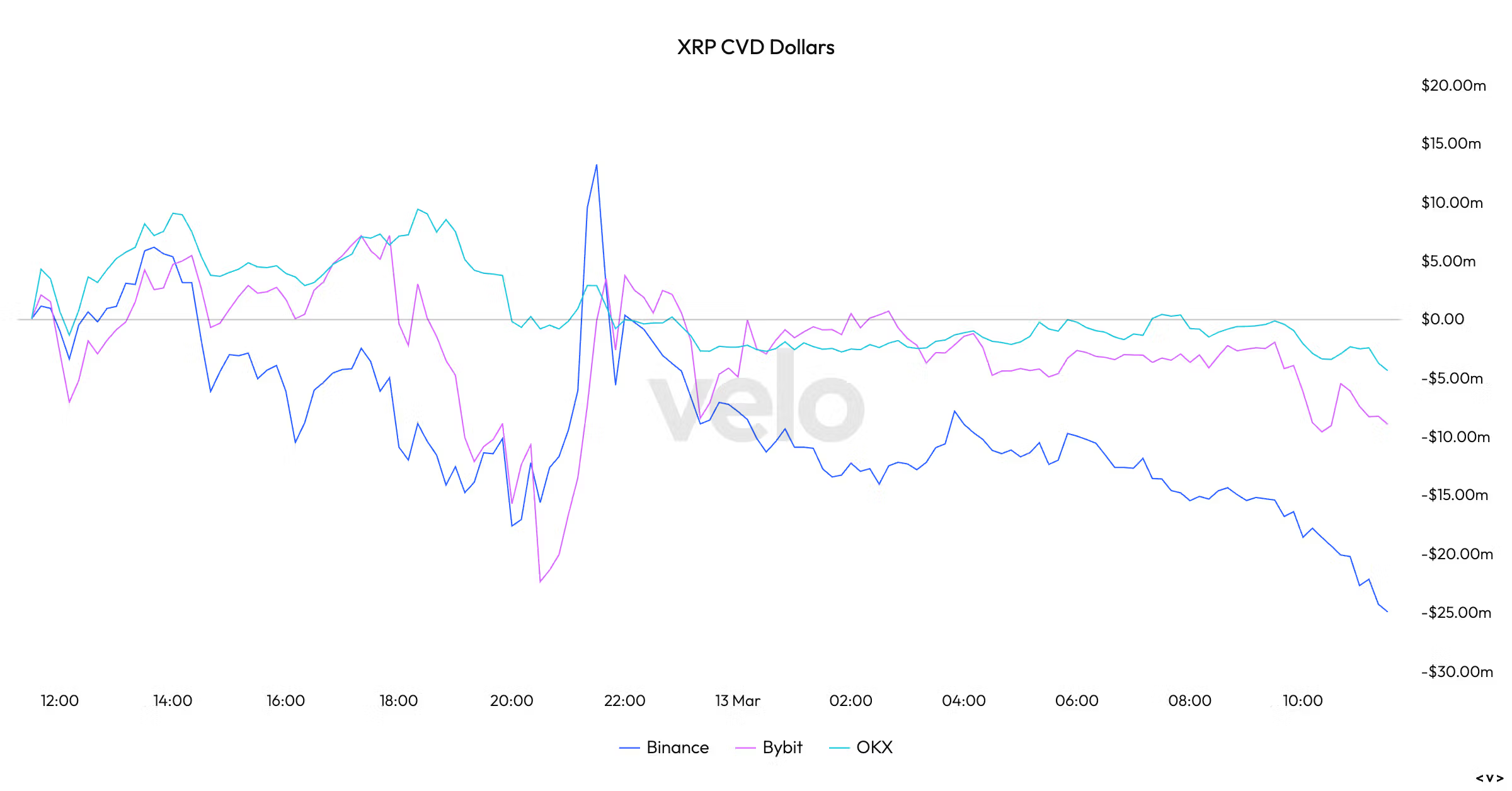

Amid the price rise, cumulative open interest in perpetual futures listed across major exchanges has stabilized near 1.35 billion XRP, with annualized funding rates and cumulative volume delta printing negative, according to data source Velo.

Negative funding rates mean shorts are paying fees to counterparties to keep their bearish bets open. It shows the dominance of bearish short positions in the market. The negative cumulative volume delta, which measures the net capital inflows into the market, indicates that selling volume has accumulated more than buying volume, potentially signaling a bearish trend.

Both indicators, therefore, cast doubt on whether XRP's price rise has legs. At press time, several other large-cap tokens like DOGE, SOL, SUI, HBAR, LTC, BTC, TRX and HYPE had negative CVDs on a 24-hour basis.

