XRP price sets sights on $1, but Ripple on-chain metrics remain lull

- XRP price breakout from a bull flag pattern hints at a retest of $1.

- On-chain metrics remain neutral and suggest a likely minor downturn before the bullish outlook continues.

- A breakdown of the $0.687 support level will invalidate the bullish thesis for Ripple.

XRP price has triggered a massive breakout from an optimistic pattern, but the consolidation has caused it to remain rangebound. While the technicals are bullish, on-chain metrics hint at a minor blockade ahead.

Also read: Gold Price Forecast: XAUUSD consolidating gains around $1,940.00

XRP price looks to continue its ascent

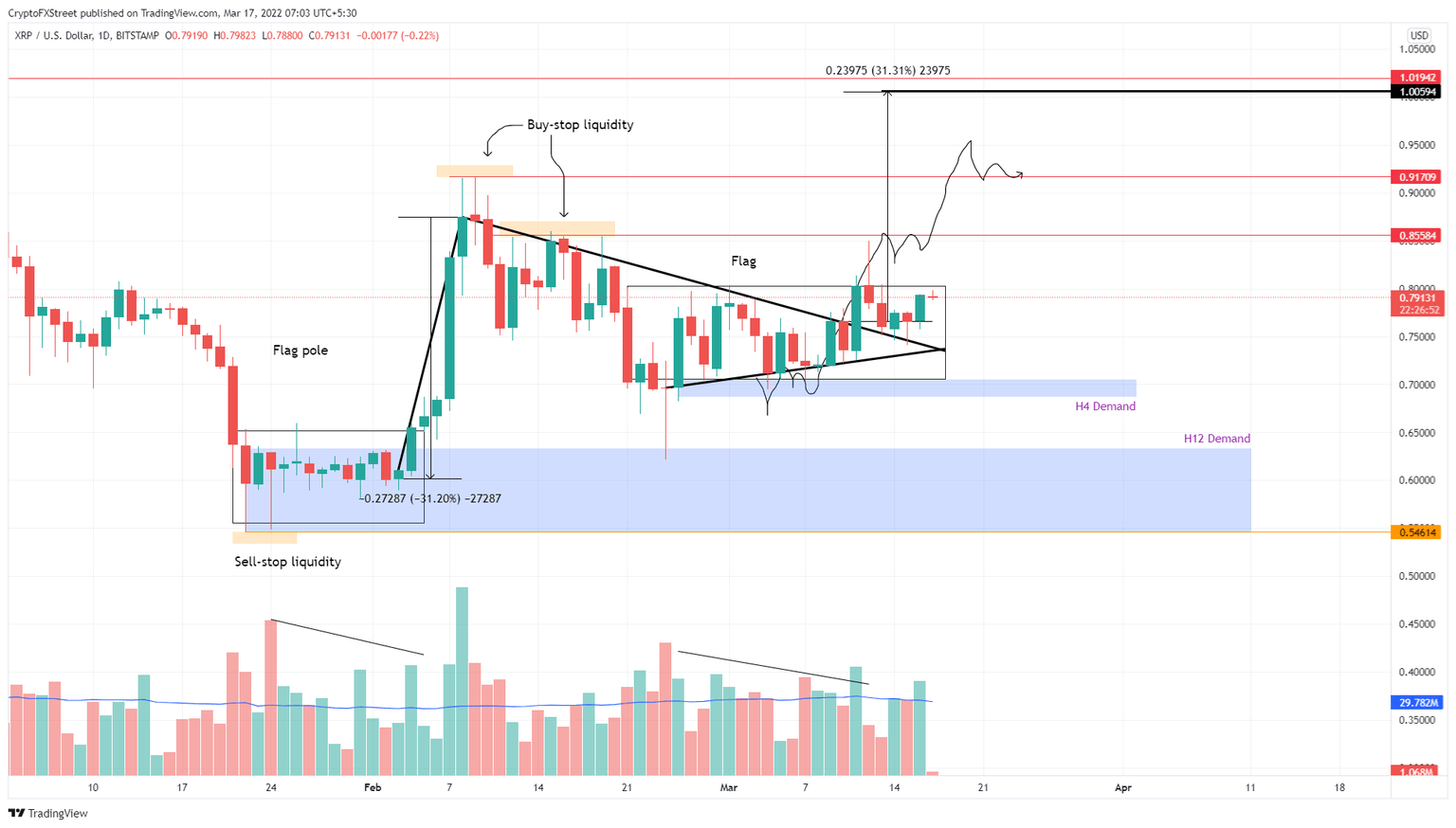

XRP price action over the past month or so has set up a bull flag continuation pattern. The 55% run-up between February 3 and 8 created a bull flag, and consolidation that ensued between converging trend lines set a flag.

