XRP update: SEC Chair Gary Gensler resurfaces as Judge Torres refers Ripple case under Sarah Netburn

- District Judge Torres has referred the Ripple case to Magistrate Judge Sarah Netburn for General Pre-trial.

- The pre-trial will include scheduling, discovery, non-dispositive pre-trial motions, and settlement.

- Netburn is the same judge that cited the SEC for lack of faithful allegiance to the law in a case update in February.

- Despite the judge's selection inspiring optimism among XRP community members, Ripple price is extending losses while Gensler expresses disappointment with the recent ruling.

XRP price continues with a bearish bias, pulling toward the negative side of an otherwise neutral technical formation. The move is unorthodox, considering a recent development that has inspired a new wave of optimism among Ripple community members. In a related development Chair of the US Securities and Exchange Commission (SEC) has resurfaced publicly for the first time since Judge Torres' ruling, saying he is disappointed about the court's decision.

BREAKING: Gary Gensler talks about the Ripple Vs SEC ruling.

— Cryptic Poet (@1CrypticPoet) July 17, 2023

Says the SEC is continuing to asses Judge Torres' opinion. #xrp $xrp #XRPCommunity #crypto #blockchain pic.twitter.com/GGvXSmFKBp

The comments come during the National Press Club and mark the first time he resurfaces since Judge Torress’ summary judgement.

XRP price southbound despite Judge Torres updating Ripple case

XRP is down 6% and indicates a continued rally south. This is unexpected considering District Judge Analisa Torres referring the Ripple vs. SEC case to Magistrate Judge Sarah Netburn for general pre-trial.

NEW: District Judge Torres has referred the @Ripple case to Magistrate Judge Netburn for General Pretrial (includes scheduling, discovery, non-dispositive pre-trial motions and settlement). pic.twitter.com/EyrA3flpXC

— Eleanor Terrett (@EleanorTerrett) July 17, 2023

In legal vocabulary, this defines a hearing before a trial, with the defendant, plaintiff, and their respective attorneys attempting to determine the issues, laws, or facts that matter before the court trial.

In turn, Judge Sarah Netburn has ordered that both Ripple and the SEC work together and choose three dates convenient for both sides for a settlement hearing if they deem it fit. She has also suggested that the parties reveal the chosen dates in advance as the court has a busy schedule.

NEW: Judge Sarah Netburn orders both @Ripple and the @SECGov to agree on 3 mutually convenient dates to schedule a settlement conference, “if they believe it to be productive at this time.”

— Eleanor Terrett (@EleanorTerrett) July 17, 2023

Also recommends scheduling 6-8 weeks beforehand due to the court’s busy schedule. pic.twitter.com/zyU4Ku2OOu

XRP community turns optimistic on the news

XRP community members posted a new wave of optimism following the announcement. This is because Judge Netburn has a history of ruling against the US SEC. As echoed by pro-Ripple attorney John E. Deaton, Judge Netburn said in regards to Ripple Labs vs. SEC litigation that the regulator lacked "a faithful allegiance to the law."

cryptocurrency, and on the other hand, that Hinman sought and obtained legal advice from SEC counsel in drafting his Speech, suggests that the SEC is adopting its litigation positions to further its desired goal, and not out of a faithful allegiance to the law.”

— John E Deaton (@JohnEDeaton1) February 20, 2023

-Judge Netburn

While Judge Torres's summary judgment was bipartisan, the Ripple community remains adamant that the victory was in their favor. Unfortunately, this level of optimism is not indicated in the XRP retail interest, which continues to dampen, causing an extended price slump. One community member says:

We’re bullish regardless of what happens at this trial (which has virtually nothing to do with XRP). XRP holders already won. It’s been decided. Period. The current law in the United States = XRP is not in and of itself EVER a security.

Meanwhile, there has been a lot of chatter about Judge Torres' recent ruling that XRP was only a security when sold to institutional investors. According to Deaton, while one section supports the determination, another group challenges that the result was "inconsistent with the entire premise or policy behind the US."

More still, another class of legal minds speculates the overturning of the ruling in the 2nd Circuit court. Nevertheless, Deaton has committed to "meeting the claim head-on."

