XRP hovers near $0.50 as Ripple CTO addresses concerns related to stablecoin launch

- XRP is hovering near $0.53 on Friday, spending nearly all week below $0.55.

- Ripple CTO David Schwartz addressed concerns on stablecoin and XRP utility on Thursday.

- Ripple’s clients will have the option to choose between using the stablecoin and XRP depending on what works best, Schwartz said.

Ripple price (XRP) edges higher near the $0.53 level on Friday. The altcoin is range bound below $0.55 since Tuesday, struggling to break from sticky resistance at this level.

The XRP holder community and crypto experts recently posed questions regarding the altcoin’s utility in Ripple’s On Demand Liquidity (ODL) amid increasing concerns that XRP Ledger’s native token may fall out of use with the stablecoin’s launch set for later this year. Chief Technology Officer (CTO) David Schwartz addressed these concerns in his tweets on X, implying that both coins will have their own use and suggesting that XRP is unlikely to be overshadowed.

Daily digest market movers: Ripple CTO addresses concerns regarding XRP utility

- Ripple’s announcement regarding its stablecoin in April 2024 came as a surprise to XRP holders. Experts have raised concerns regarding XRP utility in Ripple’s ODL platform once the stablecoin is launched. Find out more about this here.

- Some XRP holders also raised concerns about the future of the altcoin as it may become less useful once the firm introduces the stablecoin on the XRP Ledger.

- David Schwartz, Ripple CTO, explained that Ripple’s idea is to get clients using the payment software that can settle with XRP. Schwartz says that it may not be the best solution for all and “it would be kind of silly to try to get people to use a solution when it’s inferior.”

- The CTO believes that, where XRP works best, it will continue to be used and there will be no barriers to its adoption or utility. Ripple is, therefore, using the stablecoin to address the situations in which XRP is not the ideal solution or offers “an inferior experience or worse economics.”

The idea is to get people using payment software that *can* settle with XRP. Then there's no reason for them not to settle with XRP where it works best. It would be kind of silly to try to get people to use a solution where it's inferior. 1/2

— David "JoelKatz" Schwartz (@JoelKatz) April 24, 2024

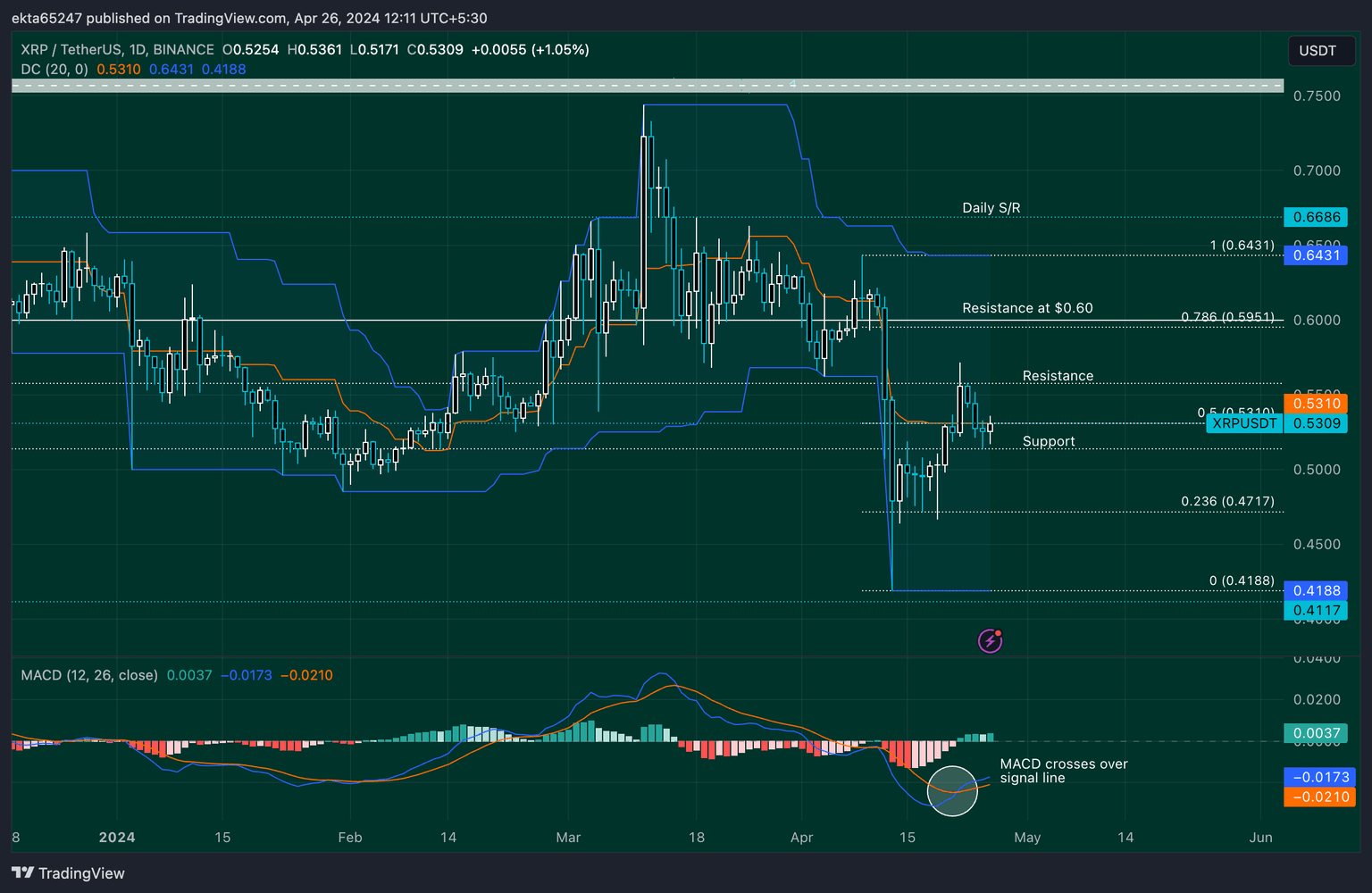

Technical analysis: XRP hovers above key support at $0.51

XRP price traded within a tight range between resistance at $0.5576 and support at $0.5137 this week, with the exception of Monday. A breach of the resistance level would allow XRP traders to explore the possibility of a rally to April 9 top of $0.6431. This level coincides with the upper boundary of the Donchian Channel.

The $0.60 level remains a psychologically important resistance level and the $0.50 level is an important support for XRP. A breach above the former and below the latter could signify a shift in the altcoin’s price trend.

XRP price is currently hovering around the midpoint of the channel, so traders who enter a trade at this price could look for the $0.6431 target, which would represent a 20% increase.

The Moving Average Convergence Divergence (MACD) is a technical indicator that helps traders identify entry points in the market and shows whether there is positive or negative momentum. In XRP’s case, the MACD shows green bars above the neutral line, and there was a recent bullish crossover on April 21. This indicator points towards gains in XRP price.

XRP/USDT 1-day chart

If XRP price declines towards the lower boundary of the channel, it could signal a trend reversal. The bullish thesis would be invalidated should prices close below support at $0.5137, making it more likely for the altcoin to sweep the $0.4717 level (23.6% Fibonacci retracement of the decline from April 9 top of $0.6431 to April 13 low of $0.4188).

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.