- XRP rebounds after immense volatility in recent days, triggered by US President Donald Trump’s reciprocal tariffs.

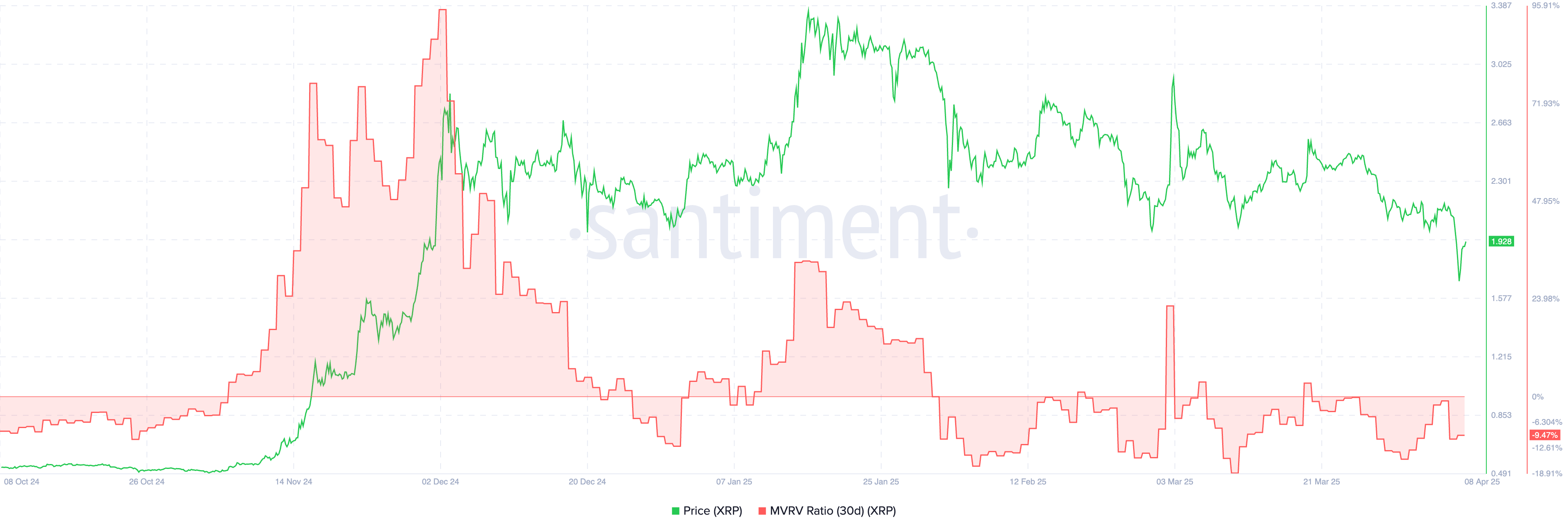

- A negative MVRV ratio signals that XRP is significantly undervalued, calling on traders to buy the token.