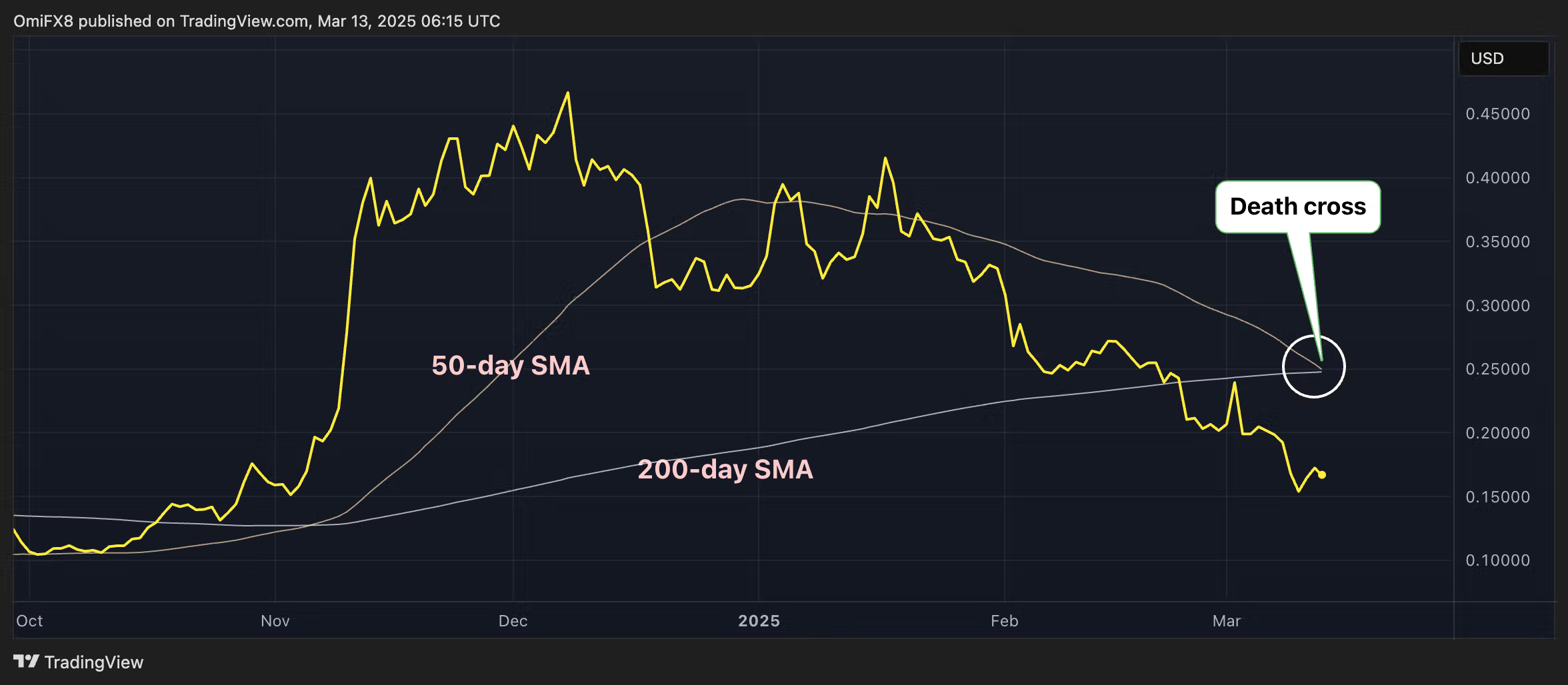

Speaking of DOGE, the 50-day simple moving average (SMA) of the token's price is about to cross below the 200-day SMA, confirming the so-called death cross. The ominous-sounding pattern indicates that the short-term price momentum is now underperforming the long-term momentum, with the potential to evolve into a major bearish trend.

These SMA crossovers are widely followed by trend traders, meaning the confirmation of the death cross could bring more selling pressure to the market. That said, long-term SMA crossovers are lagging indicators, reflecting the sell-off that has already materialized and have a mixed record of predicting price moves in the BTC and ETH markets.

Note that, DOGE has already dropped 65% since peaking at over 48 cents in December.

