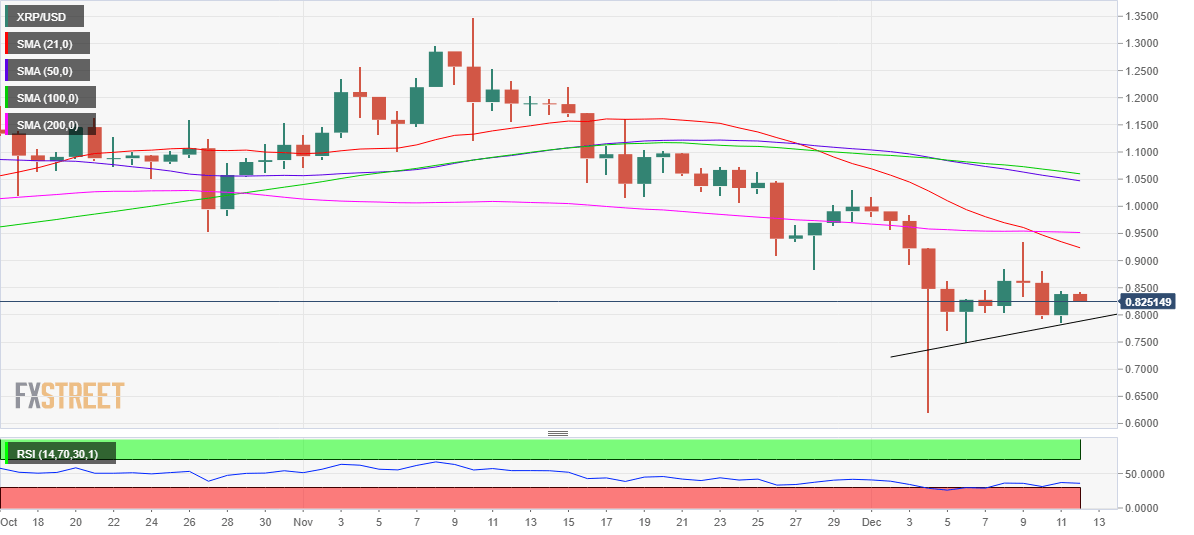

XRP price risks a drop towards $0.60 once this key support caves in

- Ripple bears back in the game after Saturday’s temporary rebound.

- XRP price could fall further if the critical daily support line at $0.79 is eroded.

- RSI is pointing lower towards the oversold region while below 50.00.

XRP price has returned to the red this Sunday, calling for a negative start to a brand-new week, as the weekend love appears to dissipate across the crypto space. The granddaddy of cryptocurrencies, Bitcoin, is extending its struggle with the $50,000 level while Ethereum defends the $4000 mark.

After the December 4 flash crash, XRP price has entered into a phase of bearish consolidation, with sellers lurking at the $1.00 mark. As of writing, Ripple price is trading around $0.83, losing about 1% so far.

Investors continue to weigh in on the developments around the ongoing Securities and Exchange Commission (SEC) v. Ripple Labs case.

Raoul Pal, former Head of European Hedge Fund Sales – Equities and Equity Derivatives and ex-Goldman Sachs executive, said on Friday, the SEC v. Ripple lawsuit made XRP very attractive as an investment.

Pal said: “I bought it for the reason that: a) it does have use cases and it is being used, and b) the court case is a phenomenal risk-reward.” He has considered the risk-reward for XRP at the time to be 10 to 1.

How is XRP price positioned on the daily chart?

XRP price is heading for a retest of the critical daily support line at $0.79, having rebounded from it a day before.

The 14-day Relative Strength Index (RSI) is edging lower towards the oversold territory while holding well below the central line. This suggests that the abovementioned strong support could be put at risk in the day ahead.

If the bears crack this key support on a daily closing basis, a sharp sell-off towards the December 4 lows of $0.62 cannot be ruled out.

Ahead of that level, December 6 lows of $0.75 will act as a fierce cap.

XRP/USD: Daily chart

On the flip side, XRP bulls need to find a strong foothold above Saturday’s high of $0.84 to resume the rebound towards a downward-sloping 21-Daily Moving Average (DMA) at $0.92.

The next significant resistance is aligned at the $0.95-$1.00 region, where the 200-DMA and psychological barrier coincide.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.