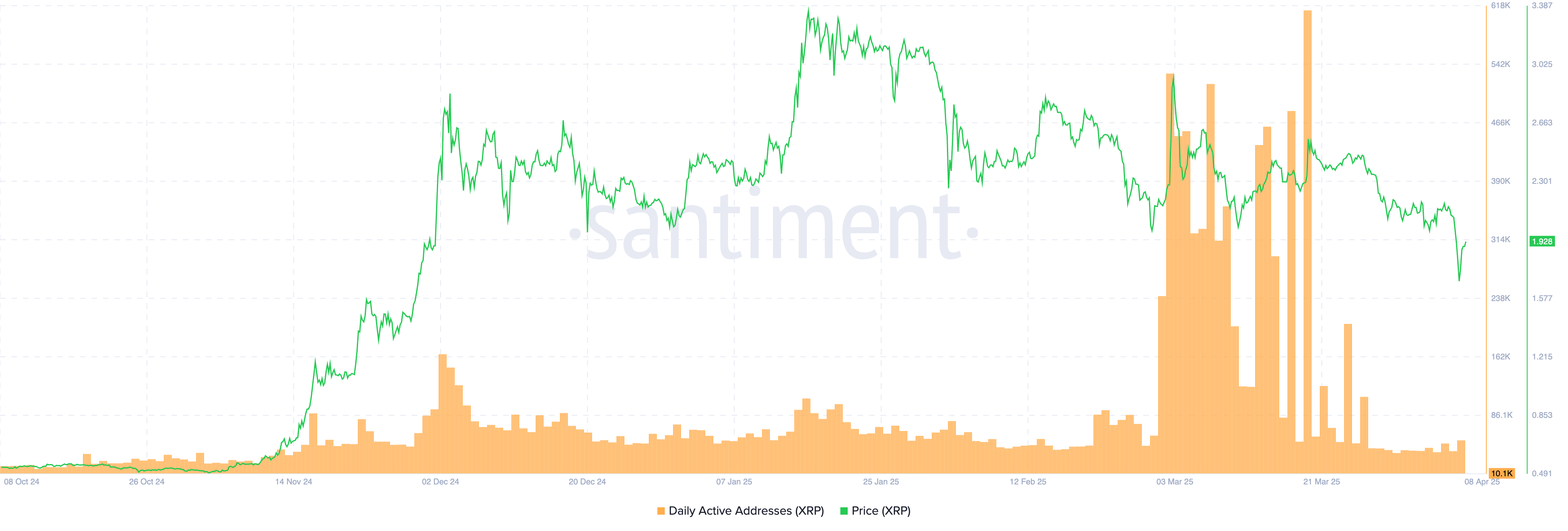

- A noticeable decline in the network’s on-chain activities could slow recovery.

Ripple (XRP) seeks stability in a volatile crypto landscape influenced by macroeconomic factors, including reciprocal tariffs. The international money transfer token hit a low of $1.64 on Monday after opening the week at $1.92, representing a 14.5% daily drop. At the time of writing on Tuesday, during the late Asian session, XRP had recovered Monday losses, exchanging hands at $1.92, as global markets continue to adjust and digest United States (US) President Donald Trump’s ever-changing tariff policy.

XRP rebound targets $2 as President Trump maintains tariff tune

After a gruesome sell-off on Monday, major assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are bouncing back. Trump’s blanket 10% reciprocal tariffs announced on April 2 will be effective on Wednesday.

Despite the bleeding in global markets, including US stocks, Trump insisted during a press conference with Israeli Prime Minister Benjamin Netanyahu on Monday that tariffs would continue as planned. The president seemed to add fuel to the fire, threatening an additional 50% tariff on China.

It is not immediately clear whether the recovery in XRP price to $1.92 is sustainable, especially with tariffs taking effect in just a day. Meanwhile, some on-chain fundamentals support the beginning of a larger rebound, calling on investors to consider buying XRP at current levels.

Santiment’s Market Value Realized Value (MVRV) metric holds 9.47% below the mean at 1 in the chart, suggesting that XRP is heavily undervalued. Traders holding the XRP token are unlikely to sell at the current price as they would realize substantial losses. This situation could translate to reduced selling pressure, hinting at a potential rebound amid growing seller exhaustion. A negative MVRV ratio has historically been viewed as a buy signal.

XRP MVRV | Source: Santiment

Can XRP sustain a recovery above $2?

XRP could rejuvenate its bullish structure if support at $2 is reclaimed. However, bulls must first navigate a volatile landscape to keep the price higher, including a daily close above the 200-day Exponential Moving Average (EMA). Moreover, the Relative Strength Index (RSI) continues to slide toward the oversold region, which may encourage sellers to stay put. At the same time, the Moving Average Convergence Divergence (MACD) indicator sustained a sell signal on March 28, suggesting a deeper downtrend is in play.

XRP/USDT daily chart

All eyes are set on the bull’s ability to reclaim the $2.00 level as support — a move that could reinforce XRP’s bullish structure and pave the way for recovery to $3.00.

However, the declining network activity observed with Santiment’s Daily Active addresses metric could slow recovery. As per the chart, only 10,100 addresses were active on the network on Monday compared to 581,000 addresses on March 19.

XRP Daily Active Addresses | Source: Santiment

A consistent drop in network activity impacts the underlying asset’s performance, depriving it of momentum to sustain recovery due to low demand. Hence, waiting for a trend confirmation before going all in and buying the dip would be prudent.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.