XRP price surge lures investors before another crash

- Ripple price is back to its usual pattern, breaking below the low of Tuesday as its incurred gains get entirely wiped out.

- XRP price is under pressure from global markets, with the collapse of crude oil below $100 leading the way.

- As this counts as confirmation or a sign that a recession is not far off, expect more cash outflow from cryptocurrencies overall.

Ripple (XRP) price is set to drop back to its 2022 lows as market sentiment starts to factor in more risk of a recession. The oil price has collapsed on slowing demand, and is on the brink of dropping below $100. Adding to the fear of recession, are several strikes and protests worldwide as high inflation now really starts to bite into households' disposable income, and this is setting a grim tone for traders, and triggering a drop in investments into cryptocurrencies.

XRP set to slip 15%

Ripple price takes a step back after Tuesday’s relief rally hit a curb in the ASIA PAC session this morning. The sudden change in sentiment comes as the oil price collapses and is in danger of dropping below $100 tonight – the API oil numbers, which will throw additional light on the situation, are set to be released a day later because of the US holiday on Monday. A build-up of stockpiles could be perceived as further proof that demand is starting to drop, and mark a prelude for a feared recession already taking place over the summer, instead of 2023, as previously feared.

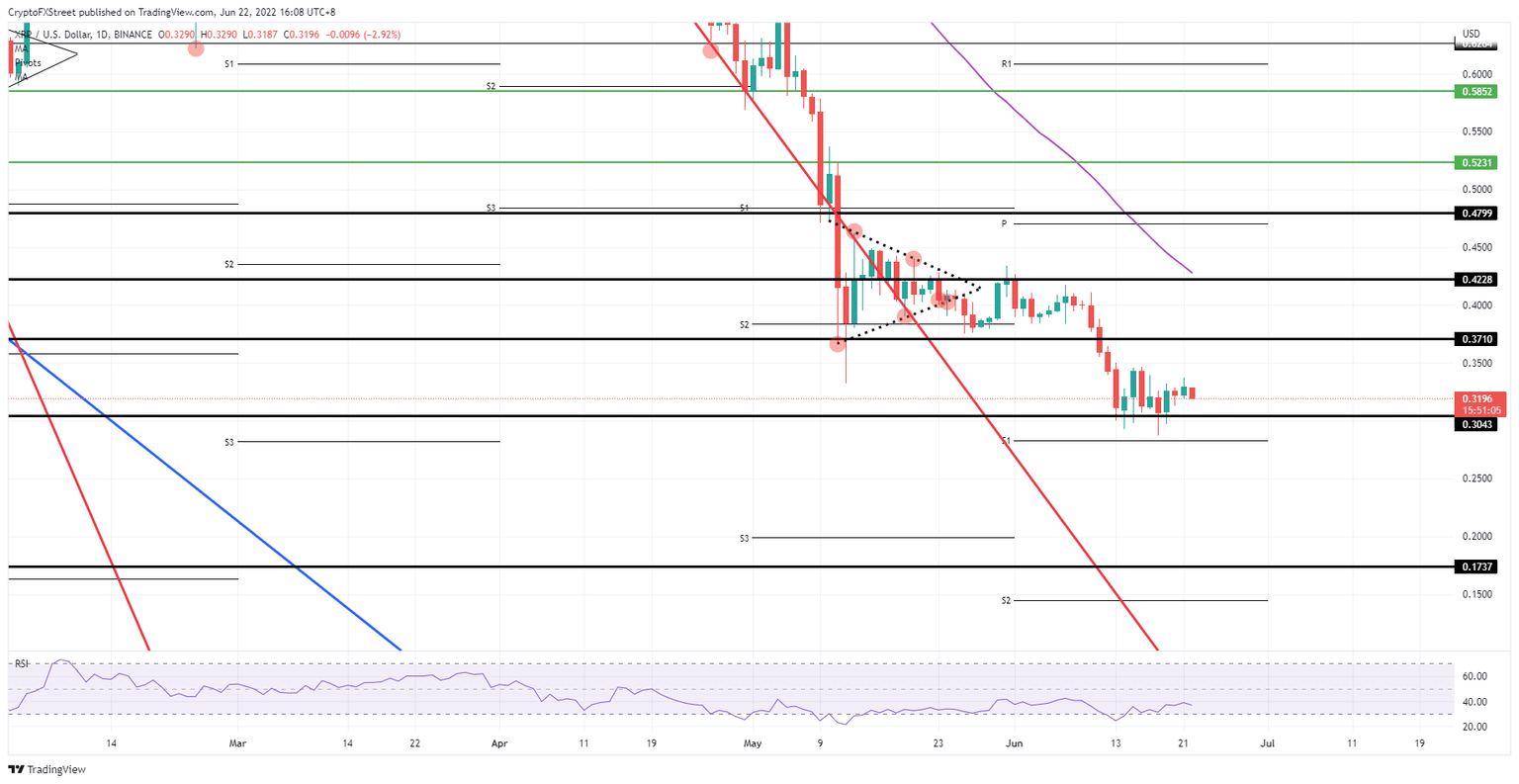

XRP price has already broken below the low of Tuesday, at close to $0.3190. Meanwhile, the pivotal level of $0.3043 will work like a magnet and pull price action lower. With the dollar not rallying so forcefully, any further drops, for now, should be contained by the monthly S1 pivot support level at $0.2830, which also held on June 18.

XRP/USD daily chart

Although markets are on the back foot, the EU and ASIA PAC sessions have not shown losses above 4% or 5%, and are nothing like what was seen last week and the week before. This shows that markets are nearing the point where a recession is now already priced in. As a recession is the worst of all scenarios, any other scenario would mean potential upside and see XRP price quickly tick $0.3710 or even $0.4428, to test the 55-day Simple Moving Average and book 31% of gains in the process.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.