XRP price tries to rebound but gets rejected from a critical resistance level

- XRP price is currently contained between two important simple moving averages (SMAs).

- The digital asset looks for a rebound but faces critical resistance ahead at $0.244.

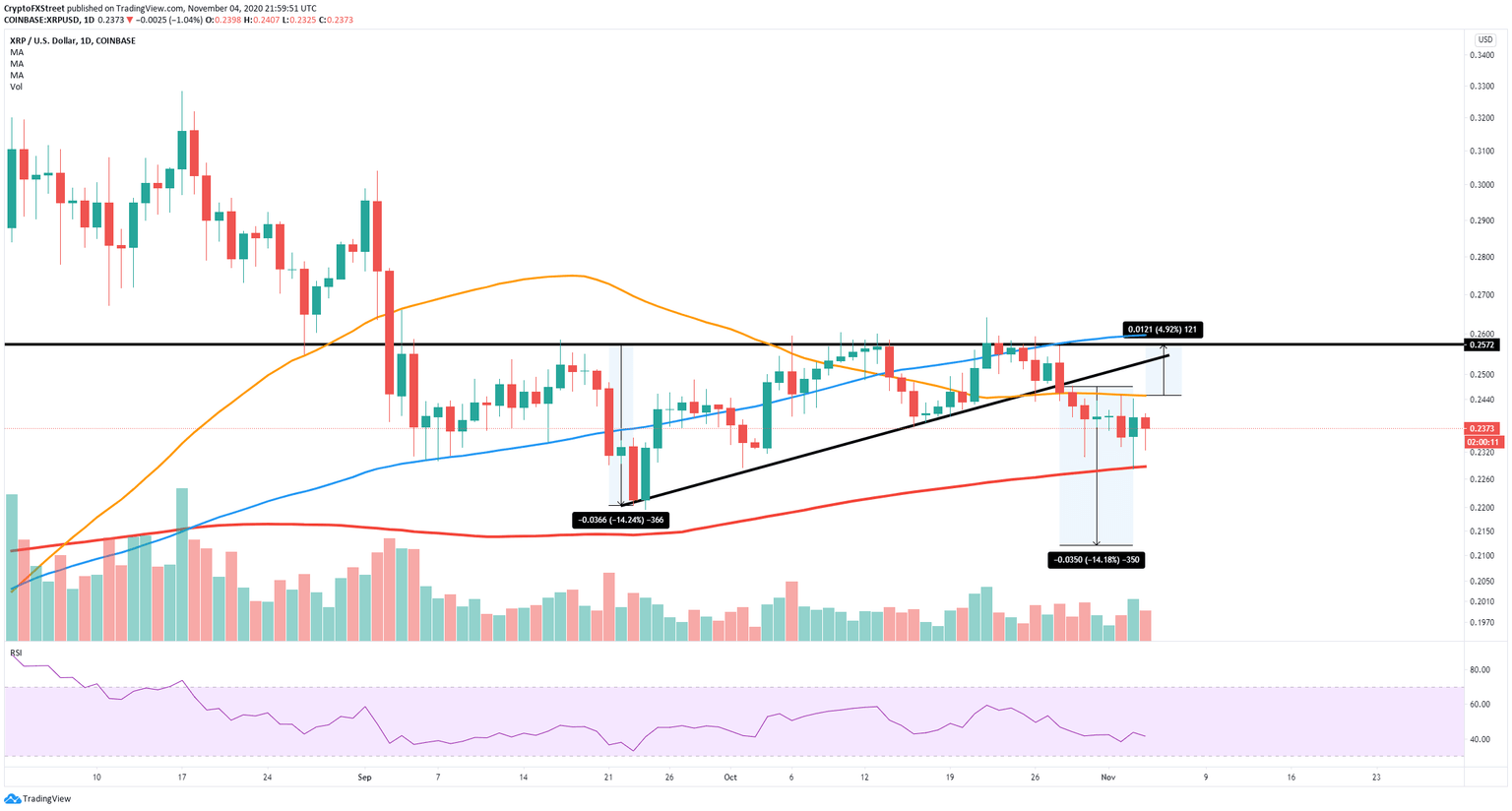

XRP remains as the lagger cryptocurrency while Bitcoin and Ethereum continue climbing higher. A breakdown from an ascending triangle on October 28 destroyed all the bullish momentum for XRP which is now trading at $0.237. The key resistance seems to be located at $0.244 in the form of the 50-SMA on the daily chart. A breakout or rejection from this level will decide the next target for XRP.

XRP needs to crack $0.244 in order to rebound

After the breakdown on October 28 from the ascending triangle, bears saw a lot of continuation action which dropped the price of XRP as low as $0.228 on November 3. The next resistance level is located at the 50-SMA at $0.244.

XRP/USD daily chart

The price has already tested this 50-SMA level two times before. A breakout from this point can easily drive the price of XRP towards the upper trendline of the ascending triangle at $0.257 which will continue to act as a resistance level.

XRP holders distribution chart

On the other hand, another rejection can lead the digital asset towards its bearish target at $0.212 and potentially even lower. The 200-SMA at $0.228 is also a likely price target in the short-term.

Additionally, it seems that whales are exiting their XRP positions in the past two weeks. The number of holders with at least 10,000,000 coins was hovering at 313 throughout September and two-thirds of October. However, this number dropped significantly on October 24 to a current low of 305, indicating that whales are not that interested in XRP as prices continue declining.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%20%5B23.00.37%2C%2004%20Nov%2C%202020%5D-637401241992865855.png&w=1536&q=95)