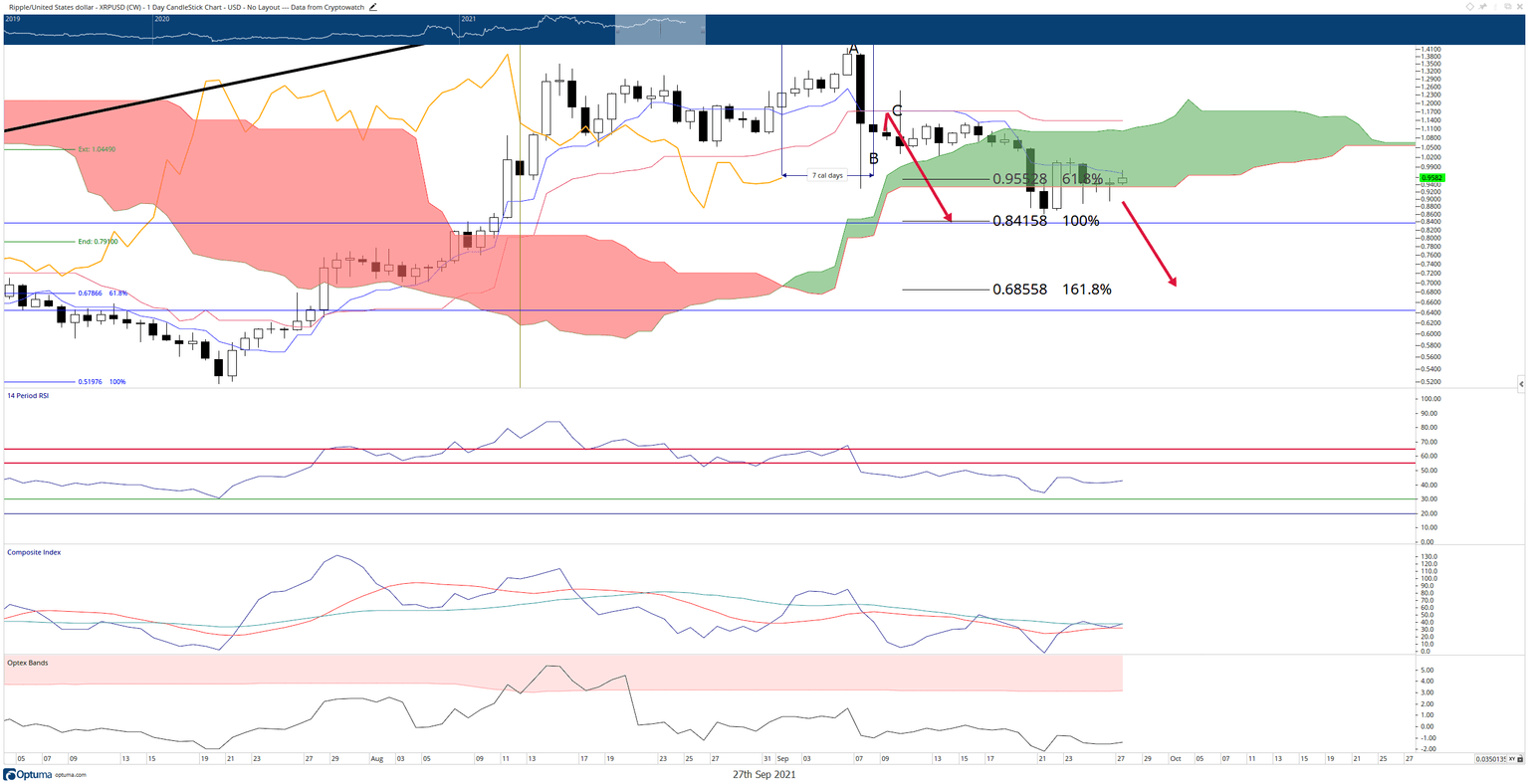

XRP Price Prediction: Ripple to plunge to $0.70

- XRP price continues to test the final and most decisive support level in the Ichimoku Kinko Hyo system: Senkou Span B.

- A drop below Senkou Span B will likely generate a swift move below the $0.90 and $0.80 value areas.

- Bears have a limited amount of time to capitalize on any weakness.

XRP price has spent twenty-one consecutive days attempting to push above the Tenkan-Sen. However, despite the Tenkan-Sen being the weakest support/resistance level in the Ichimoku Kinko Hyo system, XRP has been unable to sustain any move above it.

XRP price doggedly resisted from moving higher, now pressed between the weakest and strongest Ichimoku conditions

XRP price has near-term resistance against the Tenkan-Sen at $0.97 with near-term support at Senkou Span B (bottom of the Cloud) at $0.94. The Cloud represents indecision, volatility and consolidation. I affectionally call it the “place where trading accounts go to die.”

The most significant frustration for any bull or bear comes as XRP price trades against the weakest level in the Ichimoku system (Tenkan-Sen) and is unable to break above while it is supported against the most substantial level in the Ichimoku system (Senkou Span B) and fails to rally after finding support. Thus, sellers may be waiting for a close below Senkou Span B before pouncing on any shorting opportunity. A close below $0.93 would fulfill the final criteria for and confirm the ideal selling pattern in Ichimoku: the Ideal Bearish Ichimoku Breakout.

XRP/USD Daily Ichimoku Chart

While bears target the 161.8% Fibonacci expansion below the $0.70 value area, buyers want to maintain XRP price to levels that remain at least inside the Cloud. The Ichimoku indicator buyers want to watch is the Chikou Span. If the Chikou Span can close above the candlesticks, all of the criteria necessary to see XRP continue a clear and sustained bullish expansion phase are complete.

Sellers will likely need to hit the $0.70 value area before October 4th because the threshold for a bullish entry to target for a clear bullish breakout falls substantially on that date.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.