- XRP price commences recovery journey after tapping the massive demand area around $0.3200.

- Weekly digital asset inflows in XRP-related products stay at zero despite price drop.

- An incoming buy signal from the MACD could cement the bulls’ presence in the market against a potential retracement to $0.3000.

XRP price is printing the second bullish candlestick from support at $0.3200. The largest international money transfer token traded at $0.3559 on Monday after bulls rushed to prevent overarching losses below $0.3000. A daily close above $0.3500 (XRP’s immediate support) will point the token to highs around $0.5577.

XRP price in green as weekly digital asset funds soar

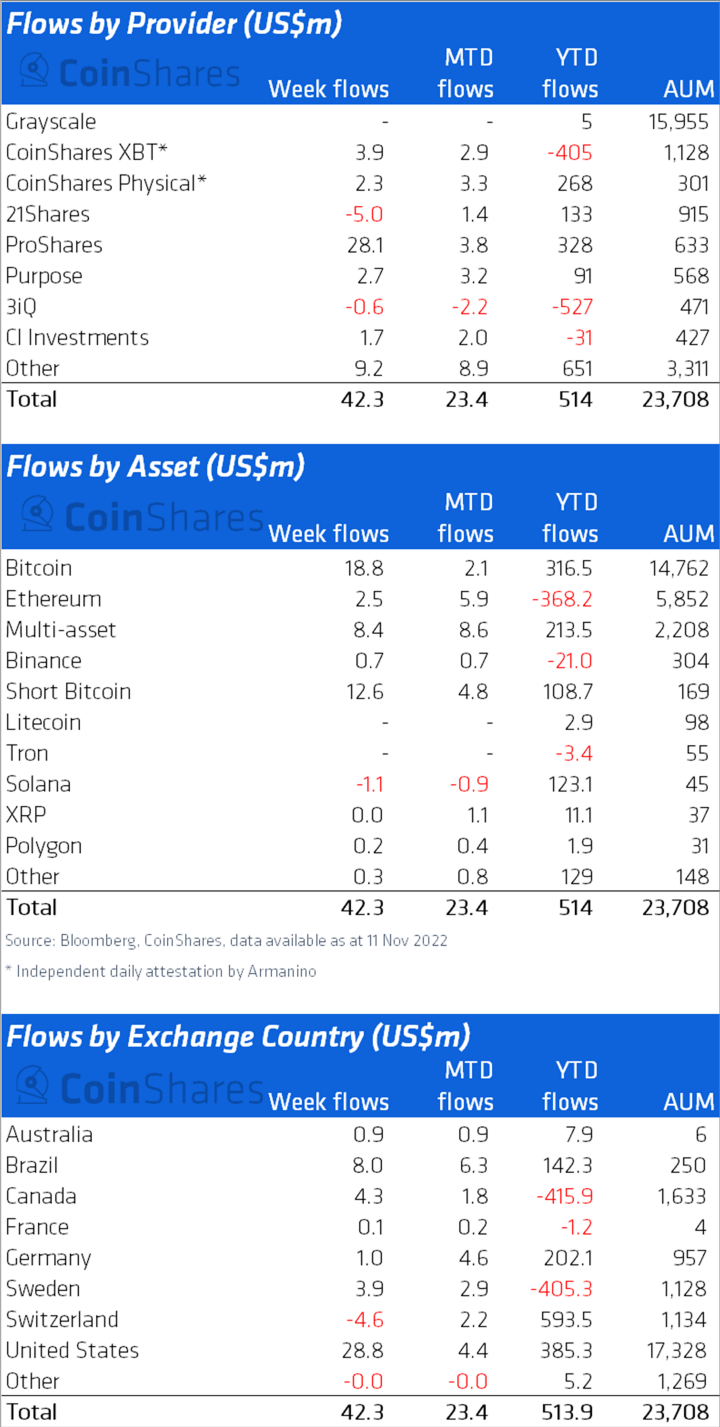

Investors appear to be watching the FTX collapse with a microscope – possibly to gauge its impact on the crypto market. According to a report by CoinShares, crypto-related products recorded over $42 million in inflows – the highest in 14 weeks. However, no funds were sent to XRP-related investment products.

According to the report published on CoinShares blog site, most funds started to trickle in toward the end of last week as the crypto market reacted to the crash of FTX and Alameda.

Bitcoin accounted for most of the inflows at $18.8 million, while $2.5 million entered Ethereum-focused investment products.

CoinShares weekly inflow report

XRP price bullish again, but is it time to buy the dip?

XRP price could quickly validate an anticipated move to $0.5577 if the Moving Average Convergence Divergence (MACD) indicator flashes a buy signal. Traders should wait for the 12-day Exponential Moving Average (EMA) (in blue) to cross above the 26-day EMA (in brown) before triggering their long positions.

XRPUSD 12-hour chart

XRP will likely uphold its uptrend now that the Stochastic oscillator is almost climbing out of the oversold region (above 30.00). Assets tend to recover after such oversold conditions and return to their fair market value in the process. The optimistic outlook in XRP will keep solidifying as the Stochastic moves into the neutral zone and possibly enters the overbought region (above 70.00).

Traders can consider $0.4100 as the first take-profit position (TP-1), but those who are stubbornly bullish will hold on until XRP tags $0.5577 (TP-2). Nevertheless, XRP is not out of the woods yet, and short-term retracements - testing support at $0.3100 are possible, especially with the fresh FTX scandal.

On the bright side, investors could use the retracements to fill their bags (buying lower-priced XRP tokens), as cited by CoinShares. Therefore, pullbacks are okay for XRP as long as they are quickly exhausted, thus paving the way for more gains.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Cronos rallies 17% ahead of its zkEVM v26 Mainnet upgrade

Cronos (CRO), the token for the Crypto.com platform, extends its gain by 17% and trades around $0.11 on Monday after surging nearly 18% the previous day.

DYDX announces its first-ever buyback program; 25% of net protocol fees will be allocated to monthly buybacks

The dYdX (DYDX) price hovers around $0.72 on Tuesday after gaining nearly 8% the previous day. The recent announcement of its first-ever buyback program, where 25% of net protocol fees will be allocated to monthly buybacks, supported this rally.

Trump Media partners with Crypto.com to begin launching ETFs

Trump Media and Technology Group (TMTG) announced on Monday that its fintech arm, Truth.Fi has signed a non-binding agreement with Crypto.com to launch several exchange-traded funds (ETFs).

Trump's WLFI tests USD1 stablecoin on BNB Chain: Will Binance Coin finally hit $700?

Binance Coin (BNB) saw a 3% price increase on Monday, crossing the $635 mark as rising trading volumes signaled heightened market interest.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.