XRP Price Prediction: Ripple readies for bullish weekend

- Ripple price pops +2% in ASIA PAC trading on supportive news.

- XRP price is set to rally into the US close as both European and US stock markets point to a handover in positive sentiment.

- Expect to see a possible tag at $0.50 into the weekend.

Ripple (XRP) price has refrained from testing the S2 support level and rebounded beforehand, with intraday XRP price popping back above $0.4228. The uplift comes from a rate cut out of China that has set the tone for a broad risk-on trading day this Friday. Favourable tailwinds are rolling through all segments of the financial markets, with cryptocurrencies on the front foot as well, and XRP set to possibly break above $0.50.

XRP price set to book 16% appreciation into the weekend

Ripple price could be closing the trading week out with a bang as a surprise rate cut from the Chinese central bank has taken away all hesitation and is making traders forget about the blood-red sell-off markets have been experiencing over the past few days. Whilst that tailwind is helping, a second supportive element is that the dollar index is trading sideways and going nowhere, opening up some more room for XRP price to rally and loosen the chains it had on from dollar strength. XRP price is set for a couple of interest trading days ahead with all these elements at play.

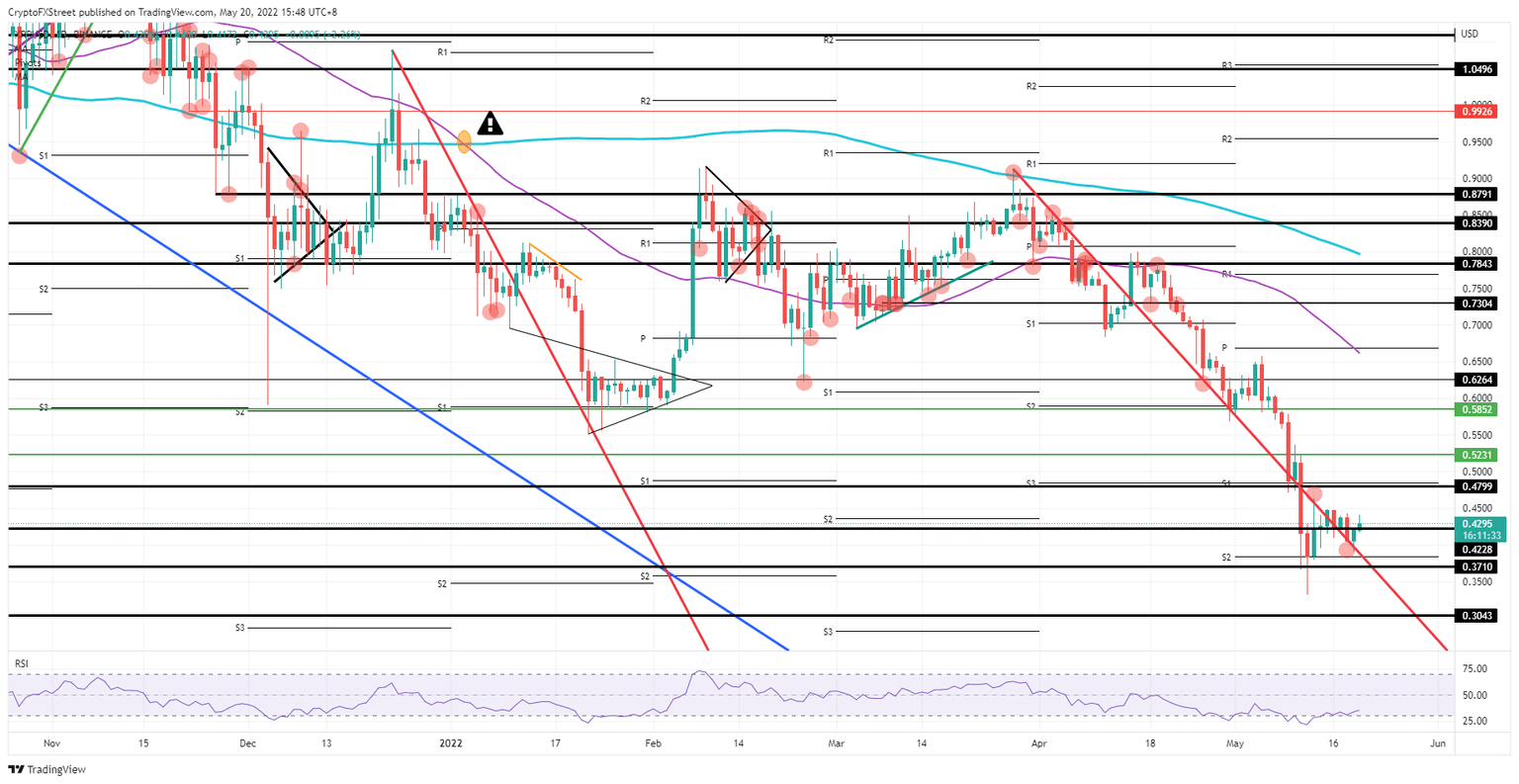

XRP price already broke above $0.4228 in the ASIA PAC session and is set to cover some ground towards $0.4800, where a historic pivotal level and the monthly S1 are waiting. There is a slight risk of rejection, but seeing the Relative Strength Index (RSI) has been so subdued for so long, a return to the mid-levels for the RSI is more than logical, and thus, bulls will have the opportunity to pop above the monthly S1 and hit $0.5000 in the process. Another jump higher towards $0.5231 could be on the cards for the weekend.

XRP/USD daily chart

Nearing the close of this week, traders could be in these trades just for today without wanting to hold any risk over the weekend in case negative headlines hit the wires. Expect the rally to start fading nearing the close of the US session as investors cash in and could trigger a full pullback with XRP price dropping back to $0.4200, giving up all its intraday gains. A further drop to the downside could even be possible in search of support near $0.3710 or $0.3840.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.