- Ripple (XRP) price surged 22% in 3 days to hit $2.47 on Friday, as crypto markets started 2025 on a positive note.

- On-chain data shows the price rally coincided with a cryptic Trump-related message embedded in Ripple’s latest 500 million XRP escrow transaction on January 1.

- XRP Weighted Sentiment turned increasingly negative on Tuesday, signaling room for further upside as market sentiment rebounds from the holiday sell-off.

Ripple (XRP) price reached a 14-day peak of $2.5 on Friday, as the mega-cap altcoins make a positive start to 2025.

With market sentiment still trending cautious, on-chain data suggests XRP price could potentially score larger gains as the United States (US) President-elect Donald Trump inauguration nears.

XRP starts 2025 with a 23% rally as Ripple’s Trump reference ruffles feathers

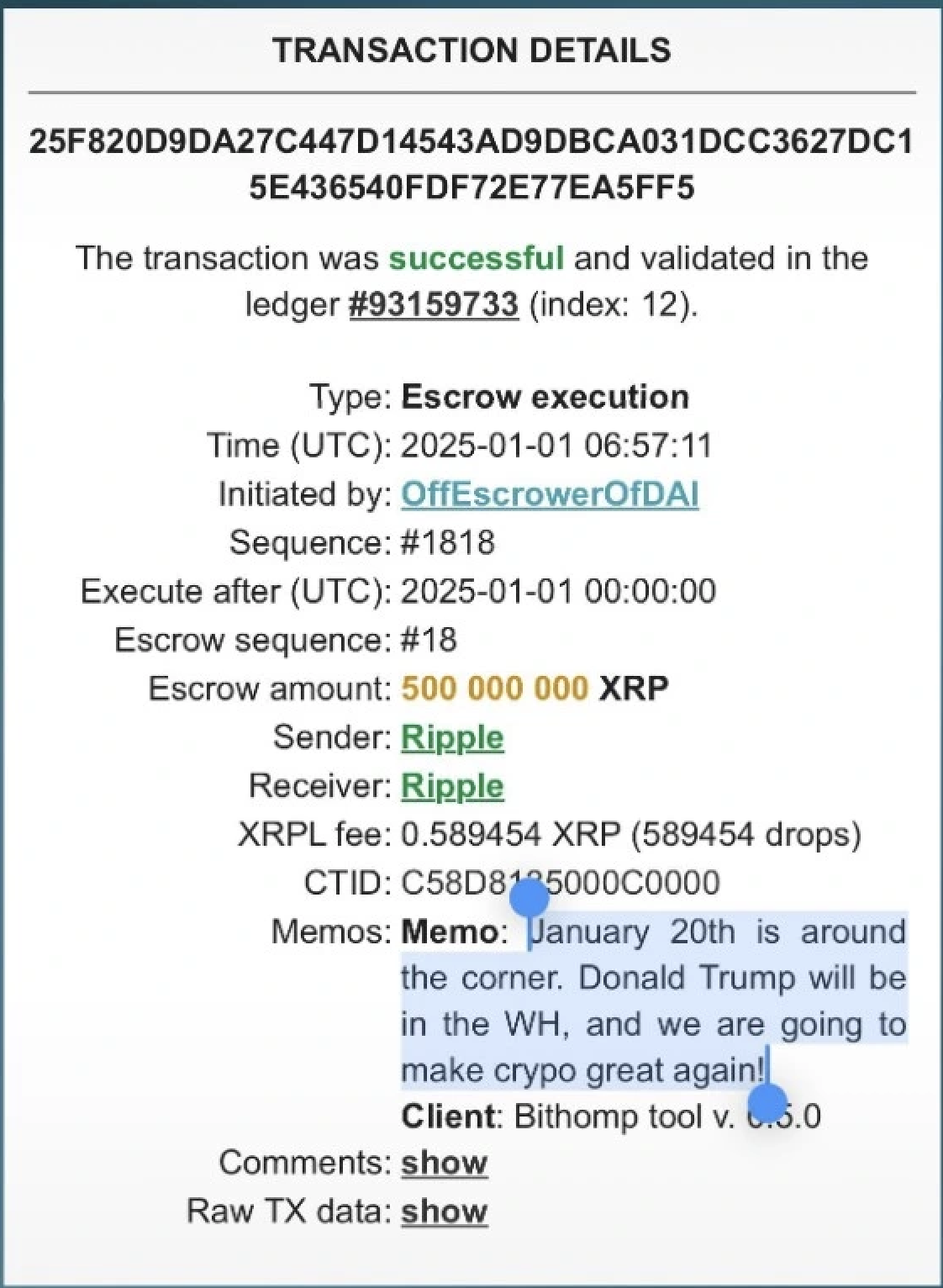

On Wednesday, Ripple unlocked another 500 million XRP tokens from its escrow account as a part of Ripple’s monthly schedule to manage the token supply.

However, a cryptic message referencing Trump's upcoming inauguration embedded in Ripple’s latest transaction has sparked a positive market reaction.

XRP community influencer JackTheRippler alerted his 302,400 followers on X to a memo accompanying Ripple’s latest transaction details.

Transaction details of the 500M XRP Tokens (Source: X Post)

The meme read: “January 20th is around the corner. Donald Trump will be in WH [Whitehouse], and we are going to make crypto great again.”

Hinting at potential transformative changes in crypto under the Trump administration, this transaction meme has ignited optimism within the XRP spot markets.

Ripple (XRP) price action | January 3, 2025

Ripple (XRP) price action | January 3, 2025

As seen in the chart above, XRP opened trading at $2.1 on Wednesday. But since the Trump reference embedded in Ripple’s latest escrow transaction, XRP price has surged by 23% to hit the $2.5 level on Friday, overtaking Tether (USDT) as the third largest cryptocurrency project by market capitalization.

Market sentiment remains cautious despite recent gains

Despite the recent price surge, on-chain data aggregates show market sentiment is yet to recover from the US Federal Reserve (Fed)-induced bearish headwinds in the second-half of December.