On March 11, the XRP price breached the flag’s upper trend line at $0.779, indicating a breach of the pattern. This technical formation forecasts a 31% ascent to $1, determined by measuring the bull flag’s height and adding it to the breakout point.

So far, the XRP price seems to be holding up well but needs to surpass the $0.856 and $0.917 hurdles to reach its intended target at $1.

XRP/USDT 1-day chart

While the breakout from the bull flag formation is bullish and something to look forward to, the funding rate for XRP price seems to have spiked massively. The funding rate is used to determine which side of the camp traders are in. A positive value suggests that many investors are expecting the asset to go higher.

However, extreme values are often indicative of the tops or bottoms. For Ripple, the funding rate has seen an uptick from 0.015% to 0.123%, a 720% increase, suggesting that a temporary reversal in trend is likely.

XRP funding rate

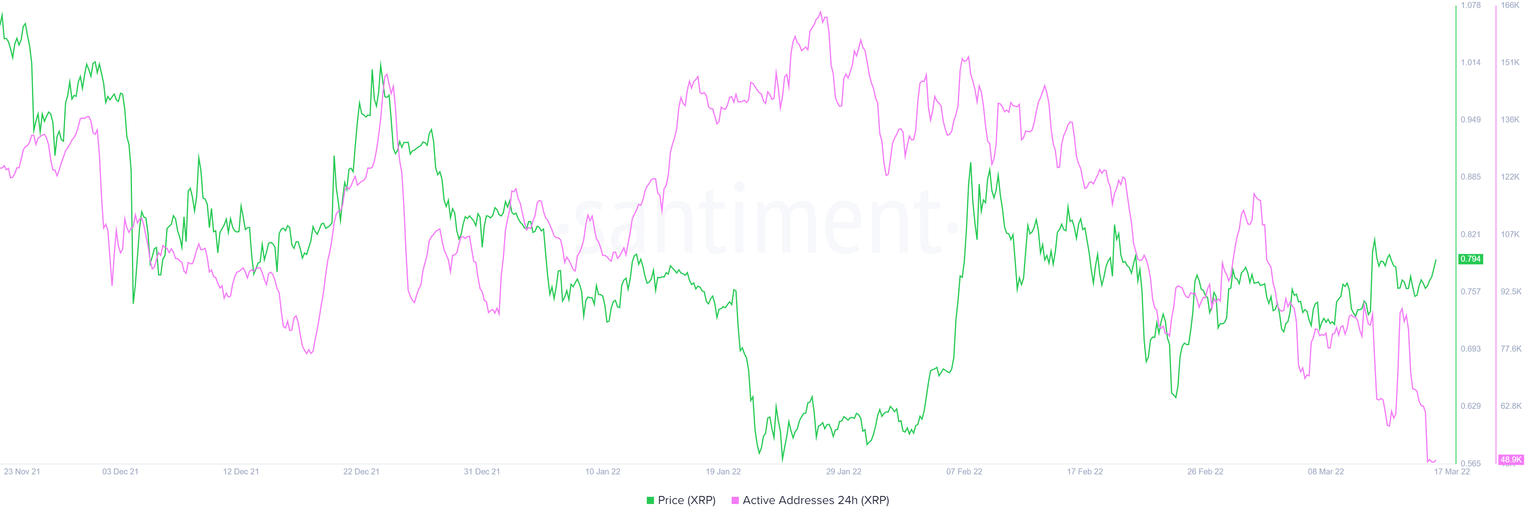

Moreover, the 24-hour active addresses metric that is used to determine the investors’ interest in XRP at the current price levels has dropped from 117,000 on March 2 to 49,000 on March 16.

This 58% decline indicates that the inflow of capital is reducing as these market participants are uninterested in the prospects of Ripple.

XRP 24-hour active addresses

Therefore, investors need to exercise caution at least until the funding rate neutralizes, to enter long positions. If XRP price produces a decisive close below the immediate support level at $0.687, it will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.