- XRP became a means of payment on Enterix, a Romanian ticketing platform, after it added support for Binance Pay.

- XRP is potentially repeating a one-and-a-half-year-long bearish pattern resulting in the overselling of the asset.

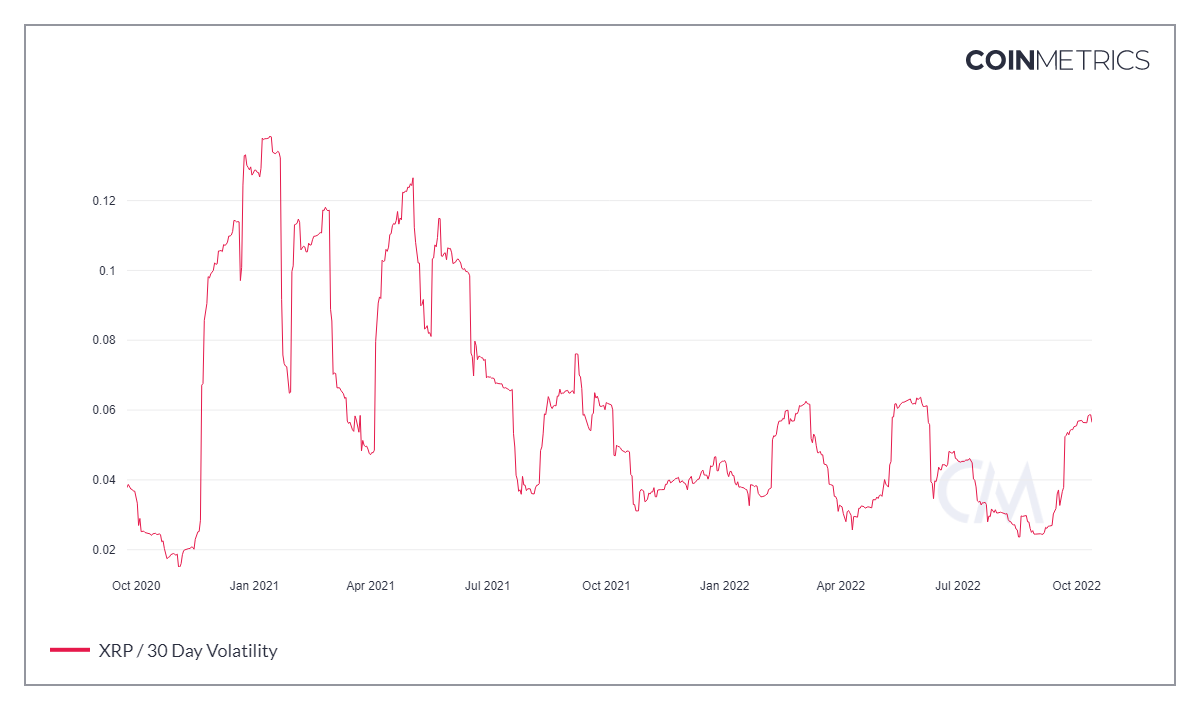

- XRP’s volatility is currently at a four-month high, which can trigger a price swing in the upward direction.

Ripple is seemingly in its good days at the moment as it is finding positive development on multiple fronts. The Securities and Exchange Commission (SEC) lawsuit against Ripple is coming to an end soon; the price of its token XRP recently shot up by more than 65%, and it also expanded its user base as a means of payment.

XRP making ripples in Romania

In a tweet on Friday, Binance head CZ announced the addition of Binance Pay as a payment medium on Enterix. With the biggest ticketing platform in Romania supporting Binance Pay, over 40 cryptocurrencies, including the likes of XRP, Dogecoin and more, can be used to buy tickets.

#Binance Pay is now available on the biggest ticketing platform in Romania - Entertix. You can buy tickets for the team we sponsor @RapidFC1923 and many other events. Pushing adoption. pic.twitter.com/MHeFCmRD8k

— CZ Binance (@cz_binance) October 13, 2022

Along with this, XRP’s price has been having a fairly good run as the altcoin noted an increase of 65.4% over the last month. Bringing the price to $0.49, the buying pressure is cooling down, which might set off a pattern that has been XRP’s bane for almost 18 months now.

Right after hitting the overbought zone – above 70.0 on the Relative Strength Index (RSI) – the RSI began trickling down toward the lower threshold. This results in excessive selling pressure and comes to an end after around three months.

XRP 24-hour price chart

XRP 24-hour price chart

If the pattern is repeated, XRP could be looking at a severe price fall by the end of the year, but bullish factors such as the Summary judgment of December might fight the bears. Since the broader market isn’t reacting negatively, XRP might have the chance to change gears and rally on to flip the $0.58 resistance into support.

Can it, though?

Beyond the unpredictability of the global markets, XRP’s volatility is extremely high at the moment. Touching levels that were last observed back in May, XRP is vulnerable to price swings, which can be in either direction.

XRP volatility

If the persisting bullish factors sustain, the swing could potentially be upward, providing support to the altcoin to close above the $0.58 resistance.

If things take the opposite route, the year-and-half-long pattern might be repeated again.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.