- Ripple prepares for win in legal battle with SEC, agency pursued expansion of power beyond constitutional boundaries.

- John Deaton says Ripple is at an advantage, case being heard by skeptical judge who already ruled in Ripple’s favor.

- XRP price at the $0.33 level, it may be the last chance to scoop up the altcoin at a relatively low level.

Ripple is making strides towards a victory in the legal battle against the SEC. John Deaton, impartial adviser to the court and representative of 72,000 XRP holders, believes Ripple is at an advantage.

Also read: SEC v. Ripple update: Regulator argues Hinman’s speech is not relevant to the lawsuit

SEC v. Ripple case update, is the regulator overreaching?

John Deaton, amicus curiae (impartial adviser to the court) in the SEC v. Ripple case, commented on the SEC’s overreach in the legal battle with the payment giant. Deaton believes that Gary Gensler, the Chairman of the SEC, is intent on expanding the agency’s power beyond constitutional boundaries.

Gensler wrote in an op-ed:

There’s no reason to treat the crypto market differently from the rest of the capital markets just because it uses a different technology.

There’s no reason to treat the crypto market differently from the rest of the capital markets just because it uses a different technology…

— Gary Gensler (@GaryGensler) August 22, 2022

Read my recent Op-Ed:

The SEC has limited jurisdiction over the crypto industry, while the front line regulation of cryptocurrencies belongs with the Commodities and Futures Trading Commission (CFTC). The CFTC is the main regulator of digital assets that are not deemed traditional securities. Deaton therefore argues that the SEC’s battle with Ripple is evidence of overreach.

My op-ed rebuking @GaryGensler. Gensler claims that he is treating Crypto like all other markets.

— John E Deaton (212K Followers Beware Imposters) (@JohnEDeaton1) August 21, 2022

NOT TRUE!

Gensler is expanding Howey beyond recognition.

I ✍️:

“Howey involved the offer and sale of orange groves at a Florida resort owned and operated by the Howey Co.” https://t.co/JgvmLI1lQC

Deaton criticizes the SEC’s regulation by enforcement and argues that crypto is the jurisdiction of the CFTC, the agency treading rather lightly around the issue for fear of stifling innovation.

Why SEC is serving as the cop on the beat

In an opinion editorial, Gary Gensler argues that the SEC will serve as the cop on the beat. Gensler commented on the SEC’s case against BlockFi, a crypto lending and trading platform. The head of the SEC argues that crypto is subject to regulation, the rules have been around for decades and platforms are not following them. Non-compliance is the inevitable result of the crypto business model.

Gary Gensler, Chairman of the SEC

Gensler said:

As with seat belts in cars, we need to ensure that investor protections come standard in the crypto market.

Ripple is at an advantage with a skeptical judge presiding the case

The SEC v. Ripple case is being heard in Federal Court and Deaton argues that judge Sarah Netburn is a skeptical judge who has made a series of rulings in Ripple’s favor. Judge Netburn has made several rulings in favor of a rational fight against the regulator. Following the court’s rulings, the William Hinman documents (key to Ripple’s defense) are up for discussion, and Ripple is seeking to authenticate these findings with the help of SEC officials.

While the SEC has refused to authenticate whether it is William Hinman, their former director of Corporation Finance, in a 2018 speech, Ripple’s defense is stronger, bringing the discussion to the table. Check the video below for an excerpt from the speech of William Hinman, where he explains that Bitcoin and Ethereum are not securities.

DID WILLIAM HINMAN COMMIT A CRIME?

— CryptoLaw (@CryptoLawUS) August 12, 2022

He ignored the legal warnings from @SECGov Ethics and met with Simpson Thacher. Again and again.

It's Time for an Investigation.

CONNECT TO CONGRESS and Demand Your Lawmakers Support an Investigation pic.twitter.com/rgrvA8lZaB

XRP price suffered a blow from the SEC’s allegations on its largest public holder Ripple. The altcoin is prepared for a recovery as the case draws to a close.