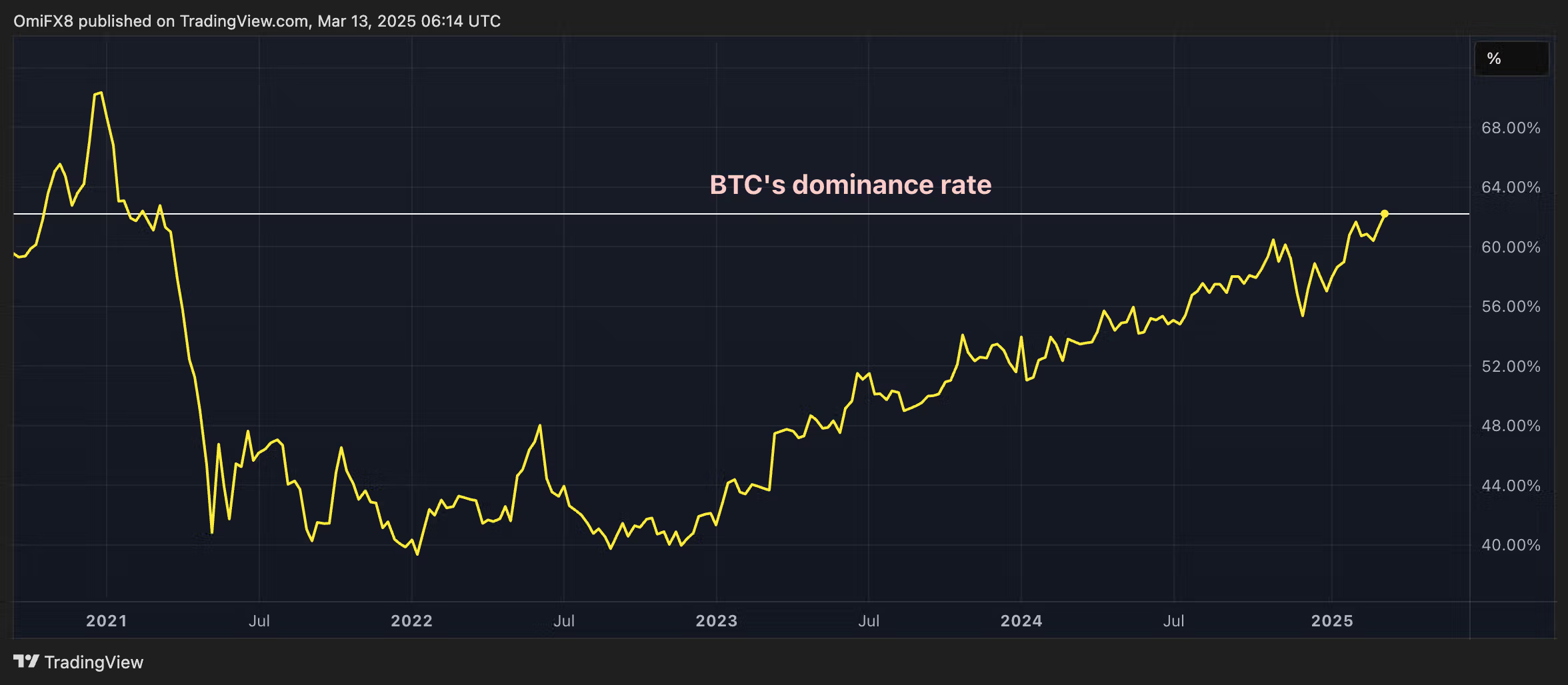

BTC most dominant in four years

Bitcoin's dominance rate, or the cryptocurrency's share in the total market capitalization, has increased to 62.5%, the highest since March 2021, according to data source TradingView.

Notably, the metric has increased from 55% to over 62% since the total crypto market capitalization peaked above $3.6 trillion in December.

It signifies a continued preference for BTC, particularly during the broader market downturns.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Why LIBRA meme coin promoted by Argentina President Milei is crashing?

LIBRA meme coin promoted by Argentina’s President Javier Milei is making headlines again, crashing nearly 15% on the day. A local Argentine media outlet, Perfil, reported that lawyer Gregorio Dalbón had requested Interpol for a red notice to be issued for Hayden Davis.

Metaverse narrative stalls as price action fades, but on-chain data signals continuing accumulation

Metaverse tokens Sandbox, Decentraland and Axie Infinity continue to face correction since they topped in early December. A Glassnode report suggests that despite price pullback, on-chain activity suggests holders accumulation.

DeFi user loses over $700K USDC in a sandwich attack that experts suggest could be money laundering

A DeFi trader became the subject of discussion among crypto community members on Wednesday after losing more than $700K worth of stablecoins to a sandwich attack on the Uniswap v3 protocol.

Tether on-chain activity surges to a six-month high with 143,000 daily transfers

Tether (USDT) stablecoin on-chain activity has rapidly risen, with over 143,000 daily transfers, surging to a 6-month high. Moreover, the USDT Network growth metric increases, indicating greater blockchain usage.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.