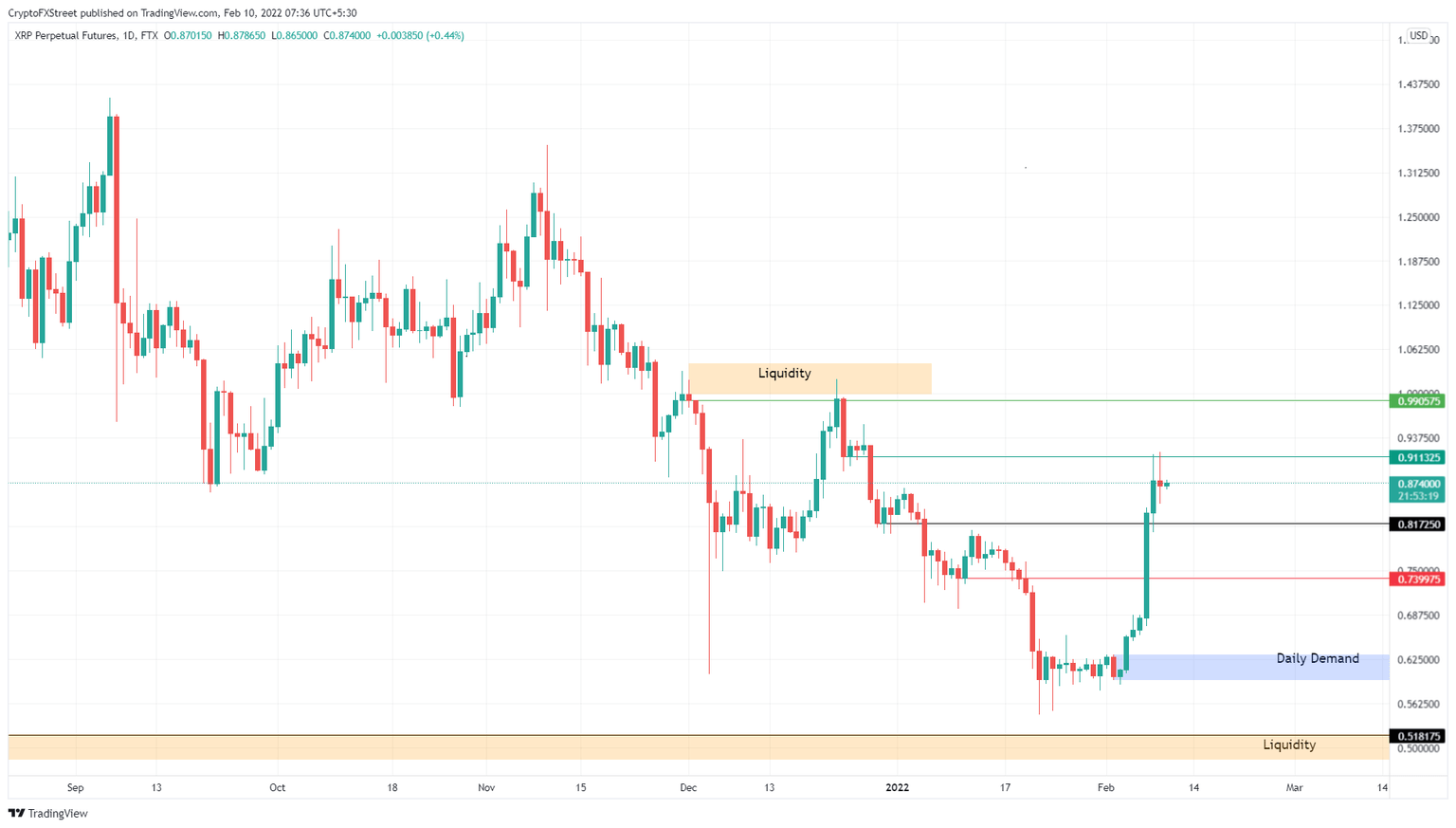

XRP price to revisit $1 as Ripple bulls search for liquidity

- XRP price is hovering below the resistance barrier at $0.911, building momentum for the next leg.

- A resurgence of buying pressure could send Ripple up by 15% to collect the liquidity resting above $1.

- A breakdown of the $0.740 support level could trigger a retracement to the $0.595 to $0.632 demand zone.

XRP price has seen a massive pump in the past week as it broke out of its consolidation. This uptrend faced significant headwinds on February 9 and is currently contemplating a directional bias.

XRP price eyes higher high

XRP price rose 55% between February 3 and February 9, setting up a swing high at $0.918. Since then, the remittance token has slowed down either due to exhaustion of the bullish momentum or increased profit-taking.

Regardless, a resurgence in bid orders could be the key to triggering a 15% uptrend for XRP price. A swift move beyond $0.911 will open the path for a retest of the $1 psychological level. Here, Ripple set up a double top in December 2021, leaving buy stops above it.

Therefore, the market makers are likely to propel XRP price above this barrier to collect the liquidity.

While the optimistic scenario assumes that XRP price will continue its ascent, a conservative outlook could see XRP price retrace to the immediate support level at $0.817 or $0.740, allowing bulls to build up the momentum before the next leg-up.

XRP/USDT 1-day chart

On the other hand, if the XRP price slices through the $0.817 and $0.740 support level, the daily demand zone, extending from $0.595 to $0.632, will provide the bulls a foothold for a reversal. However, a daily candlestick close below $0.595 will invalidate the bullish thesis and crash XRP price to $0.518.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.