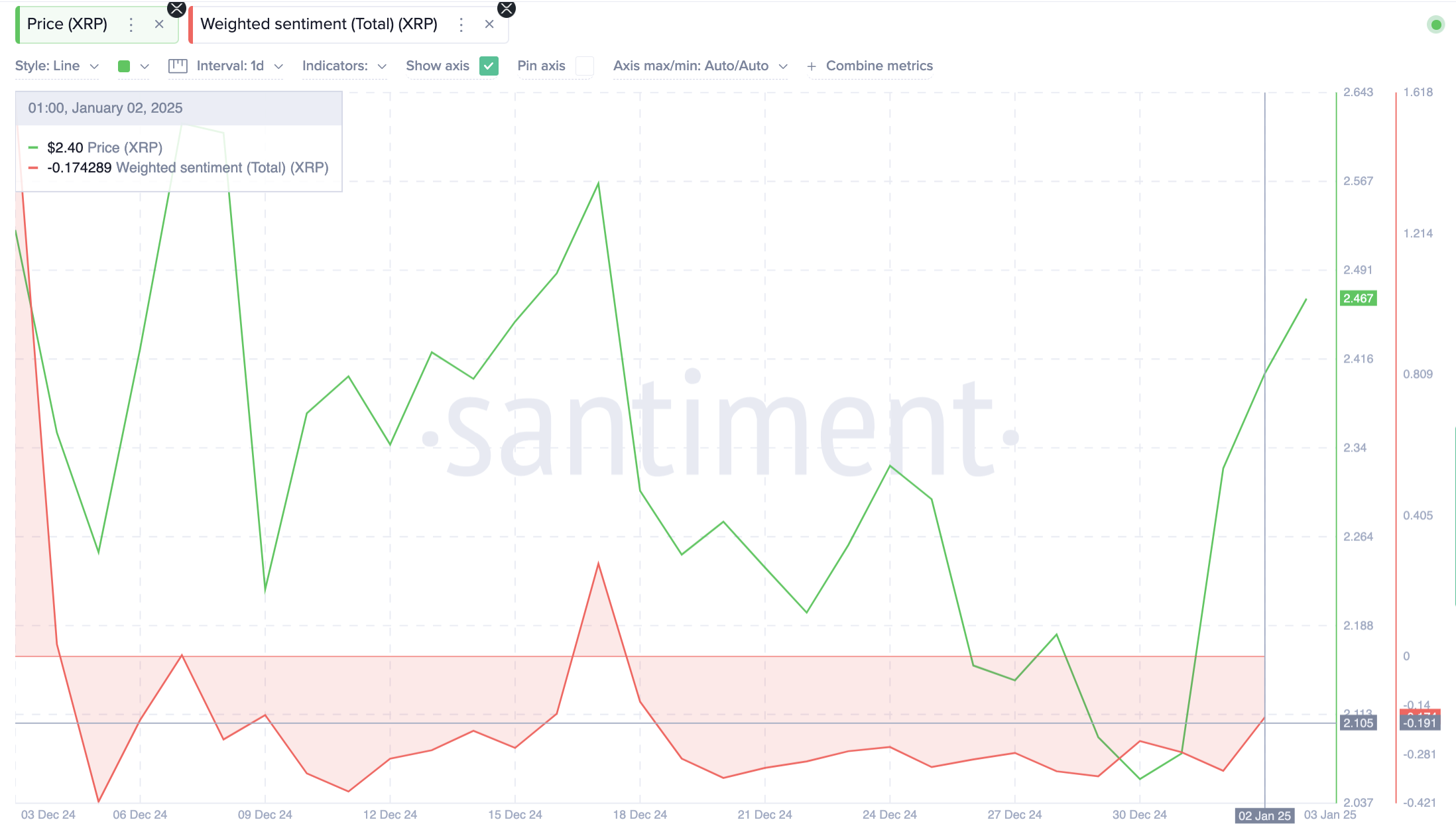

Affirming this narrative, Santiment’s Weighted Sentiment chart below tracks the incidence of positive and negative discourse around XRP.

Ripple (XRP) Weighted Sentiment | January 2025 | Source: Santiment

Ripple (XRP) Weighted Sentiment | January 2025 | Source: Santiment

As seen above, XRP Weighted Sentiment still trends in negative values of -0.2 as of Friday, showing that negative comments still outpace the positives.

This implies that despite the 23% gains in the first three days of 2025, the majority of traders still maintain a cautious outlook.

Essentially, this hints at further XRP price upside potential for two reasons.

First, the lingering negative sentiment suggests that many traders may still be on the sidelines, providing room for fresh capital inflows as confidence improves.

Second, such an accelerated price rally amidst cautious aggregate market sentiment reflects underlying buying pressure from XRP whales and large institutional players.

If the current market dynamics persist, XRP price could potentially advance further towards $3 ahead of Trump’s inauguration slated for January 20.

XRP Price Forecast: Community hints $3 rally ahead of Trump inauguration

Ripple’s cryptic Trump-related message embedded in its Wednesday transaction memo sent XRP rallying 23% to $2.5 within three days, outperforming BTC and ETH as the crypto markets began 2025 with bullish momentum.

Despite the price surge, cautious market sentiment persists, reflected in XRP’s weighted sentiment remaining negative.

This indicates potential for further upside as sidelined traders may re-enter the market, fueling more gains in the days leading to Trump’s inauguration.

XRP’s bullish outlook is supported by rising trading volumes and four consecutive green candles, signaling strong buyer interest.

However, the Parabolic SAR remains above the current price, suggesting upside potential before market saturation.

A close above the $2.67 level could set the pace for the next breakout attempt toward the next major resistance at $3.

On the downside, support is seen at $2.30, with a critical level at $2.10 if bearish pressures escalate.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Slow but positive start

Bitcoin edges slightly lower, trading around $96,500 on Friday after an over 2.5% recovery this week, with historical data showing modest average January returns of 3.35%. On-chain metrics suggest the bull market remains intact, indicating a cooling-off phase rather than a cycle peak.

Stellar bulls aim for double-digit rally ahead

Stellar extends its gains, trading above $0.45 on Friday after rallying more than 32% this week. On-chain data indicates further rally as XLM’s Open Interest and Total Value Locked rise. Additionally, the technical outlook suggests a rally continuation projection of further 40% gains.

BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders (LTH) continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.