A lot of talk about Judge Torres’ reasoning in the XRP decision. Some say her result is inconsistent with the entire premise or policy behind U.S. securities laws. A few well known and respected lawyers (I respect them as well) have predicted that Judge Torres will be overturned… https://t.co/FPXGSRCVIZ

— John E Deaton (@JohnEDeaton1) July 17, 2023

Amicus in the SEC vs Ripple case also promises to bring in Lewis Cohen, a lawyer who supposedly "knows Howey and the appellate case law following Howey better than anyone," in his online dissection of the recent XRP ruling on Tuesday.

TOMORROW - LIVE at 3PM ET:

— CryptoLaw (@CryptoLawUS) July 17, 2023

"The XRP Ruling: THE FACTS"

No disinformation and bias - let's stick to the facts.@JohnEDeaton1 and @NYcryptolawyer walk through the ruling by Judge Torres - what it says, what it doesn't say, and the likelihood of it surviving appellate scrutiny. pic.twitter.com/J1RZw1Lfym

Given Cohen's history of consulting with lawmakers drafting legislation involving digital assets, Deaton looks to leverage the lawyer's expertise on policy implications.

FXStreet team will bring you any significant revelations from the discussion as the two legal minds "walk through the ruling by Judge Torres - what it says, what it doesn't say, and the likelihood of it surviving appellate scrutiny."

XRP price slump continues

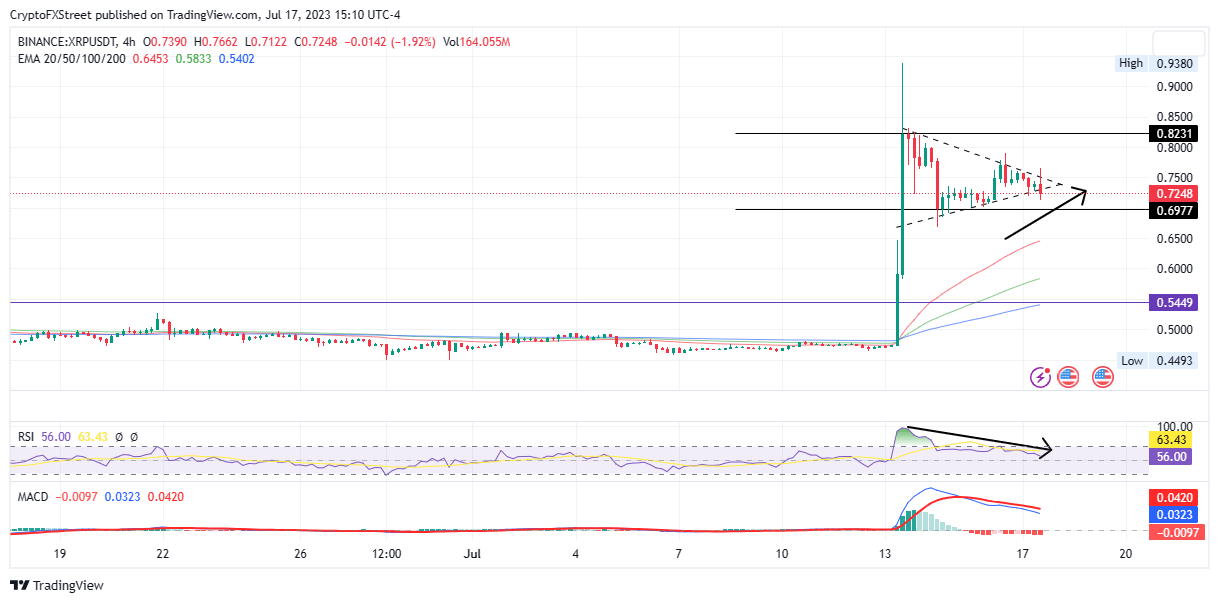

XRP price is down 6.6% with indications of a continued downtrend as the 4-hour chart shows a bearish divergence. An increase in selling pressure could see the remittance token tag $0.697, levels last seen during mid-July.

XRP/USDT 4-hour chart

Nevertheless, if the newly found optimism sustains and XRP community members actualize it, the Ripple price could break above the upper boundary of the pennant before a retest of the July 13 highs around $0.823.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.