XRP Price Prediction: Ripple to dip below $0.70 in search of buyers

- Ripple price traps bulls as RSI diverges back into the bearish camp.

- XRP price could drop as much as 11% as investors weigh their risk appetite.

- Expect to see further downward pressure as tail risks mount.

Ripple (XRP) price has investors worried after a strong rally on Monday under thin volumes got pared back during the ASIA PAC session. The issue is growing tail risks, with the FED signalling a more hawkish approach and French elections adding more weight to geopolitical concerns. As such, investors are not in a happy place and are looking to reshuffle their portfolios by cutting back on holdings of cryptocurrencies, with XRP price at risk of losing roughly 11% from said portfolio rotations.

XRP price undergoes portfolio reshuffle with a possible 11% drop

Ripple price is facing issues with continuing its trend of Monday as a negative divergence grows. Although the greenback is on the back foot today, with the dollar index down 0.10%, XRP bulls cannot seize the momentum to gain more ground as investors are reluctant to jump on the bull bandwagon. Their hesitance comes as tail risks gain ground and start to bite into several portfolios, causing a bout of spring cleaning, with cryptocurrencies in line to get a dusting.

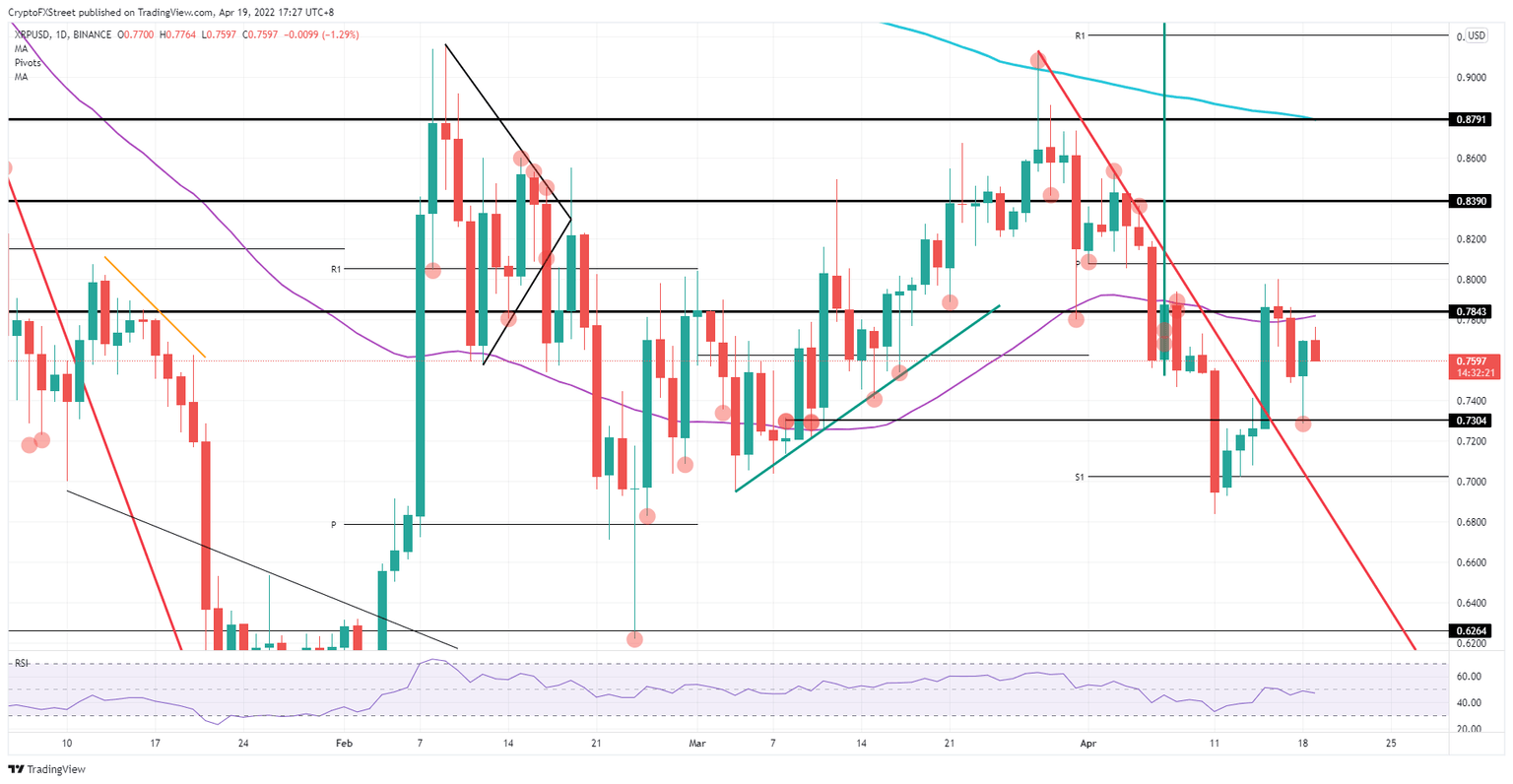

XRP price is set to undergo an 11% devaluation and could slip below $0.70 if it penetrates through the floor at $0.7304, which supported price action on Monday. Meanwhile, the Relative Strength Index (RSI) is slipping further below 50, only confirming that under the current situation, investors are in no mood to open up their wallets and fund a rally that will likely go nowhere. Once XRP price slips below $0.70, expect investors to buy in as XRP will then be valued at a lucrative discount.

XRP/USD daily chart

Another scenario could unfold when one of the current tail risks gets disarmed and even becomes a tailwind. For example, should there be a breakthrough in the peace talks between Russia and Ukraine and a ceasefire goes into effect, expect a rejoice rally to start rolling through markets. For XRP that would mean an immediate rollback of the incurred losses intraday and bears being squashed against the 55-day Simple Moving Average (SMA) and the $0.7843 level, with momentum building for a fierce pop toward $0.8390.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.