XRP recovery is brewing like hot tea

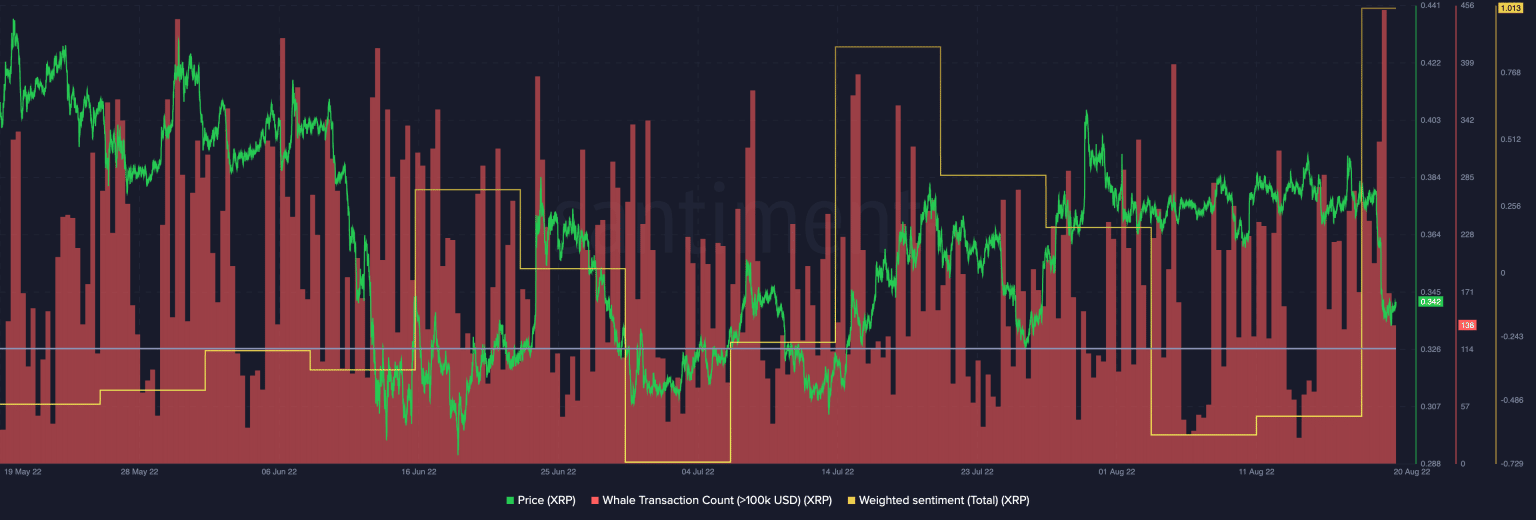

Despite a consistent decline in two key metrics – new addresses joining the XRP network, and the daily active address – Ripple has witnessed a growth in whale activity. Based on data from crypto intelligence tracker Santiment, whale activity on the XRP network has increased. Large value transactions worth $100,000 and above have hit the highest level since May.

XRP’s weighted sentiment is a metric that takes into account social media relevance, mentions. This metric is key in predicting XRP’s trend reversals. XRP token weighted sentiment is 1.013, highest level since April.

XRP whale transaction count and weighted sentiment

Interestingly, XRP enjoys a positive correlation with Bitcoin. In response to a series of liquidations that hit the crypto market over the past seven days, XRP also witnessed $1.5 million liquidations.

XRP’s price and trade volume have declined consistently since July. Analysts believe this is set to change with XRP’s recovery from the slump.

Michael Nderitu, a crypto analyst, argues that XRP price chart flashed mixed signals that investors should consider before making the next move. Nderitu expects a bullish recovery around the 2-month ascending support at $0.34.

XRP-USDT 1-day price chart

Analysts at FXStreet are bullish on XRP. Analysts argue that XRP’s consolidation has ended and the altcoin is ready to break out. For more information and key price levels, check the video below:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.