XRP price drop to $0.55 likely amidst Senator Elizabeth Warren’s final push in US crypto legislation

- XRP price is likely to decline to the imbalance zone at $0.55, before a rebound in the altcoin.

- Pro-XRP attorney John Deaton slammed US Senator Elizabeth Warren’s crypto bill.

- Ripple is battling selling pressure amidst regulatory headwinds, lawsuit settlement with the SEC remains elusive.

US Consumer Price Index (CPI) data release for November has revealed an increase of 0.3% in inflation, month-on-month and the annual inflation rate is 3.1%. The CPI report and the upcoming Federal Open Market Committee (FOMC) meeting on Wednesday make for volatile Bitcoin and altcoin prices.

XRP price sustained above $0.60, the altcoin is resisting a drop to the imbalance zone at $0.55. A decline to the imbalance zone would mark a 7% drop in XRP price. As crypto legislation in the US enters final stages, XRP price resists further drop.

Also read: Bitcoin price spikes to $42,000 in response to November US CPI data release

Daily Digest Market Movers: US gears up for crypto legislation, Crypto bill causes a stir

- US Senator Elizabeth Warren has proposed a bill that requires crypto investors to disclose where their crypto assets are located and the maximum value of assets held.

- Sen Warren’s bill has caused a stir among market participants, and pro-XRP attorney John Deaton slammed the legislator for her stance on crypto.

- The crypto bill is supported by a coalition within the Banking Committee. Sen Warren’s bill calls for an increase in oversight and crypto regulation, while citing associated risks like terror financing.

- Sen Warren is of the opinion that cryptocurrencies are an avenue for criminal activities and need to be regulated within a framework to mitigate associated risks.

- Attorney Deaton argues that the bill is a significant one as nine US senators have joined Sen Warren and considers the legislator, “the single biggest threat to crypto in the US.”

- Ripple supporters and XRP holders are awaiting the next steps in the SEC v. Ripple lawsuit. A settlement is likely elusive, the remedies related discovery phase of the lawsuit ends in February 2024.

Technical Analysis: XRP price resists decline to $0.55

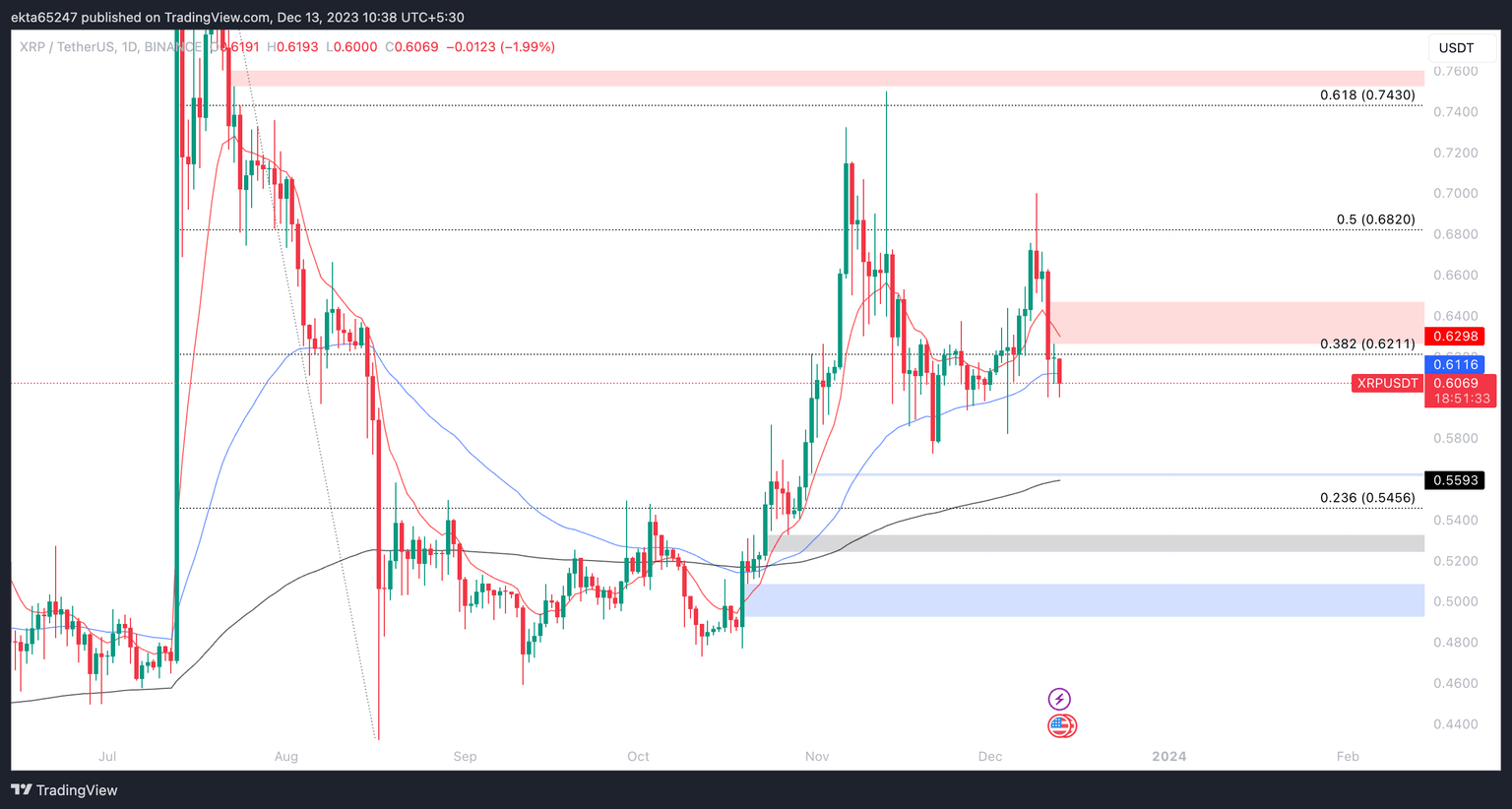

XRP price suffered a decline from its November 14 top of $0.7495 to $0.6072, at the time of writing. The altcoin is currently above its 200-day Exponential Moving Average (EMA) of $0.5593. XRP price dropped below its 10- and 50-day EMAs.

In the event of a continued decline in XRP price, the altcoin could post a recovery from the $0.55 level, close to the imbalance zone between $0.5615 and $0.5631. Once the gap is filled, XRP price is likely to resume its upward trend.

XRP/USDT 1-day chart

A daily candlestick close below $0.55 could invalidate the thesis of recovery in XRP price.

Cryptocurrency metrics FAQs

What is circulating supply?

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

What is market capitalization?

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

What is trading volume?

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

What is funding rate?

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.