XRP price wants to catch up with the rest of the market as bulls target $0.30

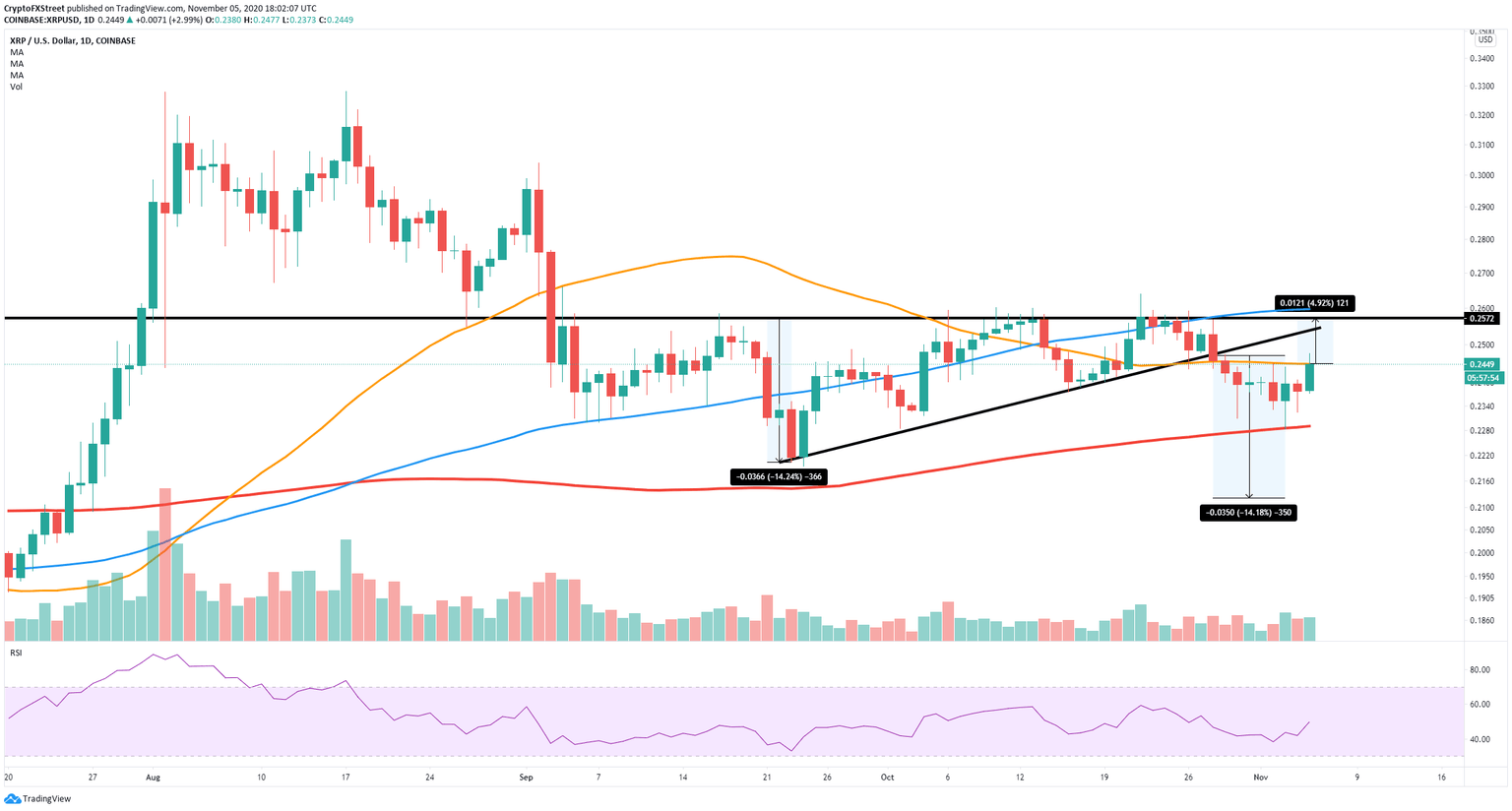

- XRP price is bounded between the 50-SMA and the 200-SMA on the daily chart.

- The critical resistance level at $0.245 is holding the price of XRP back.

XRP is trying to follow the lead of Bitcoin, which has surpassed $15,000. The current price of XRP is $0.244 after a notable bounce from $0.228, where the 200-SMA is located on the daily chart.

Unfortunately, the 50-SMA is acting as a strong resistance level around $0.245 and has already rejected the price of XRP twice on November 2 and 3. It’s still possible for XRP bulls to crack this resistance level thanks to the renewed market FOMO (fear of missing out).

Can XRP hit $0.30 by the end of this month?

As stated above, the resistance level at $0.245, where the 50-SMA on the daily chart is established, remains the most critical short-term resistance point. A breakout above this level can push XRP towards the upper boundary of an old ascending triangle at $0.257.

XRP/USD daily chart

Potentially, bulls could crack $0.257 – which coincides with the 100 SMA – in one go and drive the price of XRP towards $0.3 as there is not a lot of resistance to the upside above that point.

On the other hand, another clear rejection from $0.245 can quickly push XRP towards the 200-SMA at $0.229. A further breakdown will drive Ripple to the low at $0.212, which was calculated as a bearish target using the height of the ascending triangle pattern.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.